This year hasn’t been any kinder to real estate funds than it has to any other asset class. As of early September, the largest, most notable mutual funds in this space had all suffered double-digit losses this year.

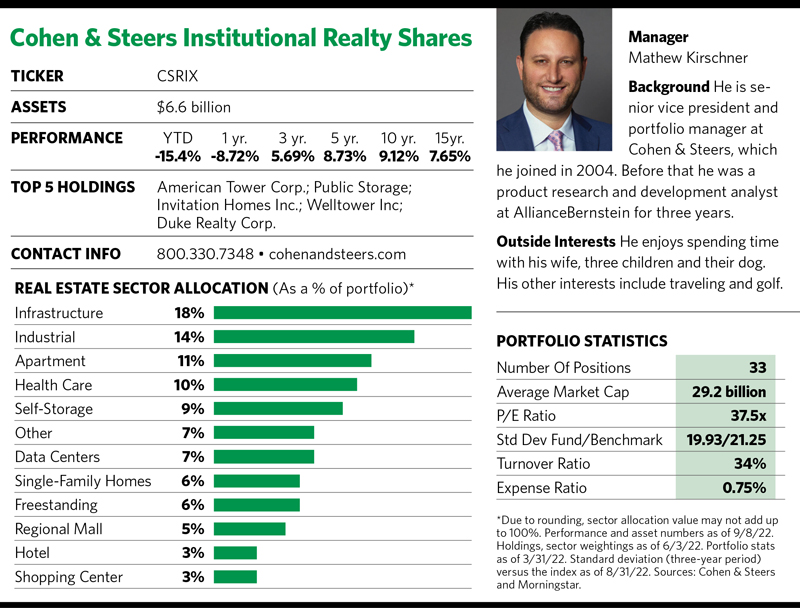

The Cohen & Steers Institutional Realty Shares fund, however, was one of the category’s better year-to-date performers. It lost only 15%. Granted, that’s a backhanded compliment and doesn’t generate much excitement.

The better way to think about this fund is to remember that real estate traditionally is seen as an important portfolio diversifier. Furthermore, the recent downturn has trimmed valuations and laid the groundwork for the sector’s eventual rebound. On top of that, the Cohen & Steers fund has a stellar track record that places it in the top quartile of Morningstar’s real estate category in every measurable time frame from year to date through the past 15 years.

As for why real estate funds are taking it on the chin these days, this sector—like the financial markets in general—is grappling with the toxic stew of higher inflation and rising interest rates, combined with fears of a slowing economy and possible recession. For now, investors who believe in the real estate sector need to hold their nose during the current stink and remain focused on the long-term picture.

The good news is that real estate investment trusts and other listed real estate securities historically have been a good inflation hedge thanks to the price appreciation of properties and rising rental income. But the potential positive aspects derived from higher inflation—and higher interest rates—can be tempered depending on macroeconomic conditions.

“Real estate can do well in a moderate inflationary environment characterized by a growing economy,” says Mathew Kirschner, a portfolio manager at the Cohen & Steers Institutional Realty Shares fund. “If interest rates go up in that environment, it’s usually a healthy backdrop for real estate and REIT returns. But if you get an environment like we’ve had year to date where rates are going up and expectations for growth are coming down, that’s a challenging backdrop for both real estate and all asset classes.”

Kirschner cites some positive attributes offered by REITs that can be helpful during troubled economic times like this. For starters, they typically pay dividends that are much higher than the broader equity market. A recent Cohen & Steers report showed that as of June 30, U.S. REITs offered a collective dividend yield of 3.3% against 2.1% for global stocks, 1.6% for U.S. stocks and 2.8% for 10-year U.S. Treasurys.

“Because REITs learned their lessons from the global financial crisis, they have good balance sheets and low payout ratios,” Kirschner says. “We think dividends will grow at a healthy clip over the next three to five years.”

He adds that REITs have stable cash flows thanks to lease-based rental income. They also have greater operating margins than the broader market because supply-and-demand factors during the past couple of years have limited new construction. And valuations have come down because Mr. Market has priced in a lot of concerns about higher interest rates.

“The market has sold off REITs based on those concerns, but we think when you look at value in the REIT space versus the broader equity and fixed-income markets, they’re on the relatively attractive side,” Kirschner posits.

He also notes that his fund is domestically focused with little exposure to foreign currencies, which is important in the current period when the U.S. dollar has appreciated dramatically.

Favorable Sectors

The FTSE Nareit All Equity REITs Index, which is the Cohen & Steers fund’s benchmark, has 16 different REIT sectors for the fund’s managers to choose from.

“Most people don’t realize that the space has evolved dramatically during the past 15 years. It’s not just about office and retail,” says Kirschner, who manages the fund along with Jon Cheigh and Jason Yablon. The fund began trading in 2000, and for a little more than half of its existence it was managed by Martin Cohen and Robert Steers, who started their namesake company in 1986. Cohen & Steers bills itself as the first investment manager dedicated to listed real estate.