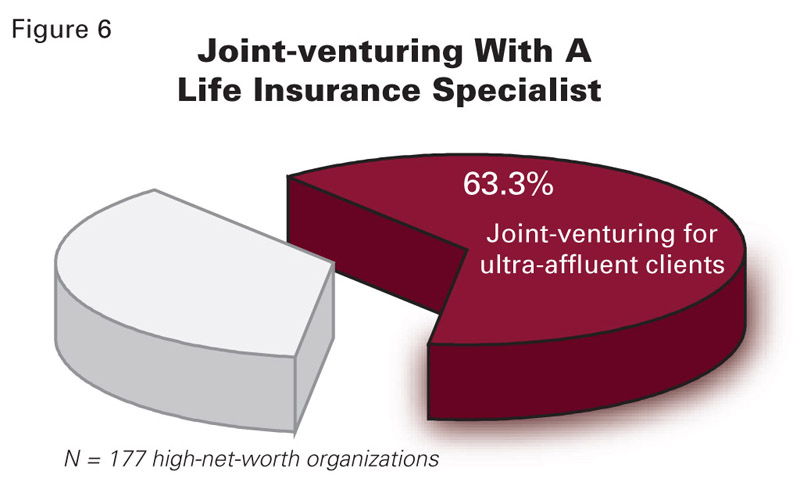

While most firms have begun to expand their platform of products and services, more often than not more complex and technical offerings are being delivered through joint ventures. Take life insurance as an example. All of the firms that offer life insurance have the necessary licenses in place to do so, however more than 60% of them are currently working with a life insurance specialist outside their firms to cater to the needs of their ultra-affluent clients (Figure 6).

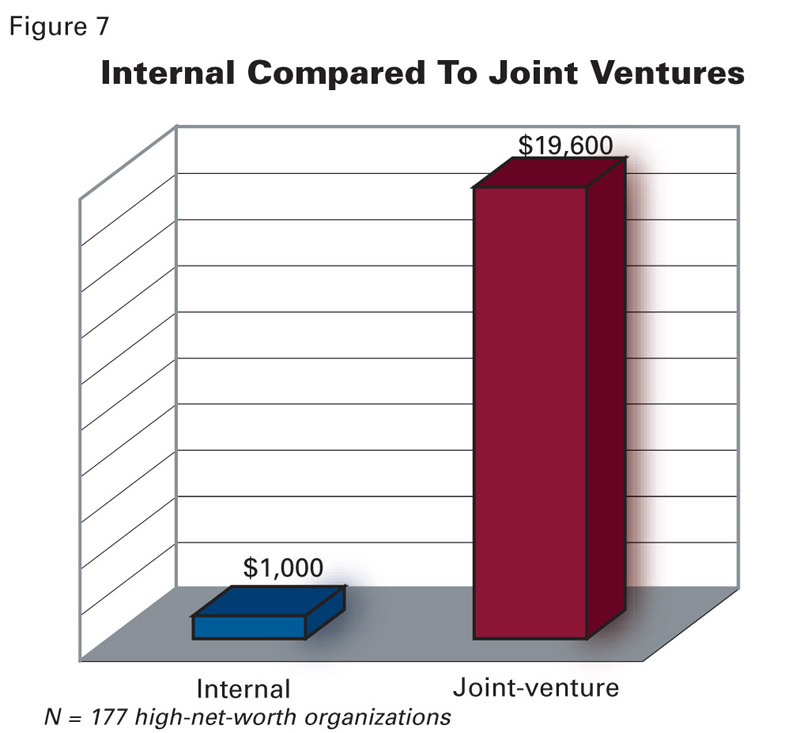

Even more interesting is that the firms that have established such a joint venture are doing significantly more business-19.6 times the life insurance revenue-than those firms that choose to do everything internally. In dollar terms, that means that firms in a JV generate $19,600 in commissions for every $1,000 generated by a firm with a self-contained insurance program (Figure 7).

This difference can easily cover the revenuesharing arrangements with external life insurance specialists and still deliver profit to the sponsoring organization.

