KEY TAKEAWAYS:

- This week we check in on some so-called Trump trades.

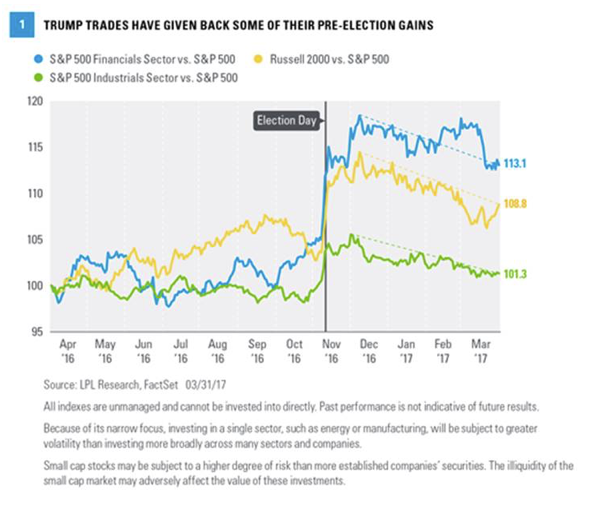

- Recent underperformance of these areas likely reflects some loss of confidence in the Trump agenda.

- Small caps and financials may have enough going for them that recent weakness may be an opportunity, even with a scaled-back policy path.

- Industrials may need more help from the macroeconomic environment should policy disappoint.

Checking in on some “Trump trades.” The election outcome and resulting expectations for fiscal policy have caused several shifts in market leadership toward areas most sensitive to these policies. Policy is not the only factor to consider when evaluating these investments, but it is a very important one. Here we discuss some of these so-called “Trump trades,” including small cap stocks and the financials and industrials sectors.

SMALL CAPS

Small cap stocks may be the most sensitive to the Trump policy agenda. Smaller companies would generally benefit more from a lower corporate tax rate than their larger cap counterparts because of their greater proportion of domestic revenue and resulting higher tax rates (global multinationals earn more profits overseas in low tax countries). The median corporate tax rate for the companies in the small cap Russell 2000 is 4-5% higher than that of the large cap S&P 500.

Small caps’ more domestic focus means they are not as impacted by potential protectionist trade policies. Many smaller, U.S.-focused companies stand to benefit from the Trump administration’s efforts to bring overseas production back to the U.S. Small caps are also more credit sensitive than their larger counterparts, relying more on bank loans than larger companies that tend to have stronger balance sheets, and therefore generally benefit more from financial deregulation.

One Trump policy that is likely to benefit larger cap companies more is repatriation. Should companies be allowed to repatriate overseas cash at a low tax rate, larger multi-nationals with huge cash hoards overseas will benefit the most. However, some of that extra cash may be used for acquisitions, potentially benefiting smaller cap companies.

Small caps have underperformed in recent months [Figure 1], begging the question of whether the relative weakness reflects dampened enthusiasm for the Trump agenda (our sense is it does), and whether the weakness presents a buying opportunity. We continue to believe corporate tax reform will pass, though it will likely be scaled down from earlier proposals from Trump and congressional Republicans and it may not get done until early 2018. Still, that potential boost along with the improving underlying health of the economy and credit markets are enough for us to suggest this latest dip in small caps relative to large is more likely to present a potential opportunity than the start of a period of prolonged weakness.

FINANCIALS

The financials sector has fallen into the Trump trade category for two reasons. First, the Trump agenda has been viewed as likely to put upward pressure on interest rates and steepen the yield curve. The yield curve—the difference between short-term and longer-term interest rates—is a key determinant of bank profitability. In addition, higher interest rates lift returns on assets on bank and brokerage company balance sheets (the same way they help savers).