Recessions are sometimes difficult to describe, let alone predict. Definitions vary widely. To make matters worse, some coin their mixed forecasts as a “growth recession.” Some simply describe a recession as two consecutive quarters of negative economic growth, which is clearly not true because the 2001 recession was shorter: growth in the first quarter of 2001 declined by 1.3% annualized but between strong quarters both grew above 2%.

The National Bureau of Economic Research (NBER) is the official arbiter of recessions and their definition is not much better. “A recession is a significant decline in economic activity spread across the economy and that lasts more than a few months.” The NBER specifically looks at economic indicators such as production and employment. Because the definitions can be elusive and ambiguous, we think it behooves investors to focus on the overall trajectory and economic environment for both businesses and households.

This Time Is Different, Or Is It?

As we emphasize above, each recession has different causes and different impacts, but one thing that is not different is the required analysis. Whatever the circumstance, investors should look at multiple signals, not just the infamous and often misused inverted yield curve indicator. Our base case is the domestic economy will weather through this current storm of elevated prices, geopolitical risks, and clogged supply chains. Serious risks remain, but we think business and consumer metrics support our base case thesis that the U.S. will not fall into recession this year.

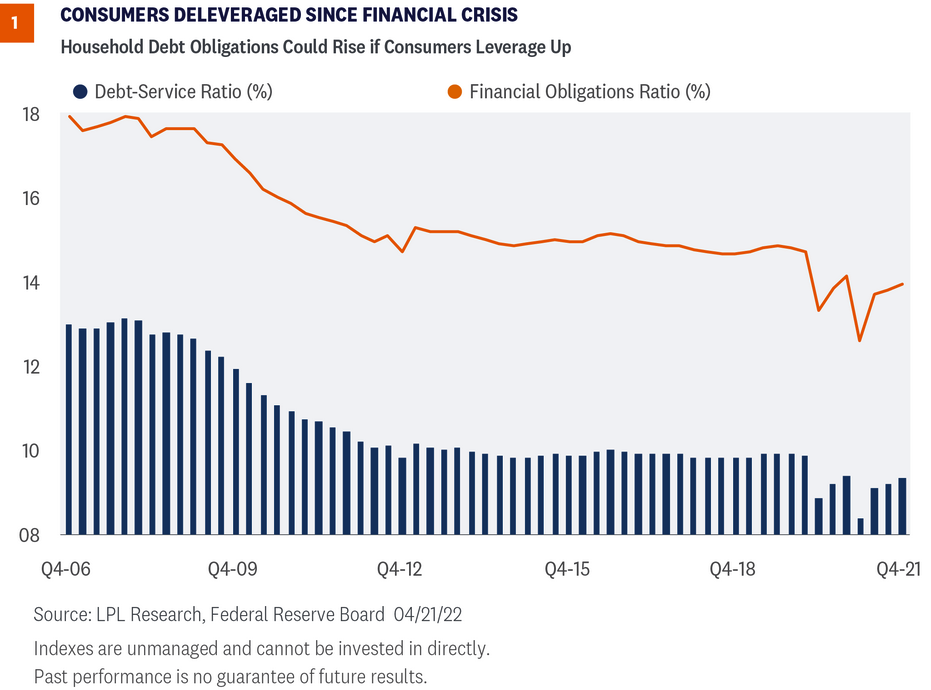

Consumers Are Much Less Levered This Time Around

After the Great Financial Crisis, consumers started deleveraging. Both the Debt Service Ratio and the broader Financial Obligations Ratio gradually declined and remained steady until the emergence of Covid-19. Government pandemic assistance programs including stimulus and forbearance periods added volatility to consumers’ financial obligations, but if consumers are able to keep relatively low debt levels, we think the consumer can successfully navigate a period of rising borrowing costs without squelching spending.

