On a local currency basis, estimates for earnings over the next year have been rising for companies in the MSCI Euro Index (which tracks Eurozone stocks) in recent weeks. In fact, in dollar terms they are up to the highest level this year, having risen 6% from their low point in the first quarter.

The growth in Europe in the first quarter was impressive especially considering the challenges of:

- a roller-coaster stock market,

- a rising currency weighing on exports,

- mounting concerns over the U.K. potentially leaving the European Union,

- the refugee crisis,

- the adverse impact on the financial sector of the ECB’s negative interest rate policy.

It is possible that GDP growth in the second quarter may ease somewhat from the strong pace of Q1, but remain solid.

ECB impact

Strong growth is a big relief to the ECB who went all out at the last meeting on March 10 meeting by announcing new actions to spur growth, including:

- a cut in interest rates,

- an increase in monthly “QE” asset purchases,

- adding corporate bonds to the “QE” program,

- a new series of targeted longer-term refinancing operations (TLTROs) to provide funds to banks.

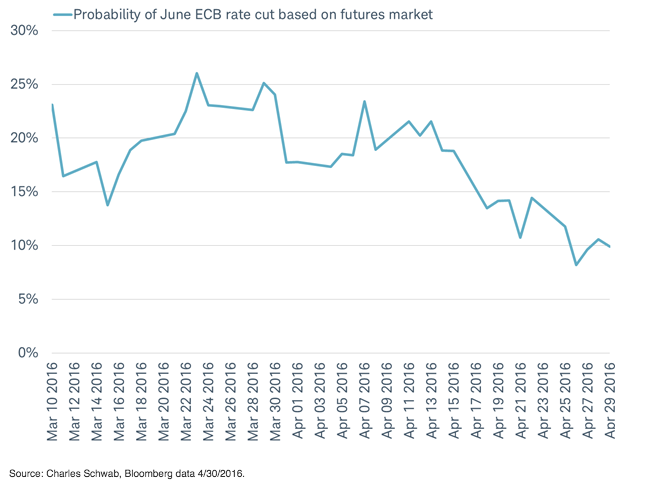

The last two announced measures haven’t even been implemented yet and may provide a further tailwind to growth. The economic outlook would probably need to deteriorate sharply to compel policy makers that more action is needed. Market expectations for additional rate cuts have fallen, as you can see in the chart below. Since the last rate cut on March 10, the chance of a rate cut in June fell from around 1 in 4 to less than 1 in 10, according to the interest rate futures market.

A June rate cut by the ECB is looking less likely

The outlook for further action by the ECB is fading despite inflation remaining weak and the euro continuing to rise versus the dollar. The return of a negative rate of inflation in the Eurozone is not a surprise; the ECB forecasts negative inflation in the second quarter. While the strength in the euro versus the U.S. dollar is not welcome, since it can further lower inflation and negatively impact exports, the euro currently stands only about 3% above the average level of the second quarter of last year. This move is small relative to the 20% year-over-year moves to the up and downside over the past five years in the value of the euro and therefore may not offset the positive economic momentum and other stimulus measures in place and on tap for the coming months.

The improving economic and profit momentum is helping lift Europe’s stocks. The MSCI Euro Index outperformed other developed stock markets including the United States and Japan (measured by the MSCI United States Index and MSCI Japan Index) in April and from the 2/11 low through the end of April.

Jeffrey Kleintop is senior vice president and chief global investment strategist at Charles Schwab & Co.