There’s no shortage of news headlines to make investors anxious before they’ve even finished their morning coffee. Chief among them today is coronavirus (COVID-19), which has sent markets into a tailspin. In these times of market volatility, we believe that closed-end funds (CEFs) may provide a compelling opportunity for investors.

Investors and markets had a muted reaction to coronavirus at first, when the virus appeared to be restricted to mainland China. Since early 2020, however, the number of cases has ballooned worldwide.

At the time of writing, coronavirus has infected more than 100,000 people worldwide, and coronavirus fear has infected the minds of many more. Investors and markets have begun to react negatively. The last week of February was the worst for global equity markets since the peak of the global financial crisis (GFC) in 2008. In the first week of March, the CBOE Volatility Index (VIX), which reflects market uncertainty and fear, hit its highest level in nine years amid global anxiety.

In a frenzy of coronavirus-driven fear, U.S. investors pulled $11.86 billion from long-term open-end mutual funds and ETFs in the week leading up to February 2, according to the Investment Company Institute.

CEFs may offer an advantage during market selloffs such as this. When open-end funds experience a sell-off, their managers must sell assets quickly in order to raise cash to meet redemptions. CEFs, on the other hand, operate on a fixed pool of capital. Trades in the secondary market fulfill redemptions; that is, the managers are not required to raise any cash from the portfolio.

It’s important to note that CEF investors are still able to redeem their holdings, as they would with a listed operating company like Amazon or Alphabet. The difference is that CEF managers are able to look through marketplace short-term noise and potentially take advantage of volatile markets. A CEF manager can consider whether or not it’s an appropriate time to sell assets, independent of any investor redemptions.

CEFs also offer access to defensive asset classes. There are plenty of CEFs investing in defensive areas with low correlations to equities, such as infrastructure. Private assets can also dampen NAV volatility. Private assets can be attractive diversifiers when markets fall rapidly because they are not marked to market on a daily basis. Therefore fundamentals—not sentiment—drive their valuation.

CEFs may also provide an attractive source of income in volatile markets. In response to the escalating concerns about coronavirus, the U.S. Federal Reserve (Fed) announced an unscheduled, emergency benchmark interest-rate cut on March 3—the first of its kind since early days of the GFC. The current federal funds rate is now in a range of 1% to 1.25%. Additionally, the 10-year U.S. Treasury yield has fallen to a historic low of below 1%. These factors both put pressure on investors looking to generate income. Many CEFs continue to pay attractive income yields, and therefore may be worth consideration.

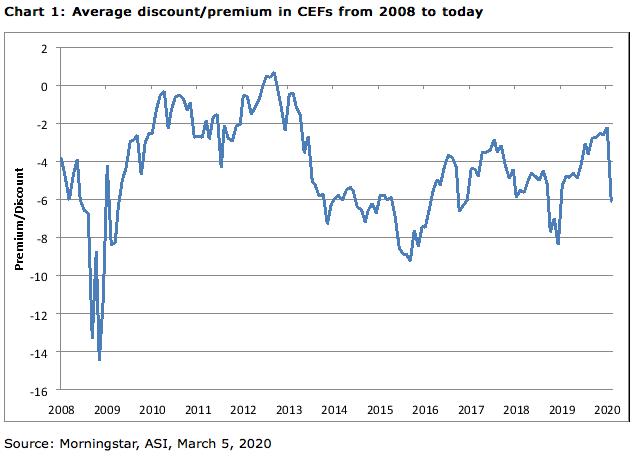

CEF shares are bought and sold on the secondary market, so supply and demand drive their prices. These shares may trade above their net asset value (at a premium) or below (at a discount). Share prices of many CEFs fell alongside equity markets in the last week of February, which we feel presents a buying opportunity to investors.

CEF share prices haven’t been immune to the recent market sell-off. According to Morningstar, the average CEF was trading at a discount of 2.37% on Monday, February 24. By the end of the week, the average discount widened to 6.12%. CEF discounts can narrow significantly in relatively short periods of time. Buying a fund at a historically wide discount provides another source of return for investors if the discount moves closer to its historic average. Investors must bear in mind, however, that discounts are not guaranteed—buying at a premium is also a possibility.