But the fund also differs from the benchmark in key ways. One-quarter to one-third of the stocks in the fund are found outside the Russell index. The outliers are mainly micro-caps too small for the bogey. Bergson likes these “smallest of the small” because they’ve historically outperformed the larger members of the small-cap universe over the long term. “The small-cap premium is not uniformly distributed,” he says. “A disproportionate portion of that premium comes from micro-caps that are often below where the benchmark cuts off.”

In addition to having more emphasis on micro-caps, the fund also significantly differs from the index in its higher return on equity (ROE), which reflects the amount of net income returned as a percentage of shareholder equity. The ROE of companies in the fund is 8.1%, while it’s only 5.4% for the Russell benchmark. That higher indicator is a sign of quality, suggesting the stocks in the fund produce income more efficiently for every shareholder dollar than the benchmark as a whole.

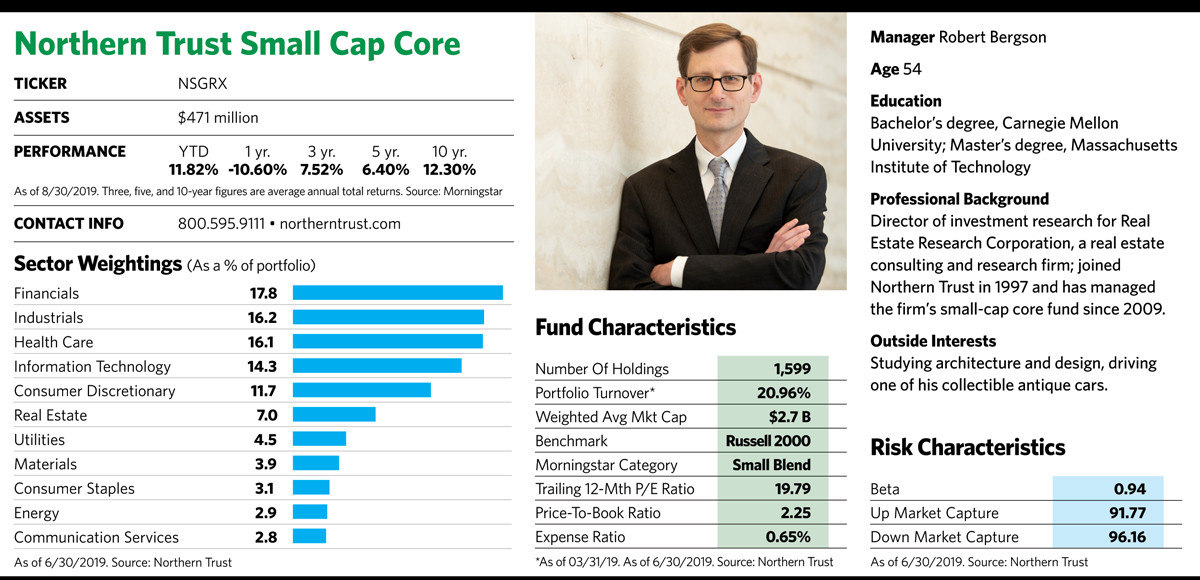

Although Bergson doesn’t aim for the top of the performance charts, he often beats most of his peers, and the fund’s consistent rules-based approach and resilience in down markets is notable. It beat its benchmark in six of the 10 calendar years between 2009 and 2018, and did better than its Morningstar small-cap blend category peers in eight of those years. It held up particularly well against both those bogeys in years when small-cap stocks produced negative returns, including 2015 and 2018. Bergson credits the fund’s quality bias for much of that resilience.

But there are also times when the fund underperforms. That happened between 2016 and 2018, for example, when investors took a risk-on stance and lower-quality stocks outperformed those with shinier financial characteristics. The period is a reminder that factors, even when they are combined for diversification, can face bouts of cyclicality and portfolios can be susceptible to periods of poor relative performance.

But for investors with patience, consistent wins can translate into returns that beat those of both peers and the benchmark over the long term. Over the 10-year period ending June 30, the Northern Trust fund’s 13.69% average annual return beat its Morningstar peer group by nearly 1 percentage point and slightly exceeded that of the Russell 2000.

At least some credit for that outperformance against other small-cap funds comes from an expense ratio of 0.65%, which is about half of what a typical actively managed fund in the category charges. The fund also keeps expenses low by minimizing trading costs, keeping turnover low and relying mainly on computer-driven quantitative analysis rather than a cadre of expensive fundamental analysts. But these qualities also take the investment process away from pure indexing. “We think of it as a quant-active approach,” Bergson says.

Whatever style label he uses, the 54-year-old didn’t follow the traditional route to investment management. He began his career as an architect, but after a few years in the field felt restless and went on to get a graduate degree from MIT in real estate development. After honing his quantitative skills at a real estate consulting firm, he joined Northern Trust in 1997 and began managing small-cap portfolios for institutional investors two years later. Today he’s responsible for several small-cap equity strategies representing more than $4.4 billion in assets.

Small-Cap Edge Prevails

Because small-cap companies tend to outperform larger ones over the long term, a smaller company size is considered a favorable factor. Still, large caps have taken the lead recently. Over the five years ending July 31, for example, the S&P 500 posted an annualized return of 11.34% while the Russell 2000 lagged with only 8.53%. The performance gap reached a historically high level in June 2019, when large caps were up nearly 10% for the year while small caps were down more than 8%.