I am fortunate to have been invited to speak at many Bitcoin conferences over the years, and recently I had two engagements just a few weeks apart. One was The Bitcoin Conference held in Miami in late May and it was followed by BTC Prague in early June in the Czech Republic. Interestingly, there was a marked contrast in the composition and the attitudes of the attendees, a contrast that offers insights into how perceptions of Bitcoin change in different areas of the world.

The Bitcoin Conference has been the largest gathering in the Bitcoin community for many years. In 2021 and 2022, this conference had a festival-like atmosphere as Bitcoin was enjoying a bull run, and in 2022, it attracted over 26,000 attendees. The euphoria of that period drew many new people to these conferences and these “newbies” constituted a large segment of the attendees.

Between the 2022 and 2023, Bitcoin was dragged into a bear market by the crash of a handful of high-flying cryptocurrency firms like FTX with Sam Bankman-Fried. As a result, The Bitcoin Conference in 2023 had a radically different feel from the two previous years and attendance fell by about 50%. There was no new batch of new Bitcoiners, and the mood was much more subdued. This should not be confused with pessimism though. The people attending were those seasoned by a few cycles of highs and lows, and I didn’t detect any loss of confidence or positivity from those at the conference.

My discussions with attendees and the topics from conference speakers tended to be very business oriented. These included subjects like evolving U.S. regulatory clarity, technological developments, wider corporate adoption, progress in payment technology and the political implications of Bitcoin. Several U.S. presidential candidates including Robert Kennedy Jr. and Vivek Ramaswamy spoke at the conference and stressed the importance of Bitcoin to the nation and a commitment to protect it.

BTC Prague on the other hand had a completely different ambiance from Miami. The conference had attracted 6,500 people and was the largest Bitcoin event ever held in central Europe. According to the conference organizers, over half of the attendees came from either the Czech Republic or neighboring Slovakia and 85% were from central Europe. From the moment of arrival at the conference site, I could feel excitement percolating, somewhat like the conference in Miami in 2022.

As soon as I started interacting with the attendees it was obvious that many of them were relatively new to Bitcoin, and their enthusiasm was not coming from speculative dreams of amassing a fortune, but because Bitcoin was solving real problems in their lives. For instance, in talking with an attendee from Slovakia, he explained that part of his motivation for his recent involvement with Bitcoin was because of his awareness of the plight of so many refugees from Ukraine. Ukraine shares a border with Slovakia and according to the United Nations Refugee Agency, over one million refugees have crossed into Slovakia since the beginning of the Russian conflict.

This has brought the stark realization to Slovakians, and most other citizens of former Soviet satellite countries, that their world can flip overnight; ownership of a car, of a company, of a home, of anything that people cannot physically carry out of their country could evaporate without warning. It is even possible that the very country they live in might disappear, the banks and all the value held in them could vanish, and the currency in their pocket could become worthless. Put another way, these people don’t live in a place where there is a high degree of confidence in property rights. This same possibility is front of mind for people in many other regions of the world like those in Central America, any country in China’s backyard, or those with in a politically unstable or dictatorial jurisdiction.

Bitcoin offers a unique solution to this problem as there are no limits to the amount of value that can be held in a Bitcoin wallet, and that wallet can be something as simple as a specialized USB drive. This allows people the option to self-custody their Bitcoin in a manner that gives them absolute control over it, it is protected by the world’s most secure digital network, and it requires no one’s approval to use it. It is the ultimate bearer asset. As a result, someone forced into a refugee situation can flee to any place in the world and still retain complete control over all their wealth held in Bitcoin. The same goes for those living under martial law or in a position where local authorities or banks cannot be trusted. This is an appealing real-world value proposition to people like the Slovakian I met at the conference in Prague, and it means much more to them than whatever upside potential they might realize in the price.

