2016 is shaping up to be a big year for poll watching by investors. While presidential candidates faced-off in primaries in the United States, British Prime Minister David Cameron announced last week that Britain will hold a referendum on June 23 to decide whether to remain in the EU or to exit. There are five things investors need to know about the so-called “Brexit.”

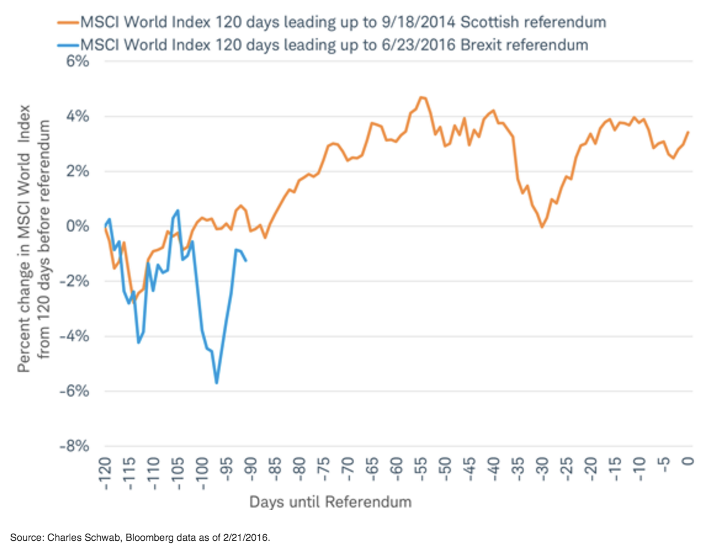

1. Expect more market volatility

Late last week, Prime Minister Cameron struck a deal with EU ministers on revised terms for U.K. membership in the EU. This renegotiation marks the start of campaigning by both sides of the issue leading up to the June 23 referendum, elevating the issue in the minds of investors. This may help to sustain the market volatility seen so far in 2016.

Remember, global markets were volatile in the months ahead of the referendum on Scottish independence from the United Kingdom (U.K.) in September 2014.

Source: Charles Schwab, Bloomberg data as of 2/21/2016.

This Brexit referendum will be the first since 1975, when 67% voted to stay in the EU. There have been growing calls for another vote because the EU has changed a lot over the past 40 years, adding new members and regulations. If it does decide to leave, the U.K. will become the first country to leave the EU since its creation in 1957. The repercussions would be felt across global markets and economies.

2. The key issues are national security and economic benefits

The EU is a partnership involving 28 European countries that has existed in various forms since shortly after World War II. Today, membership in the EU allows goods and people to move freely across Europe’s borders. Although the U.K. does not use the euro, the currency adopted by 19 of the member countries, it is subject to the rules made by the EU parliament including those on budgets, consumer rights, transportation, energy and the environment. The U.K. joined the EU in the 1970s, helping to elevate London as the financial hub of Europe.

Those who want the U.K. to leave the EU believe Britain is being held back by too many regulations on business, unfairly forced to bailout financially reckless countries, and should take back control of its borders to reduce the number of incoming migrants looking for work. Alternatively, those who want to stay believe Britain benefits from the ease of selling goods and services to the huge EU market and that the flow of young migrant workers helps to offset the U.K.’s aging demographics. They also believe national security is enhanced by remaining part of the EU.

3. Last week’s deal favors staying in

Prime Minister Cameron negotiated a package of changes to the U.K.'s membership that will take effect immediately if the U.K. votes to remain in the EU that address the key national security and economic interests.

National security - There are new powers to block immigration by people believed to be a security risk even if they have no previous convictions. Also, the U.K. gets an “emergency brake” that limits welfare benefits for EU migrant workers for several years, making the U.K. a less attractive destination for migrants.

Economic benefits – The U.K. is allowed to block, delay, and negotiate amendments to any new regulations—helping to thwart any new rules that threaten the U.K.’s financial services sector. In addition, any British money spent on future bailouts of Eurozone nations will be reimbursed.