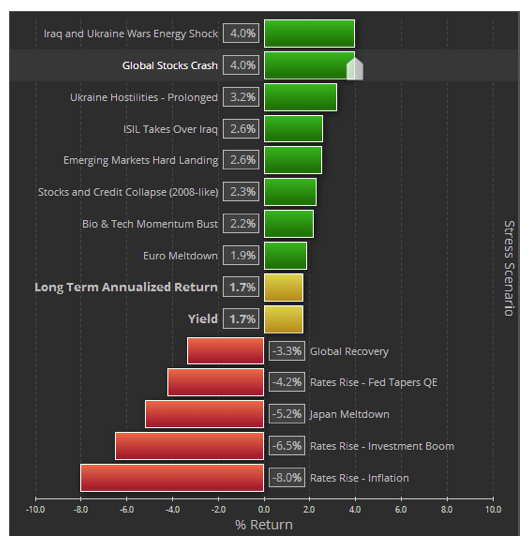

Most of the time de-risking is taken to mean shifting of the allocations to include more fixed income. Here is an extreme example of that where a whole portfolio is placed into the PIMCO Total Return fund. I am not the first one to point out that the expected yield on such investments is paltry, the upside is very limited to say the least and there is a real risk of losses if (when) rates rise.

Portfolio Insurance

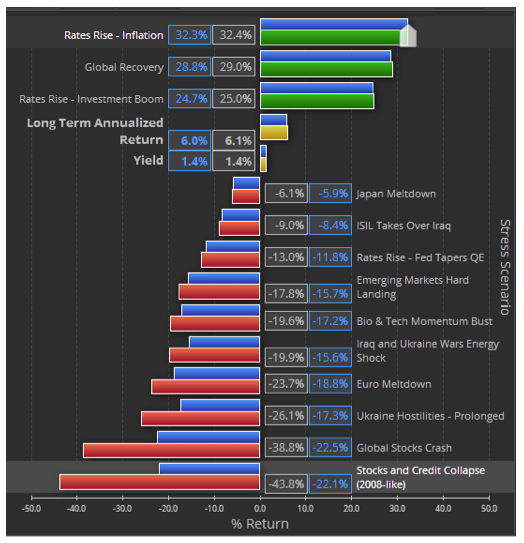

So, fixed income does not sound very appealing as a de-risking strategy. Low yields and not such a low risk do not seem like a great combination. But there is an alternative. When we see irrational exuberance and madness of crowds, it might make sense to consider put options. They give protection without the necessity to time the market. The nice benefit is that during times of exuberance, the prices of options are fairly moderate. Exhibit 2 shows the same Moderately Aggressive portfolio after we have optimized it to limit the loss in a 2008 repeat to 22% instead of ~42% that the portfolio was losing originally. The best practice is to use deep out of the money options to keep the costs low. We are not trying to get rid of all losses, but simply cushioning the blow to the degree that the client can stay with the aggressive portfolio and does not bail out at the bottom.

Exhibit 2 – Original Portfolio (green/red bars) and Optimized (blue bars) with insurance

We see that we have kept the upside and limited the downside. In order to get this result we have paid an insurance premium. In our case, we used the put option on SPX with the strike price of 1450 and expiration in December 2014. The option costs $2.50 per contract and in the case of a repeat of 2008 (a ~45% drop in SPX) it will be worth $374. Thus, for a $1M portfolio it is estimated to give a benefit of $220K while spending only about .15% (600 options at $2.50 each) of the portfolio value on the premium. Of course, there are caveats and assumptions to running an options strategy, from the available volume to bid/ask spreads and rolling of the options after they expire in December. In addition, options should be traded by a professional familiar with volatility surfaces. However, even increasing the potential costs up to 1% annually can still give an economical way to limit the downside, while keeping the upside for growth in appropriate situations. Fixed income just can’t give you that.

Daniel Satchkov, CFA, is the president of RiXtrema Inc., a risk modeling and consulting firm that focuses on the extreme financial market events.