In addition, we do not expect high PEs to be a catalyst for a sell-off in high-dividend-paying stocks. Should stocks sell off, especially if accompanied by a rise in interest rates that makes those dividends relatively less attractive when compared with bonds, then we would expect high yielders to suffer as much—if not more than—the broad market. This was the experience during the Fed “taper tantrum” in May and June 2013, which saw interest rates rise sharply, the S&P 500 pull back 6%, and high-yielding stocks lead the way down.

ARE DIVIDEND PAYERS STRETCHED?

How can dividends keep climbing when corporate profits are still stuck in the mud? Dividends for the S&P 500 are growing at a rate of about 5.5% annually, while earnings for the S&P 500 fell 2% year over year in the most recent quarter (second quarter of 2016). Although analysts’ consensus forecasts are for mid-single-digit dividend growth to continue over the next 12 months (according to FactSet data), clearly this pace of growth without profit growth is not sustainable over the long term. Something’s got to give.

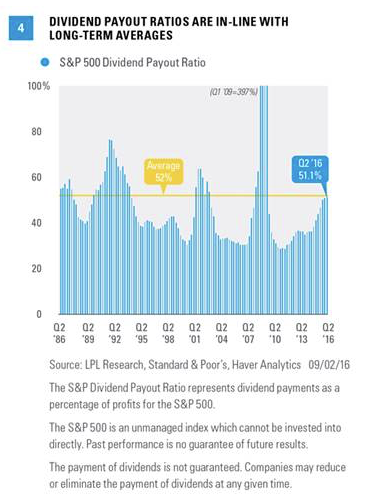

The S&P 500’s payout ratio helps show that these dividend payouts are not out of line relative to corporate profits [Figure 4]. In fact, dividend payments as a percentage of profits for the S&P 500 are actually still in-line with the long-term average, after climbing from the depths of the financial crisis. Dividend growth may be limited until companies can generate more profit growth, but payout ratios do not suggest companies are over-distributing (we see a similar story with share repurchases as we discussed in Midyear Outlook 2016).

Might profit growth help the dividend picture? If the oil and U.S. dollar drags ease further, corporations should start to generate earnings growth—we expect a potential increase into the mid-single-digits during the fourth quarter of 2016 and hopefully a bit better as 2017 begins. Better economic growth in the U.S. and emerging markets, we believe, may also help give profits a potential lift in coming quarters, which could be accompanied by more dividends.

INVESTMENT IMPLICATIONS

If dividend growth continues and high-dividend-paying stocks are not all that expensive, should we load up our portfolios with equity income ideas? If suitable, we believe investors should consider reserving a meaningful portion of equity portfolios for stocks that provide the potential for above-average yields, but we continue to favor growth-oriented and less interest rate sensitive areas of the equity market over higher-dividend-paying value stocks, as we continue to expect interest rates to move higher over the balance of 2016 and into next year.

Among equities, we suggest the following for consideration:

· Energy/MLPs. Master limited partnerships (MLP) offer very attractive yields (the Alerian MLP Index yield is 7.2%), which can vary depending on the product’s structure. Oil prices have rebounded nicely off of the lows earlier this year and could be buffeted, we believe, by the sharp cuts in oil production in the U.S. and demand growth. The traditional energy sector, which yields a good amount more than the S&P 500 (2.8% versus 2.1%), should benefit if oil prices potentially move back into the $50s over the next several months.

· REITs. We believe the economic backdrop is favorable for potential real estate investment trust (REIT) gains. The U.S. economy is growing steadily and creating jobs consistently, but not enough to overheat, in our opinion. Inflation is modest but rising gradually, a favorable condition for cash flow growth of real estate assets. We have not seen signs of overbuilding in the commercial real estate markets, a positive sign for the possible continuation of the real estate cycle.

· Pharmaceuticals. The broad healthcare sector offers lower yields than the S&P 500, but the pharmaceutical industry group is yielding 2.5% and has continued to generate solid earnings growth. We expect the Affordable Care Act to remain intact in most election scenarios. Political headlines that have led to the group’s recent underperformance have created long-term value, in our opinion.

CONCLUSION

Dividend-paying stocks have been thriving in the low interest rate environment as investors increasingly use stock dividends as a substitute for fixed income in the low interest rate environment. Although the market’s thirst for yield has pushed valuations of high-dividend paying stocks above fair value, it is hard to make the case that they are much more expensive than the stock market as a whole; and certainly do not appear bubble-like. And payouts do not look overly stretched. So consider keeping a portion of your portfolios reserved for some dividend-paying stocks, especially those in areas with more favorable growth prospects, and discuss any potential changes with your financial advisor prior to investing.

Burt White is chief investment officer for LPL Financial.