Among the lessons advisors took away from the 2008 financial crisis was that they must manage both sides of clients' household balance sheets more closely, notably liabilities and expenses.

It's no secret that clients who survived 2008 and 2009 with the fewest psychological scars often were the ones who had their expenses under control and virtually no liabilities.

The most effective way advisors can help them get to that point is to balance client resources against the future claims against them. But in a profession that has devoted the lion's share of its human capital to the asset management side of the equation, that's not so easy.

Enter Andrew Rudd, the chairman and CEO of Advisor Software Inc. (ASI), the co-creator of a comprehensive, integrated approach to portfolio construction. Rudd is an expert in risk management, performance measurement, asset allocation and modern portfolio theory, having spent most of his career at Barra Inc., a prominent institutional consulting firm he co-founded and later served as chairman and CEO of from 1984 to 1999. Rudd launched ASI because he saw some of the problems facing financial advisors and thought they could benefit from an institutional approach to budgeting and risk. To this end he has filed U.S. patents for software, developed with head of research Nicolo Torre, that analyzes budgets for clients.

Rudd's resulting process may prove challenging to advisors and clients alike. Some advisors try to beat the market as if their clients' appetite for risk matched the volatility of the S&P 500 every day. Although advisors may think of risk as the volatility of returns, their clients think of it in terms of failure: How far can their portfolio values tank in a year such as 2008 and how much time will it take them to recover? They don't look at risk in statistical terms but in terms of failing to reach their goals or tackle their objectives. At best, the second home they wanted to buy might now be out of their reach, the trip around the world little more than a dream. At worst, they won't be able to live any longer the way they do today.

"By matching specific investments with specific objectives," Rudd says, "the resulting portfolio can have less overall risk than an ad hoc, mean variance approach, which frequently requires increasing risk to get a high enough return to achieve all goals."

A Household Balance Sheet

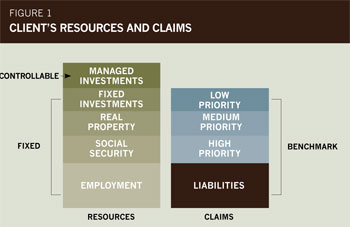

The typical relationship between a personal or household balance sheet is illustrated in Figure 1. The asset side contains financial resources, including employment income, Social Security payments, rent or capital gains from real property, interest from fixed investments and current income and capital gains from managed investments. Each asset class normally has its own unique variability and risks (for example, interest income has lower variability and managed investments higher).

The liability side of the balance sheet contains claims against these financial resources. This list could include mortgage payments, financing charges, retirement living expenses, college education or capital purchases-a list of unavoidable fixed liabilities as well as obligations with lower payment priorities that might be postponed.

The challenge for advisors is to both satisfy claims while growing different sets of assets to meet them, matching specific assets with specific obligations. If a client has a lump sum payment to make in the future, for instance, then he must invest sufficient assets in a zero-coupon U.S. Treasury bond maturing at the same time. Meanwhile, he could invest other resources in more variable assets for more variable claims (plowing money into value stocks for a college education, for instance, or into growth stocks for luxury items). You're looking for the sum total of all controllable and fixed assets to the total individual liabilities and claims.