Key Takeaways

• Oil has staged an impressive rally over the last few months. Voluntary production cut extensions from Saudi Arabia and Russia have helped improve the supply side of the equation. U.S. stockpiles of oil have also dropped to year-to-date lows.

• Oil demand is picking up. China has ramped up imports to near-record levels, while the International Energy Agency forecasts fuel consumption likely reached another record-high last month.

• The math is simple—declining supply and rising demand equal higher prices. West Texas Intermediate (WTI) recently wrapped up a nine-day winning streak that lifted oil out from a major bottom. Momentum is confirming the breakout.

• In terms of upside, the next major area of overhead resistance for WTI sets up near the $94 to $97 range, which traces back to the August-November 2022 highs and a key Fibonacci retracement level of last year’s bear market in oil.

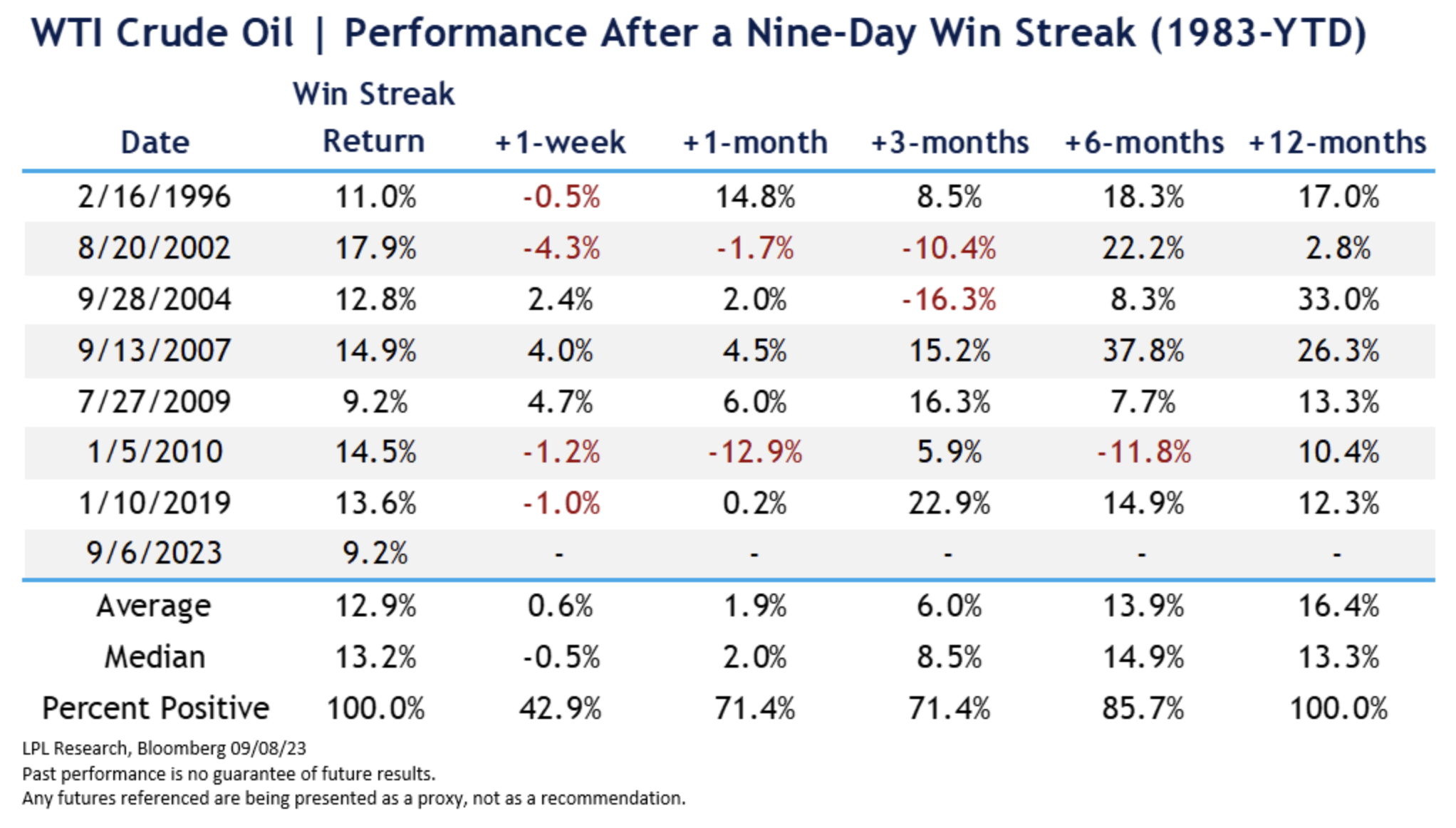

Over the last few months, improving supply and demand dynamics have reenergized crude oil. WTI just wrapped up a nine-day winning streak, marking its longest stretch of consecutive gains since 2019. During this period, crude oil amassed a 9.2% gain, an impressive rally, but not sticking out compared to the 12.9% average during previous nine-day winning streaks.

Now that the winning streak is over, what happens next? We looked at the performance of oil after advancing for nine consecutive days. Of the seven other periods that registered nine-day winning streaks since 1983, forward returns over the next 12 months have been impressive, as WTI gained an average of 16.4% and finished higher in all seven periods.

