IMPACT OF POLICY

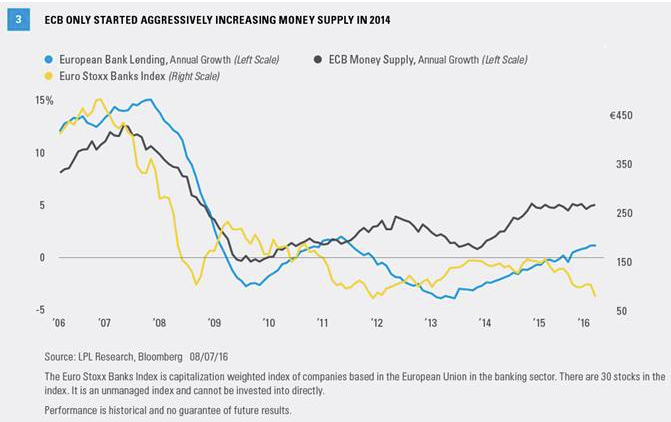

People tend to believe that central banks worked in a coordinated way after the financial crisis of 2008 to support global growth. In fact, the ECB was late to the party. Though it kept rates low, European money supply was stagnant in 2010 and rose slowly after that. It has only been since 2014 that the ECB has aggressively expanded the money supply [Figure 3]. Bank lending actually declined in 2009, and after a brief increase, was negative on an annualized basis for almost three years. It has only been recently, since the beginning of this year, that bank lending began to increase. This increase, should it continue, will be evidence that European economic recovery is truly underway. Given the reliance on banks for financing, bank credit is an even more important indicator of the economy.

Bank stocks prices also tend to follow bank lending, though typically with a lag of approximately one year. This has not happened recently; banks stock prices have declined even as lending has started to increase. This is due to both low interest rates and concern about the credit worthiness of some of the major banks. The total amount of bank lending represents the “sales” for banks; interest rates represent the “price” of what they are selling. Total sales are starting to increase. But if rates stay low, or even decrease, it will be hard for European banks, and European stocks as a whole, to earn our vote for inclusion in portfolios.

CONCLUSION

In our Midyear Outlook 2016: A Vote of Confidence publication, we expressed a generally cautious view on European equities; we’re looking for improved earnings and an appropriate response to Brexit before we could “vote for” increasing our allocation to the asset class. European banks, both as investments themselves and through their importance to the economy, represent an important factor in this decision.

Matthew Peterson is wealth strategist for LPL Financial.