As Spain, Italy, Greece and other Southern European countries continue their struggle for fiscal solvency, the possibility of finding even a tidbit of bright economic news in these regions seems remote.

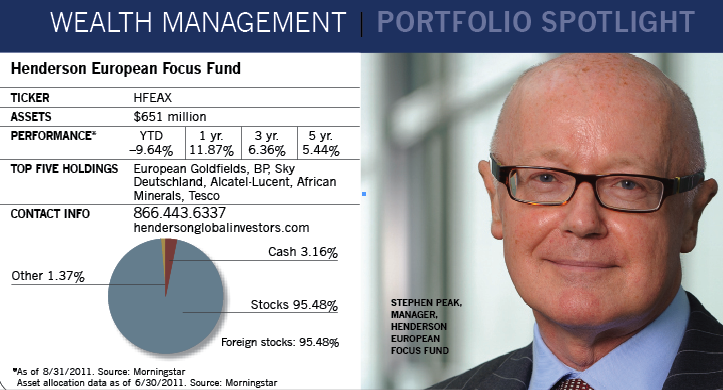

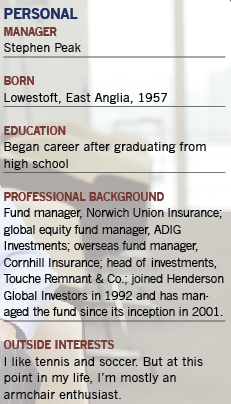

Yet the companies in Europe are an altogether different story, says Stephen Peak, manager of the Henderson European Focus Fund. "Remember, we're not investing in the growth of European economies. We're investing in the growth of companies located in the European markets," he says.

To Peak and others, strong companies represent a bastion of investment sanity at a time that U.S. government bonds have been downgraded, continued debt woes plague the euro zone and slow economic growth in Western markets continues to darken the mood of global investors.

No area has felt the pain of slow GDP growth and government fiscal imprudence more keenly than Europe, where the European Central Bank's efforts to shore up the balance sheets of troubled countries such as Spain and Italy have done little to assuage nervous investors, who fear the worst is yet to come.

Peak sees no easy solution. "Europe has reached a crossroads in terms of the euro experiment," he says. "Member countries might drive linkages deeper, but that could mean giving up individual country rights such as setting tax rates. Another option would be a kind of two-speed euro zone that separates the northern countries from those in the south. In any case, the good thing about all this is the growing pressure to come to a workable solution rather than to just paper over the cracks in the system."

People might point fingers at Europe and its market volatility, but it hasn't been the only region with problems, Peak says. The U.S. has also had its share of fiscal foibles and stock market swoons. And while the economies of China and other emerging markets have been more robust, their stock markets haven't been the powerhouses many had hoped for over the past year.

Peak presents a number of arguments in favor of European companies, including their attractive stock valuations. According to his calculations of forward price-earnings ratios and other measures, the valuations of European stocks are the lowest of any stock market in the world.

"I think a good portion of fear has already been factored into stock prices," he says. "Even though the next six to 12 months will clearly be a struggle for Europe and other markets, I feel fairly confident that the world is in pretty good order." He adds that with the threat of rising interest rates, stocks are a better bet than bonds right now.

Despite the region's problems, European companies have a durable appeal. "It's the biggest international region, with a vast array of choices in terms of company size, range and complexity," he says.

But investors also need to pick their spots carefully in European markets, he says. The Henderson fund, an all-cap portfolio, has done that by investing in stocks that most analysts don't cover, and that most European mutual funds don't invest in.