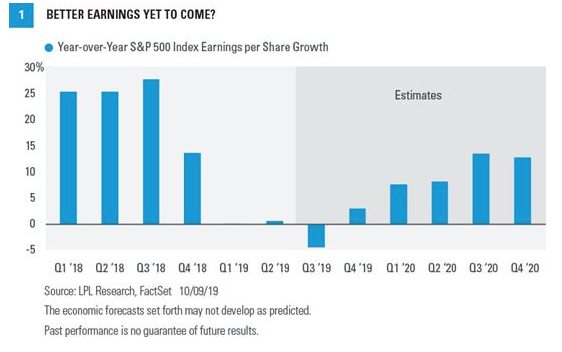

Corporate earnings growth has ground to a halt, but we think better times lie ahead. While tariffs and ongoing trade uncertainty could delay improvement, we remain optimistic that some progress on trade will be forthcoming and earnings growth could pick up over the coming quarters.

Our View

Corporate America is unlikely to deliver much, if any, earnings growth in the third quarter. However, we think better days lie ahead. We expect progress on trade to keep U.S. economic growth at or above the trend for the current economic expansion. The U.S.-China trade conflict is unlikely to be resolved anytime soon, but we believe any small steps forward could increase business confidence and spark capital investment, lifting corporate profits. Flat earnings are hardly exciting, but we think prospects for better growth in 2020 will support stocks at current valuations.

Watch Out For Trade This Earnings Season

Third quarter earnings season kicks off this week, and there may not be much to cheer about. Even with the typical upside surprise, S&P 500 earnings are unlikely to have grown much, if at all [Figure 1]. Given trade uncertainty, opportunities for positive guidance from corporate America may be limited. However, that won’t stop market-watchers from trying to gauge the impact of the U.S.-China trade conflict amid a wide range of possible outcomes.

The trade conflict is weighing on earnings in several ways. Slower economic growth in the United States is hampering revenue, while tariffs and supply chain disruptions are hurting profit margins. Uncertainty around future trade actions is weighing on corporate confidence, which has limited the capital investment needed to drive productivity gains (output per hour worked) that can boost profit margins. On top of all that, slower growth of international economies—partially due to the trade dispute—has added to near-term pressure on revenue. Roughly 40% of revenue for S&P 500 companies is derived internationally.

Economy Hits A Soft Patch

The future path of trade actions carries extra importance given weak manufacturing and services data. The domestic manufacturing sector has contracted, based on the latest readings from the Institute for Supply Management (ISM) Manufacturing’s Purchasing Managers’ Index. Meanwhile, the services sector, which makes up a much bigger piece of the U.S. economy, has slowed considerably despite the strong job market, based on the ISM Non-Manufacturing Index. While surveys like ISM’s manufacturing and services reports continue to show deterioration, other domestic data increasingly has been beating expectations overall. That trend suggests the S&P 500 may be able to beat fairly low expectations.

We believe consensus S&P 500 revenue growth estimates just below 3% for the quarter are achievable in this economic environment (Source: FactSet). Historically, revenue growth has been closely correlated to gross domestic product (GDP) growth, and GDP has grown at a respectable 4% pace (including inflation) over the past year.