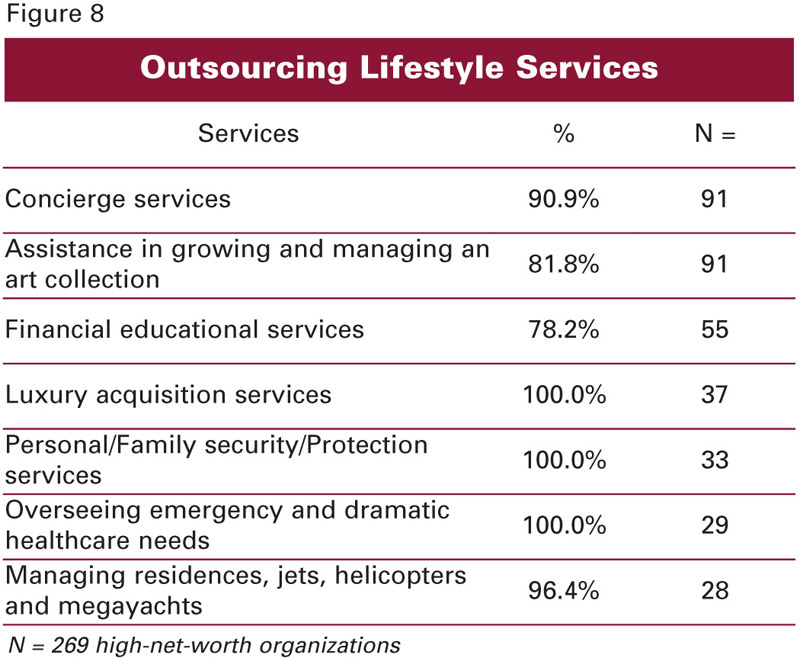

When we move beyond the scope of pure financial services, the majority of senior managers have opted to outsource those services that complement, but don't overlap with, their core financial expertise (Figure 8).

This is clearly the case with lifestyle services such as:

Concierge services

Art collection development and management

Financial educational services

Luxury acquisition services

Personal/Family security/Protection services

Medical and Health-care concierge services

Residence and vessel management

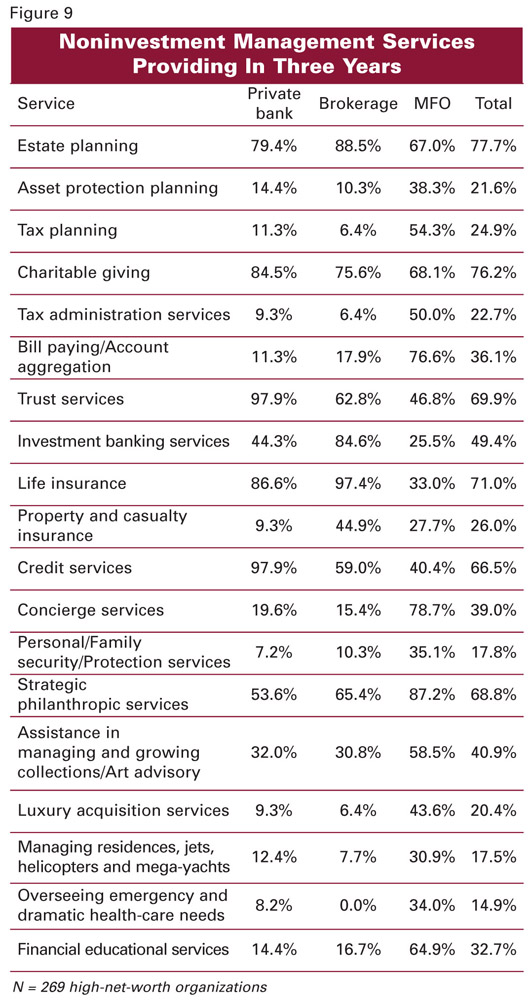

Broadly speaking, senior managers at private banks, brokerages and multifamily offices anticipate greater expansion into the noninvestment management space over the coming three years (Figure 9).

The firms that have already begun to offer products and services that fall outside the strict scope of investment management expect to continue doing so, while many firms that have not yet taken those steps plan to do so in select categories within the next 36 months.

It's no secret that serving an ultra-affluent clientele is a continually demanding process for both individual practitioners and their firms. Part of earning and keeping a wealthy client's business is being able to offer the right range of products and services at the right time. Given the fluid nature of life, problems arise, babies are born, couples are married and divorced and remarried, diseases strike, business are bought and sold, vacations are planned, inheritances are passed, purchases are made and priorities shift.

At the same time, laws change, advancements are made, currencies fluctuate, technology reinvents itself, innovations surface, markets surge and retreat, and political regimes are replaced. All of this means that clients have new and changing needs and their providers are faced with challenges and opportunities for growth. Top-notch financial firms must find a way to manage the change, stay abreast of their client's current concerns, and continually evaluate and modify the resources at their disposal to be an essential partner to their very wealthy clients.