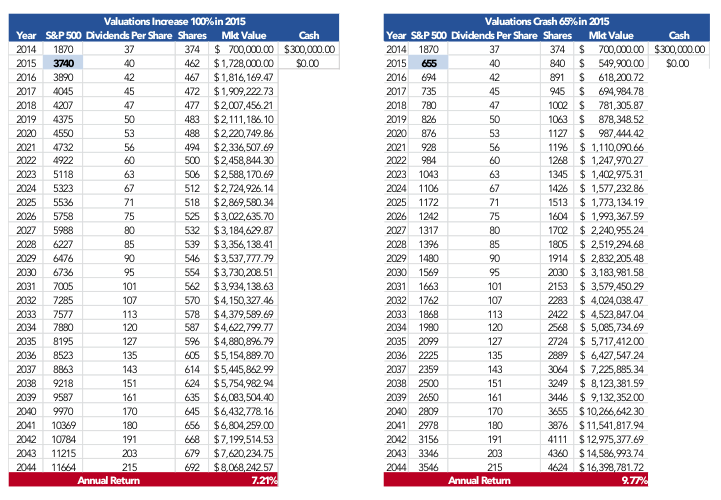

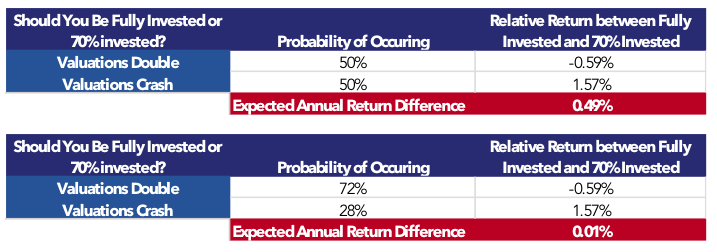

Next let’s further the illustration and take a look at an investor that is 70 percent invested in equities and 30 percent invested in cash prior to the valuation adjustment. Let’s assume that after the market either doubles or drops by about two-thirds the investor becomes fully invested. As you can see below, the annual return between the two scenarios diverge quite a bit. When the market doubles, an investor’s annual return drops by 59 basis points to 7.21 percent. Meanwhile in the crash scenario, an investor’s annual return increases by 157 basis points to 9.77 percent. If the investor assumes that each scenario has a 50 percent chance of occurring then the investor actually increases his or her expected annual return by 49 basis points by holding 30 percent cash prior to the valuation adjustment versus being fully invested. In fact, even if the investor believes there is a 72 percent chance of a doubling scenario in price and only a 28 percent chance of the crash scenario, it would still slightly be in his or her interest to hold 30 percent cash. Or put another way this is the approximate breakeven probability level.

Source: GaveKal Capital

Steven Vannelli, CFA, is managing director at GaveKal Capital and portfolio manager of the GaveKal Knowledge Leaders Strategy. He and his team blog daily about the markets at http://gavekal.blogspot.com/. Follow them on Twitter @GaveKalCapital.

Tapping into the exponential power of compounding over long periods of time is without a doubt the surest way to reach one’s long-term financial goals. For equity investors, dividends are the key to unlocking this power and with that understanding, a sustained fall in equity valuations should be looked upon as an opportunity. Holding onto some cash can increase one’s long-term rate of return, even if one believes a doubling scenario is much more likely, because the benefit of the option to deploy cash at an opportune time outweighs the risk of buying at a future higher price.