Prepping your clients’ children for the future can start way before the children apply for financial aid for college. And work with children can help you deepen your relationship with clients and invest in the future of their families.

In 2013, the University of Cambridge released a report in conjunction with the U.K. government on how young children form lifetime habits and learn about money. The report, authored by Dr. David Whitebread and Dr. Sue Bingham, says there are certain financial behaviors in children that are typically shaped by the time they are 7.

And the report says those behaviors are largely due to the parents, who young children normally enjoy being with and mimicking. By age 7, most children can count and understand the basics of exchange and equivalence, and they are beginning to conceptualize an income (or earning) and planning ahead.

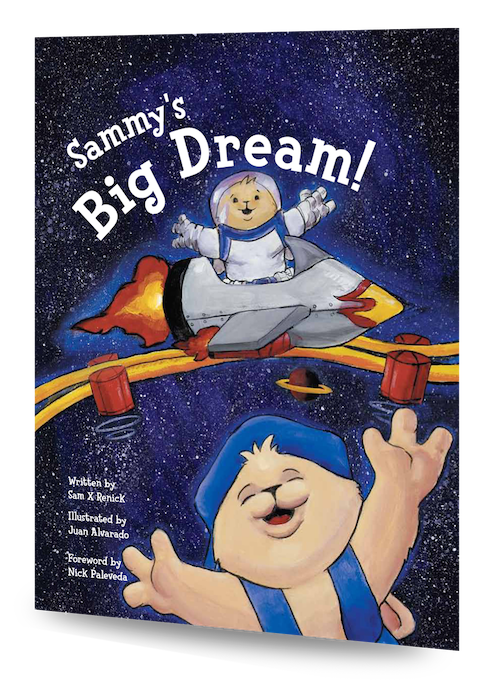

This report became the soundboard that Sam Renick, the author of the children’s book Sammy’s Big Dream and the founder of a socially conscious "It's A Habit" Company, has been using to reinforce the importance of financial literacy in young children. Renick believes parents are not only communicating financial values to children explicitly, but implicitly as well since they’re always indirectly talking about money.

Sammy’s Big Dream

Sammy’s Big Dream

The inspiration for Sammy Rabbit came from several places, said Renick.

"I was in financial services at the time,” he said. “Clients repeatedly shared with me their regret for not having been taught to save and invest when they were young. Then one day, a wholesaler showed up to give a presentation at a sales meeting [and] he encouraged us to give clients with kids an Etch A Sketch as a promotion and relationship-building tool if they opened up a college savings account."

The pitch reminded Renick of the financial habits his father had instilled in him when he was as young as age 4. Those habits led to Renick starting an automatic investment and saving program right after graduating from college. After the wholesaler’s pitch, Renick researched financial literacy among children and found that it was a challenging experience for parents and educators.

"That then got me to think it might be a better idea to give families with kids a resource that was both fun and communicated a financial education message."

Renick published Sammy's Big Dream in 1999. Sheryl Garrett, founder of the Garrett Planning Network, sponsored a revised edition last year to give to her own clients.