Riding For A Fall?

Let’s look to the short term. Not for the first time, a new decade has started with stock markets roaring ahead, and tech in the lead, while optimism abounds. This famously happened in 2000.

As the following chart shows, the enthusiasm for all things tech is nothing like as overheated as it was 2000. But tech stocks have indeed enjoyed their longest run of outperformance in many years. That run only got going seriously in 2016. At this point, tech has made up all the ground it has lost to the market as a whole since October 2000:

Does this mean that markets have been fooled again? No, but it is hard to ignore the evidence that positioning is beginning to look excessive. For the time being, we will leave out valuations, which have suggested for some years that the U.S. stock market is overpriced. This hasn’t stopped them from growing more stretched and making money for those who held stocks in the process.

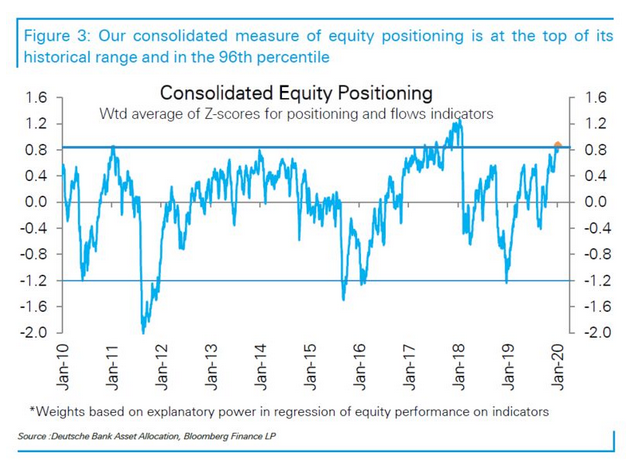

If valuation doesn’t help with timing, however, a look at how investors are positioned in equities compared to other asset classes might give more direct evidence. And according to Deutsche Bank AG’s preferred measure, positioning toward equities has been more extreme only 4% of the time in the last decade. The only time investors were this heavily invested in equities came two years ago, in the run-up to the violent sell-off of February 2018:

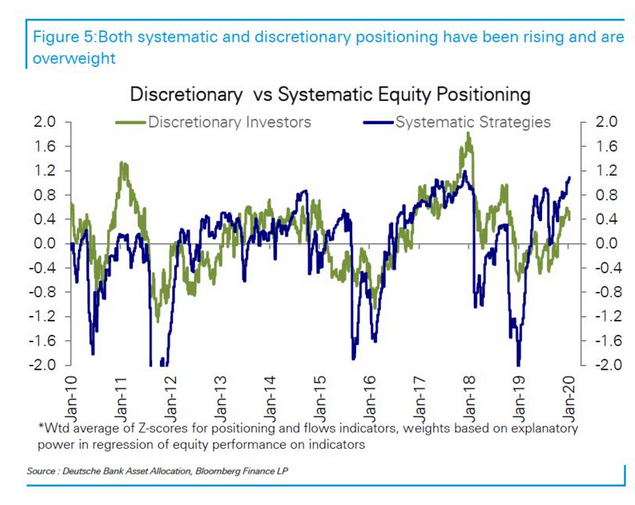

How much do quants and passive strategies have to do with this? Again according to Deutsche Bank, using data compiled by Bloomberg, it appears that systematic strategies are now even more overweight in equities than discretionary investors are. Indeed, the enthusiasm of the systematic strategies exceeds that of the humans to a greater extent than at any point in the last decade. As the importance of systematic investing has only risen throughout this period, that suggests that we should take the current overweighting seriously. The quants got out of equities in a very big (and with hindsight mistaken) way during the big sell-off at the end of 2018, so there is every reason to believe that they could do the same again.

This is a shame because individual investors, a far less influential group than they used to be, are far more balanced in their approach to the current market. The regular survey of the American Association of Individual Investors asking if members are feeling bullish or bearish has been an excellent contrarian indicator over the years. The historic extreme of bearishness over bullishness came in the very week that the stock market hit bottom and started to rally in March 2009. The greatest excess of bullishness over bearishness came just ahead of the sell-off in early 2018. At present, the sentiment of individual investors appears unremarkable, with bulls only just outnumbering bears. This is evidence that sentiment isn’t overblown, but this evidence may not be as valuable as it once was, given the advance of the machines.