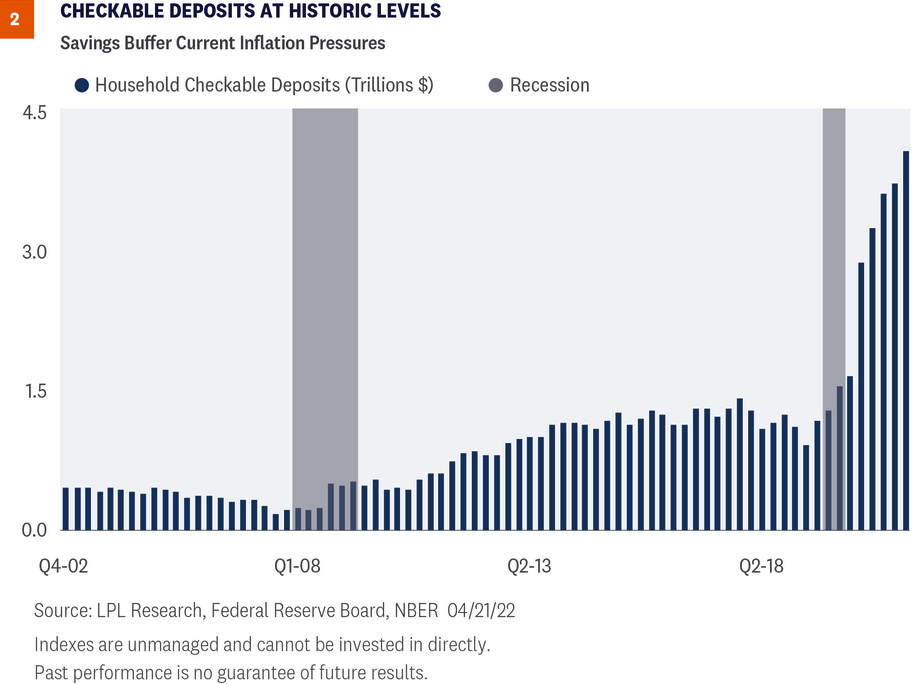

Checkable Deposits Are At Historic Levels

High savings will help consumers navigate the current inflationary period. Given the uncertainty of the pandemic and generous stimulus measures, deposits grew to roughly $3 trillion above normal levels. During the crisis when the Federal Reserve (Fed) aggressively cut rates and individuals were highly risk averse, the cost of holding checkable deposits was low so individuals tended to increase savings, thereby adding to bank deposits. Aggregate savings were also bolstered by higher income households who normally spend a larger percentage of discretionary income on services—like travel experiences—but were shut down during the pandemic. Accumulated savings provide a cushion for some consumers during this period of high prices and economic uncertainty.

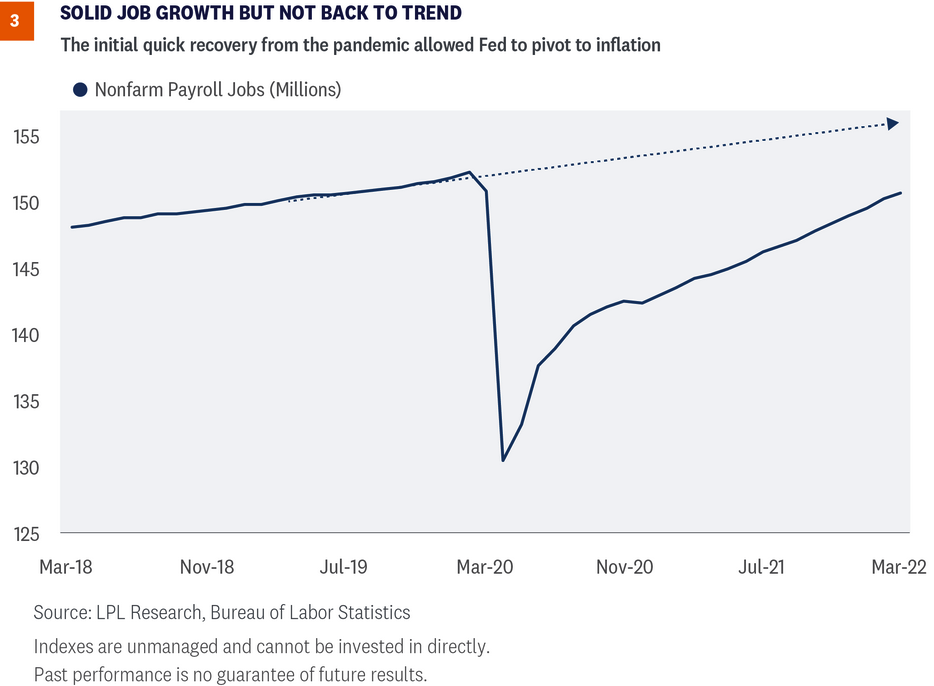

Labor Market Gives Power To The People

Employment rebounded from the lows of April 2020 but soon after the beginning of 2021, the rate of job creation slowed. The tight labor market is ripe for the 1.5 million former workers to return on their own terms. Such a high inflationary environment could convince some of these “lost” workers to return. As long as the economy is approaching full employment, the Fed will focus on the mandate for price stability. Our base case scenario includes a cooling of both inflation and the job market, which may allow the Fed to pause rate hikes toward the end of the year, limiting risks of over tightening. In many previous cycles, the Fed was accused of overtightening and pushing the economy into a hard landing, which is the scenario where unemployment rises and economic growth contracts.

Firms Are Taking Advantage Of Pricing Power

Consumers are likely in a safe space for the current environment, but what about businesses? The National Federation of Independent Business (NFIB) reports that small businesses are adjusting to a variety of current headwinds such as a tight labor market with high quit rates and clogged supply chains pushing up raw material costs. As of March, roughly 50% of small businesses in the U.S. raised compensation to attract and retain workers according to the NFIB. In the same month, over 70% of firms raised prices to cover increased costs. Firms with the ability to pass along cost increases will be able to protect profit margins as labor and material costs increase.