There is a focus on the S&P 500 because it is so widely used as a benchmark, but it could have been easily bettered just within the world of U.S. stocks. The equal-weighted version of the S&P, or effectively the performance of the average stock within the 500, beat the cap-weighted version and very nearly doubled:

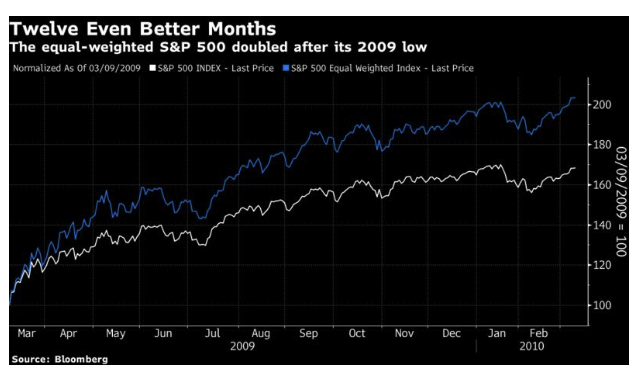

It’s not unusual for the equal-weighted version to do better in a rally. Bigger stocks more or less by definition start off more richly valued. Indeed, this wasn’t the best ever 12 months for the equal-weighted S&P 500. That title belongs to the year following the GFC nadir, when the equal-weighted version more than doubled:

How Could We Have Spotted It?

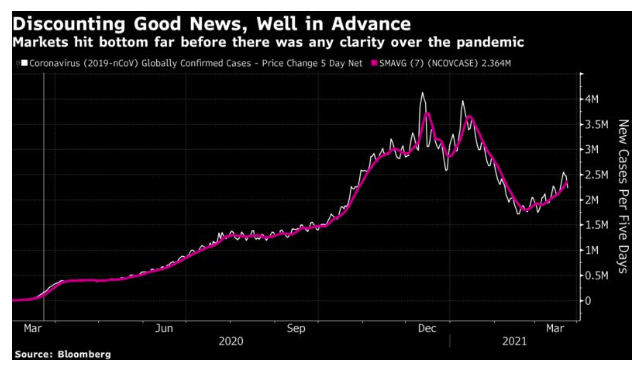

We all know now that deaths are a lagging indicator. Here is the same exercise for global Covid-19 confirmed cases. Again, there was no possible way to predict the course of the next 12 months from the data available at the time (and note that the rate of new infections has started worryingly increasing again):

As for the news flow, there was no obvious big new news on the morning of March 24, a Tuesday. The Fed had announced a massive program of support on the Sunday evening, and yet stocks had still dropped on the Monday. The U.K. announced its lockdown that Monday. And this is how Points of Return started on the Tuesday morning when the market was about to rebound:

These are extraordinary times. The Federal Reserve opened the week with a package of measures to support the market so drastic that Jim Bianco, head of Bianco Research and a Bloomberg Opinion contributor, commented: “At first blush, it looks like they are nationalizing financial markets, except for equities and high yield. This better work in stabilizing financial markets!” And yet U.S. stocks finished down for the day, as did bond yields, in part because of continuing Congressional drama that saw the Democrats continue to play a risky game and block a $2 trillion fiscal package. By the end of the day, Britain had been put under lockdown for three weeks. In one item of good news, the increase in the Italian death rate appears to be declining. Meanwhile, Spain appears to be entering its own nightmare.

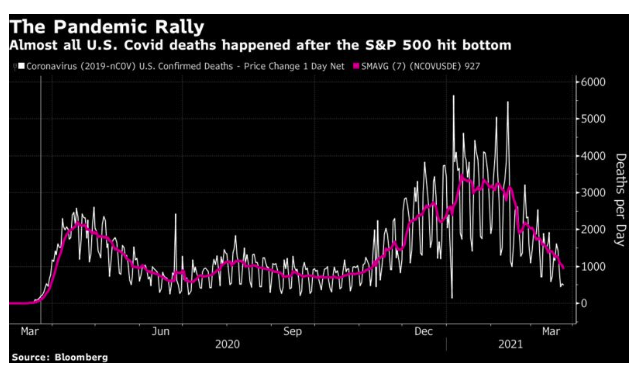

All of this raises the question — could we have spotted the buying opportunity in real time? The obvious compelling question of the time was over the damage that would be done by the pandemic. The following chart shows the course of Covid-19 deaths over the last year, with the moment to buy marked with a vertical line. Nobody could possibly have bought on the basis that the worst of the pandemic was over: