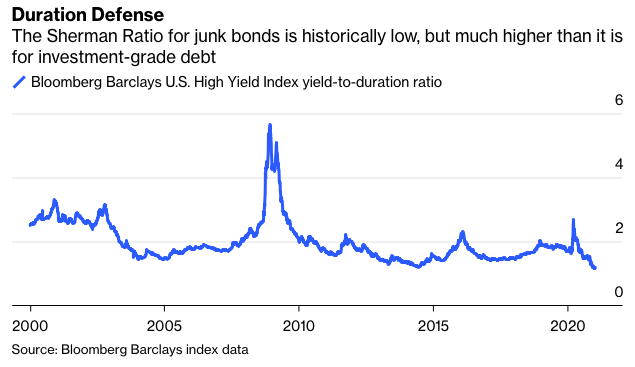

The Sherman Ratio is meant to “calculate what percentage increase in rates will offset a bond fund’s yield,” according to DoubleLine. For fixed-income investors who think 10-year Treasury yields will continue to move up this year as more Americans receive Covid-19 vaccinations, perhaps reaching JPMorgan Chase & Co.’s recently revised forecast of 1.45%, one of the few choices left that doesn’t lock in losses is junk bonds. The Sherman Ratio on the Bloomberg Barclays U.S. High Yield Index isn’t exactly appealing — it fell to a record low of 1.15 last week — but the securities are more insulated from interest-rate swings with a duration of just 3.64 years, less than the five- and 10-year average.

As I noted last year, holding investment-grade corporate debt only lost investors money six times since 1981, but those instances are becoming more frequent, including 2013, 2015 and 2018. The nearly four-decade bull market in bonds has erased the income buffer that provided steady gains regardless of short-term volatility in benchmark Treasury yields. We’ve reached a point that even a 20-basis-point move is enough to wipe out a $6.75 trillion index of company debt.

That’s just one more reason to expect the Fed will push back against any swift move higher in U.S. yields. A slow and steady climb like the one in the second half of 2020 is one thing. Even last week’s jump above 1% was tolerable, given the outlook for additional fiscal stimulus now that Democrats will control the Senate in addition to the House and the presidency.

But as I said when 10-year yields crossed 1%, now comes the hard part, both for the Fed and bond traders. At the central bank, officials are already starting to walk back last week’s taper talk. Meanwhile, Treasury yields retreated after strong auctions as yields approached levels that some viewed as attracting demand from overseas investors. HSBC Holdings Plc put out a report that said in no uncertain terms: “Buy U.S. Treasuries after yield spike.” It’s likely to be a grind from here.

That’s great news for corporate-bond buyers who can ill afford a sharp move higher in interest rates. It seems as if no matter how low the Sherman Ratio goes, fixed-income investors always manage to avoid the nightmare scenario.

Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News. He is also a CFA charterholder.