What’s the value in “value” emerging markets investing? After all, for many investors the allure of emerging markets is their tantalizing growth prospects, fueled by the sector’s favorable one-two punch of a youthful population demographic and potential for a blossoming middle-class consumer society. Given those features, emerging markets are generally viewed as a way to juice the growth profile of an equity portfolio, with the value component to be filled in with supposedly cheaper and/or less risky U.S. or other developed market stocks.

But value investing isn’t just about finding stocks with low price-to-whatever multiples. “Because people pursue growth in the emerging markets universe, it stands to reason that there’s a lot of latent value there,” says Paul Espinosa, lead portfolio manager at the Seafarer Overseas Value Fund. “It’s not that I don’t look at growth, but I minimize that factor in what I look for.”

One of the key metrics that Espinosa and his team focus on is the spread between the return on equity and the cost of equity of a company. According to Seafarer, the team looks for a return on equity significantly higher than the cost of equity throughout most of the economic cycle. This analysis forces them to understand the actual operations of the business and the cost of its growth, instead of just the growth it delivers. They believe this process can produce better investment results.

“To the extent that most EM investors are focused on the growth factor, they leave these other two factors on the table for the picking that can be bought at very attractive prices. That’s the opportunity,” Espinosa says.

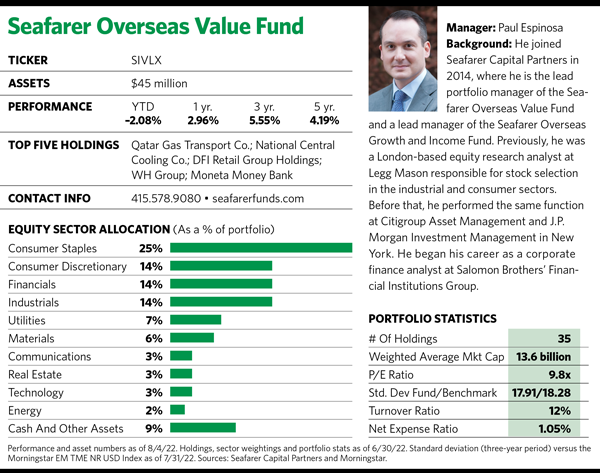

And for the most part this approach has meant success since the Seafarer Overseas Value Fund launched in 2016. According to Morningstar, the fund has been a top-quartile performer in the one-, three- and five-year periods within its diversified emerging markets category. And year to date as of early August, it had massively outperformed its peers and its Morningstar designated benchmark index; it lost only about 2%, which outperformed the category by 17 percentage points and the benchmark by 14 percentage points.

Seafarer Capital Partners is an investment advisor founded and run by Andrew Foster, a former high-level investment executive at Matthews Asia. The firm also runs the Seafarer Overseas Growth And Income Fund, which is the larger of the company’s two funds. That fund holds more traditional and familiar large-cap overseas companies, whereas the Seafarer Overseas Value Fund offers a more eclectic and diversified portfolio that includes recent top-10 holdings from such places as Qatar, the United Arab Emirates and the Czech Republic. Among other holdings within the portfolio’s 35 constituents are companies that hail from Georgia, Peru and Vietnam, along with a healthy dollop of smaller, lesser-known companies listed in China/Hong Kong.

And despite its emphasis on emerging markets, the fund invests in companies headquartered in developed markets that have significant operations in developing nations.

Old-School Investing

Foster is a co-manager at the Overseas Value Fund, and analyst Brent Clayton is also part of the investment team. But Espinosa is the main driver of the fund’s strategy, which he says is an amalgamation of everything he’s learned over the years at previous jobs.

The fund employs a bottom-up security selection process based on fundamental research, and it doesn’t rely on algorithms to point the way. “The process is labor-intensive,” Espinosa explains. “I like to think of it as old-school investing. We don’t start from the benchmark at all. It’s about pencil and paper, and doing the numbers.”

He posits that investing strategies based on artificial intelligence and reams of statistics can produce data that sometimes lack context. “The fact you can analyze data doesn’t mean that you have information,” he continues. “Information comes from thinking, so this is about setting the numbers first, and then meeting the companies and talking to management and then putting the numbers together.”

He adds that his investment process isn’t about trying to capture which sector or company will work in the next year, but rather how in real terms he will get a dollar return above inflation from investing in a particular company at a particular price.