BNY Mellon Investment Management is launching eight exchange-traded funds designed for core asset allocation strategies, including zero-fee large-cap and bond products.

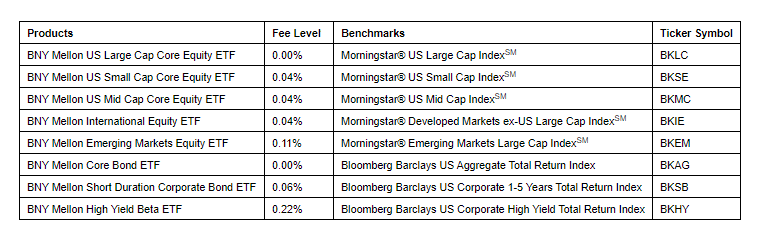

The asset manager, which has $1.9 trillion under management, said three of the products—the BNY Mellon US Large Cap Core Equity ETF, the BNY Mellon US Mid Cap Core Equity ETF and the BNY Mellon US Small Cap Core Equity ETF—will commence trading today on the New York Stock Exchange and will be benchmarked to Morningstar indexes.

Two other Morningstar-benchmarked equity ETFs, the BNY Mellon International Equity ETF and BNY Mellon Emerging Markets Equity ETF, will follow in the coming weeks, along with three fixed-income ETFs benchmarked against the Bloomberg Barclays Fixed Income indices, according to a press release.

The large-cap core and core bond ETFs will be the first zero-fee ETFs in the largest equity and fixed-income U.S. market categories offered without fee waivers or other restrictions, BNY Mellon said.

"BNY Mellon's ETF range will be among the lowest-cost ETFs in the industry," the press release said.

The complete lineup of upcoming ETFs is as follows: