It should be noted that the massive Thrift Savings Plan for Federal and Military Employees, does not offer an emerging market fund. Its International Fund (the “I Fund”) only invests in developed markets. However, in late 2017 its board voted to evolve the benchmark of its international fund to MSCI ACWI IMI ex-US, which includes Emerging Markets. Senators Jeanne Sheehan and Marco Rubio have recently questioned this substantial planned allocation to China.

What this means is that American investors—both institutional and individual—already have very high exposure to Chinese companies; this exposure will be growing substantially later this year, and likely further accelerating in 2020 and 2021.

This transformation of the two benchmarks that guide more than $3 trillion in indexed and actively managed emerging market assets globally will have an enormous impact. While index fund must track the weights of the key EM indexes, active managers also tend not to allow large deviations of country weights, and thus these funds will also likely be increasing their allocation to Chinese stocks.

Massive Global Capital Flows Driven By MSCI And FTSE Index Changes

To quantify the flow of assets into China during this year of major structural change in global equity benchmarks, BlueStar estimates the following: Just considering indexed/passive assets, approximately $40 billion flowed into Chinese locally listed stocks in late-May through early-July. This will be followed by another $20 billion or more in August’s MSCI inclusion and $20 billion for September’s FTSE inclusion, followed by another $25 billion or more in November for MSCI’s third tranche, which will include mid-cap stocks. This total of more than $100 billion in passive assets will be supplemented by perhaps another $200 billion or more of actively managed assets which are benchmarked to the same indexes and thus loosely need to shift their allocations. An even larger aggregate investment flow—$400 billion—was projected by Chinese asset manager CSOP earlier this year.

The "elephant in the room" being ignored by institutional and individual investors alike is in fact a Chinese panda. This “Panda in the Index” should lead investors to contemplate whether such a high allocation to China is aligned with their values, as well as consider a range of alternative benchmark weighting approaches that attenuate the unintended country and sector bets that the standard Emerging Market indexes make.

Controlling Emerging Market Risk: Single-Country And Sector Concentration

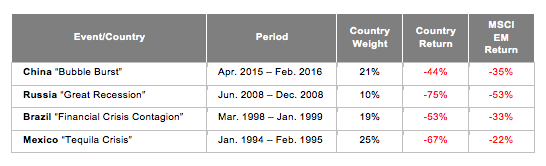

The BlueStar Indexes team has a legacy of emerging market thought leadership stretching back to the early 1990s, beginning at the International Finance Corporation (IFC) arm of the World Bank. In fact, IFC Capital Markets Department staff coined the term “emerging markets” in the late 1980s and “frontier markets” in the mid-1990s. (“Emerging markets” was coined in 1988 by Antoine van Agtmael, who led the Capital Markets Department as part of the process of launching the first emerging markets investment fund, and the term “frontier markets” was coined by Farida Khambata and the Global Capital Markets Department when launching IFC’s coverage of Frontier Markets within its Emerging Markets Data Base (EMDB) index family.) During these momentous three decades, we have observed the weight of single countries rise and fall as isolated crises devastated local markets and often triggered contagion effects across global markets.

Figure: 2: Examples Of Major Single Country Drawdowns Since Mid-1990