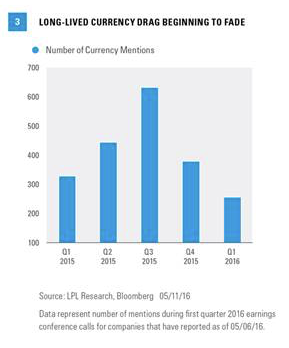

Should the U.S. Dollar Index stay where it closed on May 13, 2016, for the rest of the year, the dollar would drop from a 2% headwind for earnings in the first quarter of 2016 to a tailwind of about 2% in the second and third quarters and over 3% in the fourth quarter.

· “And one positive is that we will get a big help from currency as it turns from a headwind into a tailwind beginning in the next quarter.” (Airline)

· “The weakening U.S. dollar gave us some relief.” (Chemicals producer)

· “So with the current circumstances of the world and what everybody is talking about in terms of real negative interest rates and so forth, that actually favors weakness to the dollar for us right now.” (Healthcare products)

OIL STILL IN THE PICTURE

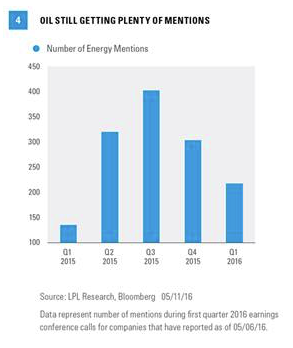

Oil’s rise from the February 2016 lows in the mid-$20s per barrel to the mid-$40s (as of May 13, 2016) eased concerns about the negative impact of low prices and led to fewer oil mentions on conference calls [Figure 4]. The rebound in oil prices has provided some light at the end of the tunnel. Energy sector profit fears have begun to fade, as have concerns about the profitability of other commodity-sensitive areas. The topic did still get plenty of mentions.

Oil could show year-over-year gains in the third quarter if it stays in the range of mid- to high $40s. We believe this is possible, based on the trend in U.S. production cuts and expected continued growth in global demand (consistent with the Energy Information Administration, which raised its oil price forecasts on May 10, 2016).

Comments from oil and gas industry management teams reflect the ongoing uncertainty:

· “If a lower-price environment persists for longer, we will adjust and pursue even more significant cost savings and even greater cuts in capital to continue to lower our cash flow breakeven.” (Energy producer)

· “We’re focused on lowering the breakeven cost of the business. Now for perspective, if we were in a steady-state world of sustained $45 per barrel oil prices, we believe we could cover the capital required to maintain flat production and pay our dividend with cash from operations.” (Energy producer)

· “In the first half of 2016, we're still oversupplied by about 1.5 million barrels per day. We do expect to see convergence in the second half with the seasonal demand growth, but that's going to widen again in the first half of 2017.” (Energy producer)

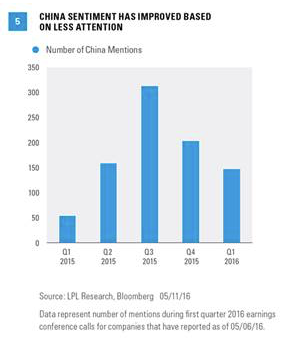

Stock market gains over the past three months have been partially due to more sensible policy and greater stability in China. Although risks remain, we see the drop in the number of China mentions on this quarter’s earnings calls as encouraging [Figure 5].

Comments from some more China-focused companies generally reflect optimism amid slower growth:

· “In China, growth continued to decelerate; however, economies in Japan and Europe showed some modest improvement compared to the fourth quarter.” (Energy company)

· “The world wrings its hands about slowing growth rates in China; and China was 6.5%. And I think if any other country of the world was growing 6.5%, we’d all be doing cartwheels and investing heavily.” (Healthcare products)

THE BOTTOM LINE

Earnings fell sharply during the first quarter of 2016 relative to the first quarter of 2015 and were about flat excluding the downtrodden energy sector. We did get a small upside surprise in earnings results this quarter, consistent with history, and a trough in the earnings growth rate has almost certainly been put in. But another decline—the third or fourth in a row depending on the data source—is hardly worth celebrating.

With hundreds of companies commenting on currencies, it is not difficult to find interesting insights from management teams about the currency environment. Here are some examples:

SLOWER CHINA EVIDENT

More encouraging though, we did see slightly more optimistic than usual guidance. Thomson-tracked consensus estimates for the next 12 months were revised lower by 1.4%, compared with the recent historical pattern of 2–3% negative revisions (fourth quarter 2015 earnings season saw a more than 5% haircut). The better economic environment during March and April 2016 helped, as did the dollar and oil reversals.

The most important earnings question is still tough to answer: Are consensus estimates for mid- to high-single-digit gains in earnings in the second half of 2016 more credible? This earnings season provided little evidence that companies are seeing a growth pickup (nor does our economic analysis). This casts some doubt regarding the strength of a potential second half earnings rebound, which may need help from the economy, market forces (oil and the dollar), and corporate efficiency (strong profit margins).

Burt White is chief investment officer for LPL Financial.