Supply And Demand

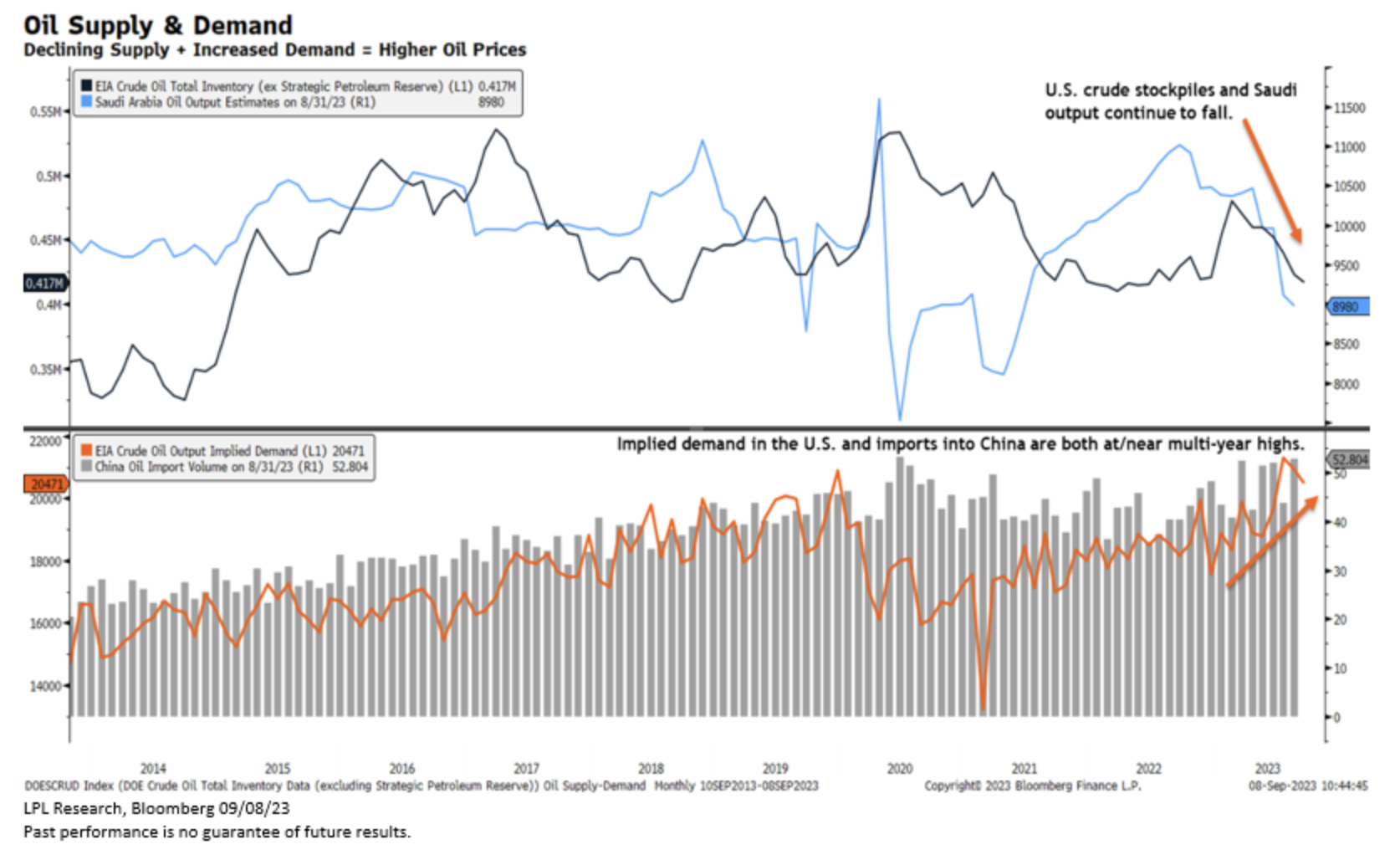

Tightening supply has been a significant driver of crude oil’s rally over the last three months. Saudi Arabia, the de facto leader of the Organization of the Petroleum Exporting Countries (OPEC, now more commonly referred to as OPEC+, which includes Russia and other non-OPEC oil-exporting countries), has voluntarily extended its production cut of one million barrels per day until the end of the year. This means the Saudis will hold output at around nine million barrels per day, marking the lowest production quota in several years (blue line in the chart below). Russia also voluntarily extended its export reduction of 300,000 barrels per day over the same period.

In the U.S., crude stockpiles continue to fall. The Energy Information Administration (EIA) reported commercial crude inventories in the U.S. dropped by over six million barrels this week, marking a fourth straight weekly drop that has left inventories at their lowest level since December (dark blue line in the chart below).

On the demand side of the equation, China continues to import more oil (see grey bar chart below). In August, they imported 52.8 million tons of crude oil, or 12.5 million barrels per day, marking a 21% increase compared to July. In the U.S., implied oil demand reached multi-year highs (orange line below) in July before pulling back modestly last month.

Simple Math

You don’t need to be an economist to understand that rising demand and falling supply equate to higher prices. As shown below, WTI has broken out from nearly a year-long bottom formation after clearing key resistance at $83.25. Momentum is confirming the breakout, including a recent bullish crossover between the 50- and 200-day moving averages (dma) and a Moving Average Convergence/Divergence (MACD) indicator buy signal.

Tightening oil market conditions have also shown up on the futures curve. WTI time spreads between front-month and second-month futures contracts have been climbing higher in positive territory (technically switching from contango to backwardation in July), pointing to an uptick in near-term demand for oil.

In terms of upside, the next major area of overhead resistance for WTI sets up near the $94 to $97 range, which traces back to the August-November 2022 highs and a key Fibonacci retracement level of last year’s bear market in oil.

Summary

Oil has entered a new uptrend after finally breaking out from nearly a year-long bottom formation. Support from OPEC+, notably Saudi Arabia’s one million barrel per day production cut for the remainder of the year, has been a major driver of the rally. Demand is also picking up as imports into China surge. While prices may be overbought short-term, momentum remains bullish, leaving oil’s next major resistance hurdle at the $94 to $97 range. In large part due to the improving technical backdrop for crude oil, LPL Research’s Strategic and Tactical Asset Allocation Committee (STAAC) recently upgraded its view on energy commodities to positive from neutral. Furthermore, in addition to the breakout in oil, improving fundamentals and attractive valuations underpinned STAAC’s recent upgrade of the energy sector to positive from neutral.

Adam Turnquist is chief technical strategist for LPL Financial.