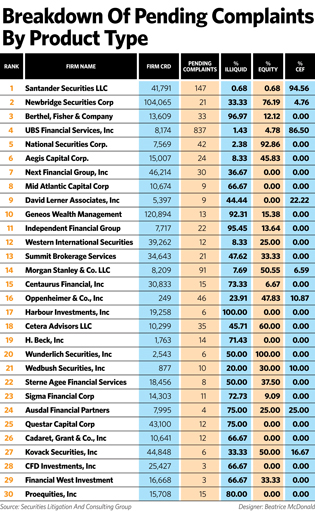

SLCG also correlated the products brokers are selling to the types of customer abuses and complaints their firm received, including breach of fiduciary duty, misrepresentation, fraud, churning and unauthorized data. Major findings include:

• The more heavily a firm’s customers are concentrated in equity products, the more likely the firm’s misconduct involves excessive trading in client accounts. 76 percent of the customer complaints still pending against Newbridge Securities LLC came from equities, SLCG found.

• The higher the concentration in illiquid securities, the more likely the firm’s clients have suffered from breach of fiduciary duty, misrepresentation or fraud. Nearly 95 percent of the 146 customer complaints pending against Santander Securities in 2016 involved the sale of illiquid securities, SLCG found.

Currently, Finra only makes one broker record at a time available to customers through its BrokerCheck tool (https://brokercheck.finra.org/).

While Finra has admitted it has ranked all 634,000 of the brokers it oversees since 2015, it continues to decline to release bigger-picture complaint and disciplinary data on firms to the industry or consumer groups. Instead, the regulator has created a special exam unit targeting high-risk brokers, said Susan Axelrod, Finra’s executive vice president for regulatory operations at the National Society of Compliance Professionals Conference in Washington, D.C., last week.

Finra did not respond to a request for comment by deadline. “Publishing a list with people’s names, where we haven’t proven any violations, there would be challenges to that,” Axelrod said. “That being said, if we are showing up at a firm asking for information on a particular registered person and coming on site to interview that person, that’s a clue they’re on a high-risk broker list.”

While the industry itself may concur with the secrecy, consumer groups and some securities experts do not. “The problem is by not disclosing the bigger picture to investors, or allowing anyone in the industry to do the analysis, Finra is protecting not only firms but predators and I think someone ought to call them out on it,” a securities analyst who asked to remain anonymous told Financial Advisor magazine.

TABLE 3