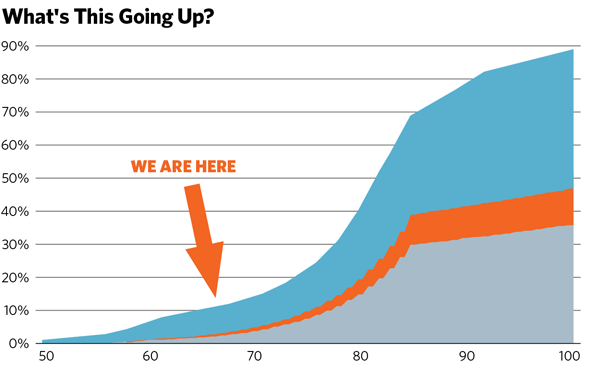

I recently attended a meeting of top advisors hosted by Wright State University in Dayton, Ohio, and while I was there, I shared the chart below with the attendees.

“What’s that going up?” you may ask. Is that Tesla’s stock price? Is it a projection for bitcoin? Is that the amount of money spent by fintech firms?

It’s a nearly perfect S curve, so whatever it is, it favors early adopters. Note where the arrow is.

So imagine the surprise from my audience at my big reveal:

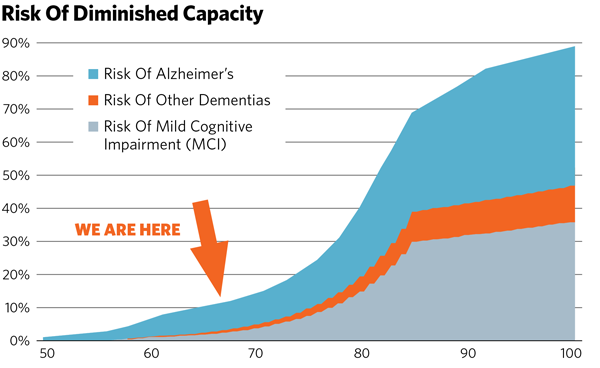

The chart is actually a measure of the risks clients face from incapacity as they age—specifically their risk of debilitating problems like Alzheimer’s, other kinds of dementia or MCI—mild cognitive impairment. My surprise got a mixed reaction. Many audience members nodded their heads. They see these problems every day among their clients, friends and families.

Savvy advisors know these ailments change both clients’ lives and the lives of their family members. The impact of these debilitating diseases is both immediate and ongoing. Nothing will be the same.

People’s priorities must change. And when clients face diminished capacity, their financial advisors will be needed more than ever, and in more complex ways.

The response of the advisory community to these problems is critical. We have to react with empathy but also engage clients professionally and with confidence when they go through these changes.

Like doctors, let’s start in a place much like an emergency room—and end up in a place that looks more like long-term care. It won’t just be our primary clients affected by these conditions. We’ll also have to be there for perhaps three generations of family members affected by their aging parent’s or grandparent’s new reality. Everyone needs to know we can help.

As you can see from the chart below, we don’t have much time before these conditions accelerate in frequency. Currently, one in eight people at age 68 will suffer from one of these illnesses. That figure more than doubles by the time they reach 78, and it increases sixfold by the time they are 88. Over the next 10 years, nearly one in three people we now serve is likely to become incapacitated, and a great many more will be affected when someone in their life does.

For advisors and their firms serving the nation’s 76 million baby boomers, this transition has been looming, yet our preparation is still light. Every firm and every advisor will need policies, procedures and supportive tools to do the following things:

• Determine a client’s incapacity;

• Protect them from things like identity theft and fraud and elder abuse;

• Engage their family to discuss their incapacitation (or otherwise determine that the client has no family support);

• Optimize the client’s finances for risk, taxes, income and long-term care, keeping in mind how the choices will affect more than one generation.