The European Central Bank (ECB) recently announced that its Corporate Sector Purchase Program (CSPP) will begin on June 8. The program was announced on March 10, 2016, as an enhancement to the ECB’s quantitative easing (QE) program, which was also increased to 80 billion euros per month (from a previous 60 billion) during the same announcement. The CSPP allows the ECB, through its member banks, to purchase both primary and secondary issues subject to predefined credit quality ratings and concentration limits. Adding corporate bonds to the mix is intended to further increase the reach of the QE program and continue to lower debt costs broadly.

HOW WILL THE PROGRAM IMPACT MARKETS?

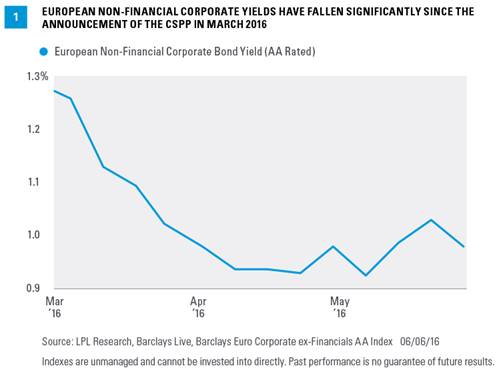

The CSPP had a large impact on the European corporate bond market, pushing non-financial corporate yields significantly lower following its unveiling in March. The ECB announced final details of the plan following the conclusion of last week’s meeting, but the impacts of the program had already been largely priced into the market [Figure 1]. The ECB didn’t announce a specific monthly purchase amount, but consensus forecasts expect a range of 5 to 10 billion euros per month. Investors remain uncertain, however, how quickly the ECB may ramp up the program.

HOW BIG IS THE PROGRAM RELATIVE TO THE MARKET?

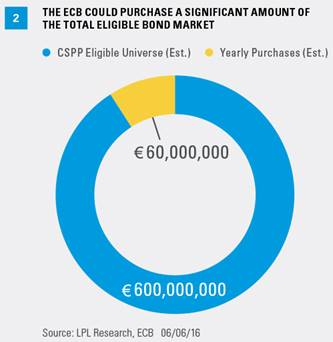

In short – it’s big. There is no question that the ECB’s CSPP is aggressive and is worthy of impacting the market. According to ECB data, outstanding non-financial corporate debt stands at approximately 916 billion euros. The size of the eligible universe for the CSPP is smaller though, as restrictions on credit ratings (BBB or better), type of business (i.e., no financial institutions), and position limits (no more than 70% of any individual bond issue) likely reduce the CSPP eligible market to somewhere between 600 and 700 billion euros. This means that based on 5 billion euros per month in purchases, the ECB would be purchasing in the neighborhood of 10% of the eligible market, and 7% of the entire non-financial corporate bond market per year [Figure 2]. If the ECB purchases 10 billion euros per month, then the share of purchases rises to a more significant 20% of the eligible market.

HOW DOES THE PROGRAM AFFECT U.S. INVESTORS?

Over $10 trillion of global sovereign debt is now trading with negative yields, but so far, corporate bonds have been a notable exception to this phenomenon. Moves from both the ECB and Bank of Japan (BOJ) have been primary drivers of pushing rates into negative territory in their respective areas. Corporate bonds offered investors higher yields; but with the addition of the CSPP, one more opportunity for more reasonable yields is put under pressure.

U.S. Treasury yields, while low compared to history, are attractive compared to European alternatives, and the yield advantage of Treasuries to German bunds is near an all-time high [Figure 3]. This fact has helped to keep U.S. yields lower than they may otherwise have been, as foreign purchases help support prices.

A similar story is playing out with corporate investment grade bonds, and the CSPP is likely to continue to put downward pressure on corporate European debt yields, potentially pushing even more money toward the relatively higher yields of U.S. corporate and Treasury markets. Both U.S. and European corporate bond yields have decreased in recent weeks, another sign that the market has already adjusted following the announcement of the CSPP, but U.S. corporate investment-grade yields remain about 2.3% higher than their European counterparts, based on a comparison of the Barclays U.S. Aggregate Credit and Euro Aggregate Credit indexes.

CONCLUSION