Interest in sustainable investing has grown dramatically in the last decade, as environmental, social and governance (ESG) issues have gained prominence, and investors have come to recognize the materiality of ESG factors to financial performance. Shifting demographics are also playing a role, with younger and female investors seeking out opportunities to align their portfolios with their values.

But sustainable investing is not new. What started out decades—and even centuries—ago as a values-based, exclusionary approach has evolved to include a much broader array of strategies and investment vehicles. This evolution has, to a degree, mired sustainable investing in complexity, and today competing definitions conspire to confound rather than inspire investors.

These five principles are an attempt to simplify some core tenets of sustainable investing. They are applicable to individuals and institutions, and offer perspective about how to be an engaged and effective ESG investor.

1. Adopt A Long-Term Investment Mindset

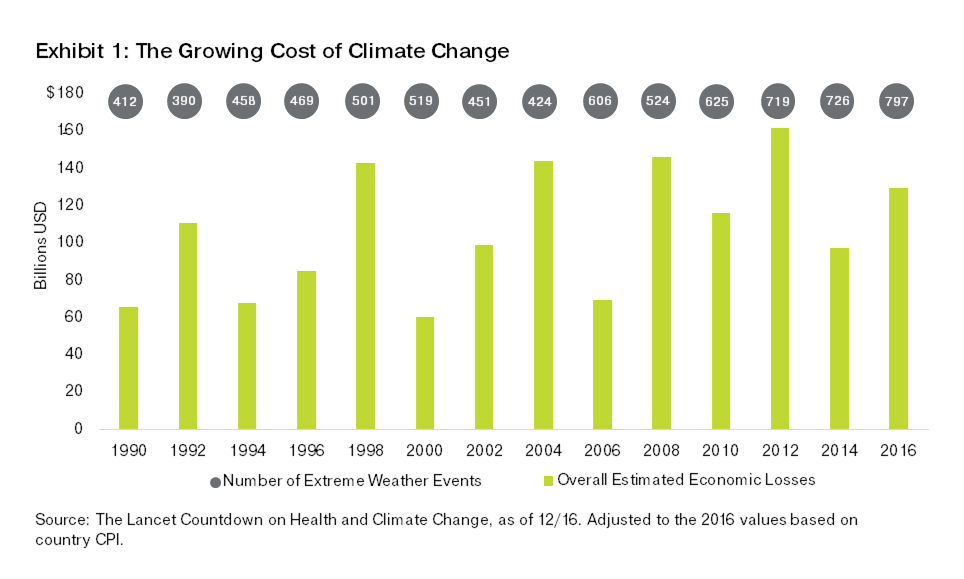

At its simplest, sustainable investing is investing for the long term. Consider the issue of climate change. There are abundant reports of impacts we’re seeing today, including shrinking glaciers, rising sea levels, and more intense weather events. But the effects will become far more pronounced in the coming decades, and this will create challenges and opportunities for companies.

For long-term investors, it’s difficult to make the case today that environmental issues like climate change, as well as social issues like human rights and supply chain management ethics, will not impact their portfolio companies. How companies and other institutions respond to ESG-related challenges is likely to be an important contributor to their long-term performance and viability. Those that acknowledge the issues and adopt proactive strategies to mitigate ESG risks may ultimately deliver better long-term performance.

2. Understand Non-Traditional, Material Risks

The data contained in corporate balance sheet and income statements are integral to fundamental equity analysis, but for the most part, these reports don’t include intangible assets that may account for a significant percentage of a company’s value. When a company’s brand health suffers because of a governance issue, for example, Volkswagen, after its 2015 emissions scandal—its earnings and share price may sustain lasting damage.

Issues such as climate change and the transition to renewable energy pose other types of risk. Climate vulnerability, for example, has already raised the average cost of capital in developing countries by 117 basis points. On the flip side, as the price of renewable energy falls, reserves of carbon-based energy sources like coal, oil and gas could become “unburnable,” or unable to deliver a return to their owners during their economic lifetime. This is known as “stranded asset risk,” and it poses a financial risk for fossil fuel companies and related industries, as well as their investors.

3. Engage With New Types Of Data

We’re in the midst of a revolution that has improved both the quantity and the quality of the ESG data available. Companies are reporting on ESG issues more regularly, and firms like Sustainalytics and MSCI provide independent research and ratings that portfolio managers can incorporate into their fundamental analysis. There are even companies like TruValue Labs that use artificial intelligence to deliver insights to investors on the ESG factors that can have a material impact on financial performance.

To manage what may become a data overload, sustainable investors can adopt a systematic approach to engaging with and evaluating these ESG-oriented datasets, understanding their methodologies, and determining their utility to the investment process through quantitative and qualitative testing. The key takeaway is that the robust data available today—particularly on the equity side—offers investors a variety of ways to evaluate sustainability issues within a portfolio.