A little over a year ago, most observers thought the Federal Reserve would raise interest rates to help ward off inflation in an expanding economy. Investment firms and mutual fund managers cautioned fixed-income investors that they should keep their return expectations in check.

But by spring, fears about rising rates subsided as concerns about sluggish economic growth crept back into the picture. The Fed ended up cutting rates three times, and the 10-year Treasury yield fell to a low of 1.46%. At the same time, de-escalation of U.S./China trade tensions, easing measures by global central banks, and strong investor demand kept bond markets buoyant. By year’s end, U.S. investment-grade corporate bonds posted a return of 14.54%, while the Bloomberg Barclays U.S. Aggregate Bond Index saw an 8.72% return.

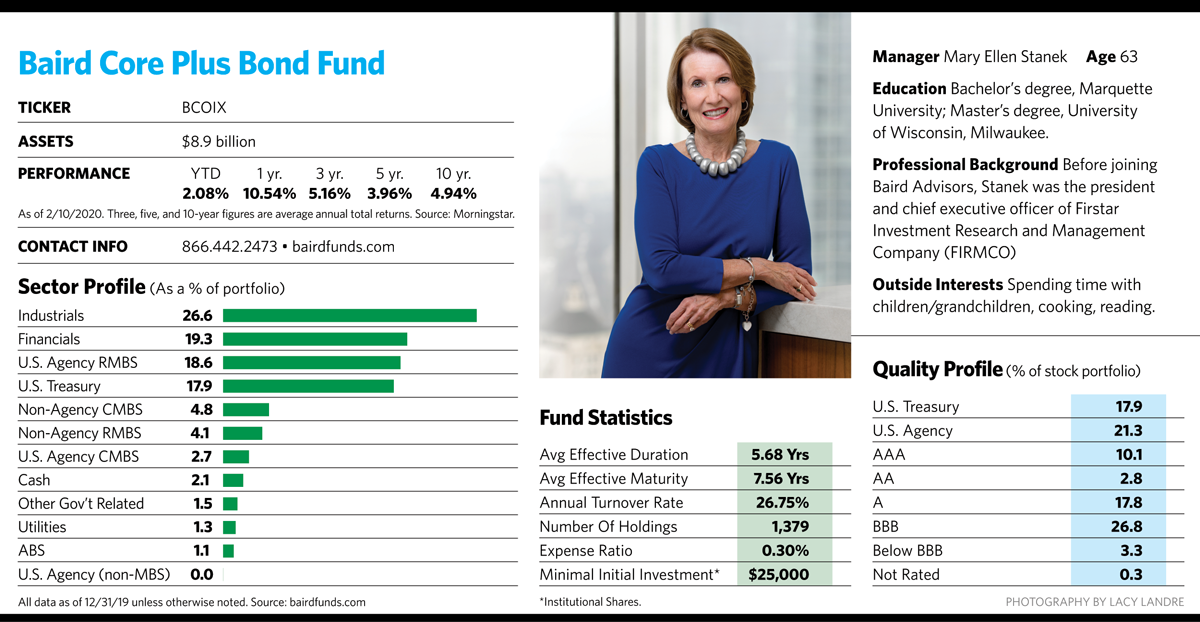

When she looks at the rest of 2020, Mary Ellen Stanek, a 40-year bond market veteran, sees the potential for an equally bumpy ride in an environment of election year uncertainty. “My advice for investors is to keep their seat belts on,” says Stanek, the chief investment officer at Baird Advisors and manager of the $24 billion Baird Core Plus Bond Fund and the $23 billion Baird Aggregate Bond Fund.

Short-term market disruptions could come in a number of fronts, she says. Because presidential candidates have widely disparate views on a variety of issues, including those affecting the economy and taxes, any shift in the political sentiment could have a powerful impact on the financial markets. Trade tensions and global discord threaten to throw a wrench into world economic growth. A growing federal budget deficit could ultimately put upward pressure on Treasury rates, and the current economic expansion, the longest since World War II, could run out of steam.

On the positive side, Baird’s economic outlook calls for the U.S. to experience gradual, albeit subpar economic growth and modest inflation. Global growth likely reached its slowest pace in 2019, and the risk of global recession has diminished. Economic growth in the U.S. should range from 1.5% to 2.5% this year, extending the long expansion.

Given that inflation has persistently run below 2% in the last several years, the Fed would be unlikely to raise rates if things stayed the same. “The Fed will probably be on the sidelines for 2020,” Stanek says, “so we’re looking for that side of the equation to be relatively quiet.”

While economic growth will be sluggish, consumer sentiment, employment and income numbers are decent. Individuals are winnowing down personal debt. Employment is broadening to wider, more diverse segments of the population. And low-wage workers are finally seeing their paychecks increase.

Over the longer term, an aging population around the world should support demand for bonds as investors shift from growth to income needs. Pension plans, insurance companies and other institutional investors with long-term liabilities will also support the market. And while the U.S. government debt burden continues to mount, the issue is unlikely to come to the forefront until after the November elections.

Shooting For Small Wins

Stanek, who has managed both her funds since their 2000 inception, believes that beating the indexes over a long period isn’t about making hefty security bets or picking the next hot issuer. Instead, it’s about navigating the comparative risks and rewards among a vast sea of bonds and issuers, picking sector spots carefully, achieving lots of small wins consistently over the long term and keeping costs low.