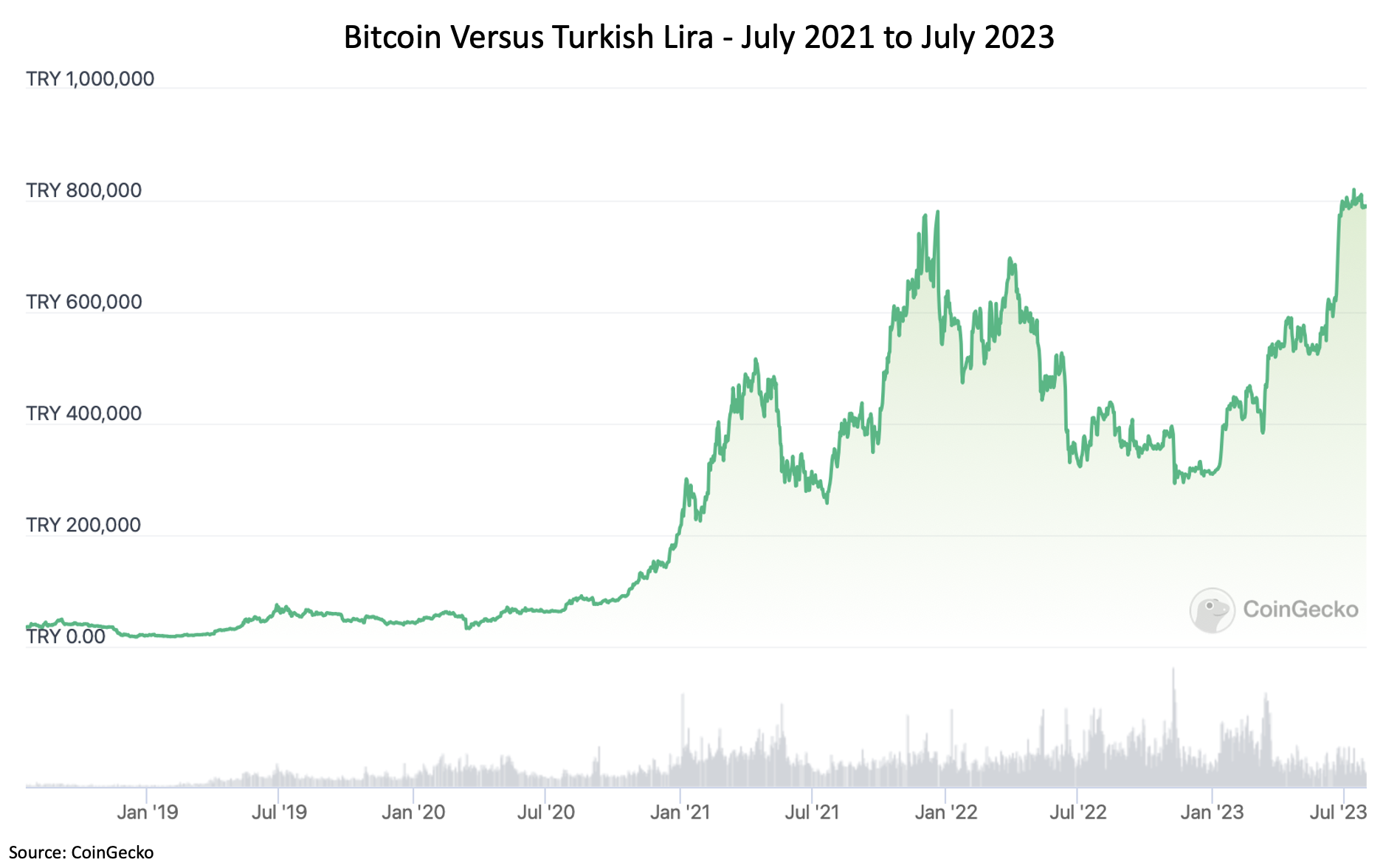

I had another interaction in Prague with a young man who was originally from Turkey. For him, and his family still living in Turkey, Bitcoin has become a haven from several years of the Turkish Lira suffering from severe inflation. Since January of 2021, inflation in Turkey has varied from 15% to 85% and it has had a devastating impact on the savings of people there. While North Americans have felt inflation in these same years, they might be surprised to learn that compared to several other regions of the world, they have had a relatively easy time. It might also be a revelation to most westerners that in many places, converting from a local currency to a more stable, globally accepted one like the U.S. dollar is often difficult and filled with risk.

Many people in the United States evaluate Bitcoin’s appeal solely through the optics of its price as measured in U.S. dollars. Since at the time of this writing, it is trading for about $30,000 versus an all-time high of about $65,000 in November of 2021, it isn’t shocking then that many look at Bitcoin with a critical or skeptical eye. As the above chart shows though, this is not true in Turkey. Bitcoin currently trades at its all-time high there and has insulated its Turkish holders from a massive loss of wealth. This is not just limited to Turkey though, in several other countries including Argentina and Lebanon, Bitcoin also trades at an all-time high. It should be no surprise that the Journal of Risk and Financial Management estimates that cryptocurrency ownership in Turkey may be as high as 25%.

It is common for people to think of technological adoption as something led by people from the world’s top-tier economies. This has been largely true throughout history, but it is no longer necessarily true. In some cases, a particular technology better serves areas of the world that are less developed or stable, and if the cost of that technology does not present a major barrier, then the area with the greatest need will lead its adoption. Since Bitcoin is essentially free to use and accessible to virtually anyone with a mobile phone or access to the internet, it would be wise to pay close attention to how the developing world is interacting with it.

Bob Burnett is the chief executive officer of Barefoot Mining.