WILL EITHER CANDIDATE PULL THE STRING?

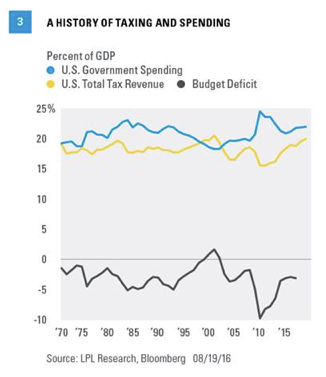

Both presidential candidates have invoked fiscal policy as a way to improve the U.S. economy, with some predictable similarities and differences between them. As the election nears, we are likely to get more details, and more rhetoric, from the candidates with regard to their proposed fiscal policies. The federal budget deficit has been growing in absolute terms; relative to GDP, the deficit has been stable at 2.8% of GDP and is expected to remain at this level for the next few years based on current trends [Figure 3]. As the candidates have promised to expand fiscal policy, the budget deficit is likely to increase in the near term, regardless of who wins the election.

One common fiscal policy proposal from both the candidates is an increase in infrastructure spending. Hillary Clinton has proposed $250 billion in additional infrastructure spending over the course of the next four years; Donald Trump has countered with $500 billion. Though neither camp provided details as to how that money would be spent, they do differ on how this spending would be funded. Trump has proposed borrowing these funds. Clinton has proposed creating a national infrastructure bank, funded from changes to the corporate tax code, likely from closing loopholes and changing the structure of the tax code, rather than raising rates. Though these numbers sound big, assuming the spending would occur during the course of a four-year presidential term, Clinton’s plan would amount to 0.25% of GDP, Trump’s to 0.5%, nowhere near the big numbers seen in the immediate response to the crisis.

Another likely change in fiscal policy will be tax reform, particularly for corporate taxes and some provision to encourage the repatriation of the over $2 trillion U.S. companies are holding overseas to avoid taxes. There is broad agreement in both parties that the tax code needs to be reformed, with lower rates and fewer exceptions and loopholes. The details of these reforms will be determined as much by the makeup of Congress as the identity of the next President. Either way, we would expect tax reform to be a source of fiscal stimulus after the election.

CONCLUSION

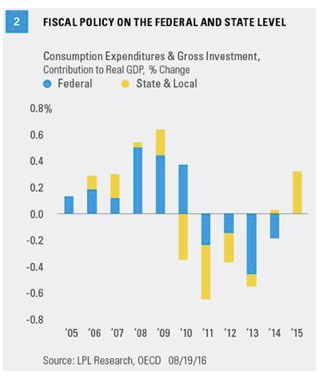

John Canally is chief economic strategist for LPL Financial. Fiscal spending on the federal level declined due to the budget sequestration section of the Budget Control Act of 2011, though the provisions did not become effectively until March 2013. More recently, states have begun to increase spending, partially because tax revenue has increased, but also because things like infrastructure maintenance and improvement can only be delayed for so long. Federally, sequestration is still in effect and creates some drag on U.S. gross domestic product (GDP).

Fiscal spending on the federal level declined due to the budget sequestration section of the Budget Control Act of 2011, though the provisions did not become effectively until March 2013. More recently, states have begun to increase spending, partially because tax revenue has increased, but also because things like infrastructure maintenance and improvement can only be delayed for so long. Federally, sequestration is still in effect and creates some drag on U.S. gross domestic product (GDP).

There is broad consensus, globally and in the U.S., that fiscal policy is going to be revamped to boost the global economy. Monetary policy has done all it can. Concerns about the budget deficit and state balanced budget mandates have been two major factors preventing the expansion of fiscal policy in the U.S. Rightly or wrongly, these issues have been put on the back burner by the presidential candidates, who have promised changes on the both taxation and spending policy to improve the U.S. economy.

Fiscal Policy - String Theory

August 24, 2016

« Previous Article

| Next Article »

Login in order to post a comment