Key Points

- Bond yields rose on news of Donald Trump’s election win on November 8, in expectation of increased government spending.

- We believe higher inflation and interest rates are likely over the longer term, but the potential for protectionist trade policies and a stronger dollar could offset the effects of increased growth and inflation.

- We believe the likelihood of a Federal Reserve rate hike in December has diminished due to heightened market volatility, but market indicators suggest that a rate hike is expected.

- We suggest investors continue to maintain a short-to-intermediate duration portfolio with a focus on high credit-quality bonds.

Change seems to be in the air. Bond yields surged as the outcome of the election became clear, with the 10-year Treasury yield jumping from 1.72% to above 2%, according to Bloomberg. The idea that a Donald Trump administration would adopt an expansive new fiscal policy appeared to add to growth and inflation expectations. Could that give the Federal Reserve room to continue raising rates?

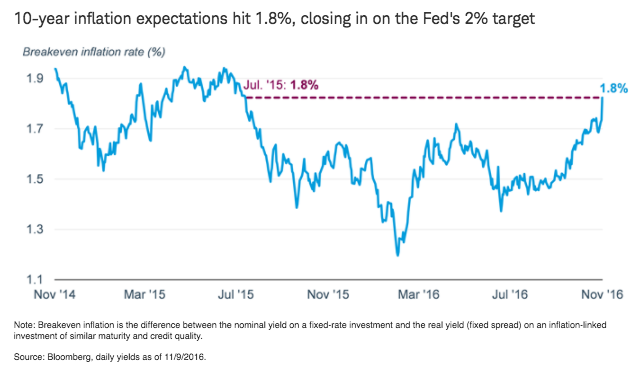

This has come in response to rising inflation expectations and coincided with increased calls for more growth-boosting fiscal spending, particularly on infrastructure.

Note: Breakeven inflation is the difference between the nominal yield on a fixed-rate investment and the real yield (fixed spread) on an inflation-linked investment of similar maturity and credit quality.

For example, if the new administration takes hard-line steps, such as as labeling China a currency manipulator or slapping tariffs on imported goods from major trading partners like Mexico, global growth would likely slow. Mexico has the most to lose from a breakdown in trade with the U.S. because about a quarter of its economic growth stems from bilateral trade. China, with $1.2 trillion of reserves in U.S. Treasury securities, could allow the yuan to fall, worsening the trade balance with the U.S.

Federal Reserve

Kathy A. Jones is senior vice president and chief fixed income strategist at Schwab Center for Financial Research.

This would fit with the broader narrative of policy change we’ve been expecting in recent months, as central banks have shifted their focus from monetary policy to fiscal policy to drive economic growth. After eight years of central banks pushing interest rates down and suppressing long-term bond yields, we view this as a game-changer for the bond markets. Central banks from Japan to Europe have been pulling back on negative interest rates and ever-expanding quantitative easing programs since last summer in the face of diminishing returns and a public backlash.

But a few caveats are in order, at least on the home front. While we believe that higher inflation and interest rates are likely in the longer term, the near term outlook is more uncertain. The potential for protectionist trade policies, a stronger dollar and caution from the Fed could be limiting factors for bond yields.

Steepening curve

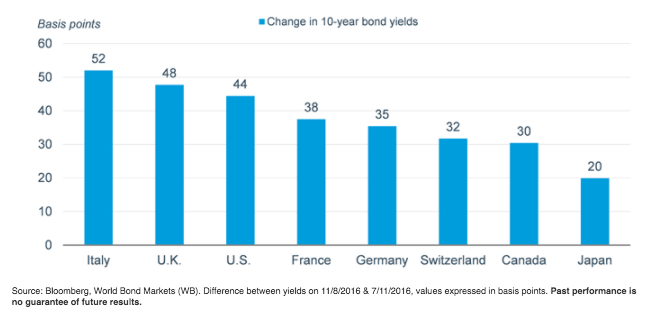

As you can see below, bond yields have edged higher around the globe since this summer, which has caused yield curves (the difference between short and long-term yields) to steepen.

Bond yields have moved up since early July in G8 countries

10-year inflation expectations hit 1.8%, closing in on the Fed's 2% target

Source: Bloomberg, daily yields as of 11/9/2016.

Caveats

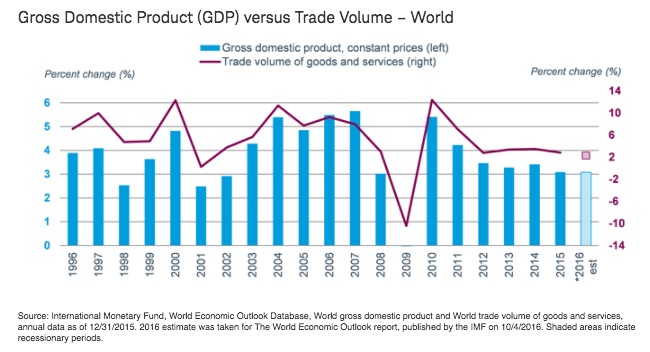

While we do anticipate that inflation expectations and yields will move higher, it’s important to note that if the U.S. follows through with some of the protectionist trade policies discussed during the campaign season, we could see already soft global growth slow while a stronger dollar reins in inflation.

The dollar gains strength in spite of post-election uncertainty

More broadly, as we’ve noted many times, global trade and global growth are highly correlated and the recent trend in both has been weak. Further impediments to the free flow of goods, services, capital and people across borders could exacerbate that weakness.

Gross Domestic Product (GDP) versus Trade Volume – World

An uptick in uncertainty could keep the Fed from raising rates at its Dec. 13-14 meeting. The probability of a rate hike implied by the federal funds futures market dropped to 68% immediately after the election, from 84% the previous day. The odds have since rebounded to about 75%. In our view, the Fed will likely want to see markets stabilize before raising rates again. Of most importance will be financial conditions as measured by stock market volatility, the change in the dollar and the movement of credit spreads.

Another issue affecting Fed policy will be the question of who will replace Fed Chair Janet Yellen when her term expires in February 2018. Trump has already said he would not support her for another term, and given his harsh criticism of Fed policy under Yellen, it seems likely he could appoint someone who is more inclined to raise interest rates or might have a very different approach to policy. The uncertainty regarding a change in Fed leadership could keep markets on edge.

Looking ahead

Overall, the effects of the changes mentioned above are likely to push bond yields higher and stoke volatility over the next few months. Municipal bonds could underperform Treasuries because of the likelihood that tax rates for high income earners will be lowered. Treasury Inflation Protected Securities may outperform Treasuries on the prospect of rising inflation.

We suggest investors:

Maintain an average portfolio duration that’s in the short-to-intermediate term—five years and under—to reduce potential volatility from rising rates.

Focus the majority of the portfolio on high-credit quality bonds such as Treasuries and investment grade bonds.

And think about the long-term. Volatility may come and go, so it’s best to focus on your long-term goals.