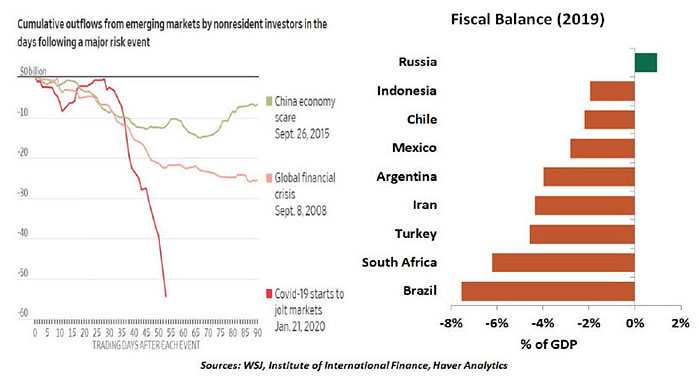

Though Latin America (LATAM)’s exposure to the viral outbreak has been limited, the Brazilian real and Mexican peso are among the worst-performing currencies this year, reaching record lows. Declining external demand and commodity prices, tightening financial conditions, and the impact of virus containment measures will result in significant shocks to LATAM economies.

Among other major emerging markets, Turkey, South Africa and Iran are also struggling, even though the first two haven’t seen a major outbreak yet. With Europe, Turkey’s main trading partner, in a lockdown, the country’s export and tourism sectors are likely to suffer. Measures aimed at limiting the spread within Turkish borders will weigh on domestic consumption. Turkey had unleashed massive stimulus from its 2018 currency crisis; its monetary and public finances will now stretch even more to underpin the economy.

The outlook for South Africa was bleak coming into 2020, but the external shock of COVID-19 will further destabilize its fragile economy. The South African rand has tumbled 13% this year. In the event of an outbreak, South Africa’s socioeconomic conditions will only make the fight against the virus more complex, as implementing lockdowns won’t be easy. The external shock coupled with weak domestic fundamentals, including high (external and short-term) debt and an energy crisis, will likely push the economy deeper into recession.

The situation in Iran is far worse. It is battling an outbreak with an already decimated economy owing to economic isolation and now the oil price war. The rial has depreciated considerably, which will fuel inflation. Standing at a breaking point, the crisis has forced the Iranian government, for the first time in 60 years, to request a $5 billion loan from the International Monetary Fund.

Though some of the economic damage can be mitigated by policy support measures, any monetary easing is constrained by these countries’ weaker currencies and risks of inflation. They have little room for fiscal easing, as several emerging markets are running fiscal deficits.

In sum, the Year of the Rat does not look like it will deliver on its promise. Next year will be the Year of the Ox, a symbol of strength: hopefully, this will bring some stability to EM economies.

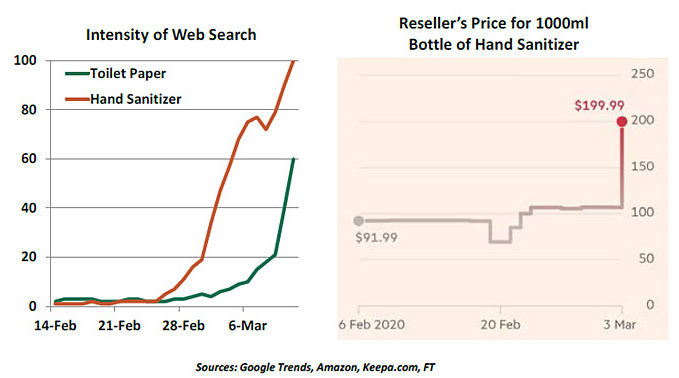

Paper Panic

What do tulips and toilet paper have in common? Read on.

Friends of mine who grew up in Eastern Europe have remarked that recent scenes in the world’s grocery stores remind them of their childhoods. Empty shelves, fights over newly delivered inventory and black markets with high prices have been common during recent weeks, as populations prepare for extended periods at home. Guards have been called out to patrol supermarket aisles, while thieves have hijacked trucks delivering particularly scarce items.

On the surface, the hoarding is completely irrational. The coronavirus does not bring digestive issues, and there are more than 100 toilet paper manufacturers in the United States. Studies suggest that an 18-roll package of toilet paper should be enough to last a family of four for two months. Why, then, do we see people marching out of retailers with 4-5 of them?

It’s because people around the globe are governed by behavioral economics. We are risk averse, and since we cannot eliminate all risks, we often work hard to control the things we can. Hoarding essentials gives us the peace of mind we are struggling to achieve elsewhere.