Florida’s home insurance market has long been a mess. With private property insurance getting scarcer and more expensive, some members of the legislature are pushing for an even greater role for the state. Unfortunately, that would only encourage homeowners to make ill-advised investments at a time of intensifying and more frequent climate-linked catastrophes. The state should take a step back—not forward.

Florida’s business model, of course, is built on real estate. As long as net migration trends are positive and the assessed value of homes keeps rising, tax revenue will rise and the state will be happy to implicitly underwrite all kinds of risks. But if residents leave and newcomers are deterred because of the high cost of property insurance, then the entire economic and fiscal edifice will collapse.

In a nutshell, that’s why some members of the Republican-controlled legislature are advancing off-brand Big Government policies for the insurance industry. A state senate panel in Tallahassee this month okayed a bill to expand the pool of homes that are eligible for relatively cheap insurance under government-backed Citizens Property Insurance Corp. An even more radical bipartisan proposal—which generated lots of headlines but fell flat with decision-makers—would have opened up Citizens as the purveyor of wind insurance for all. As recently as 2022, there was strong support for shrinking Citizens. The fact that such proposals are now seeing the light of day is evidence of growing desperation on the part of lawmakers.

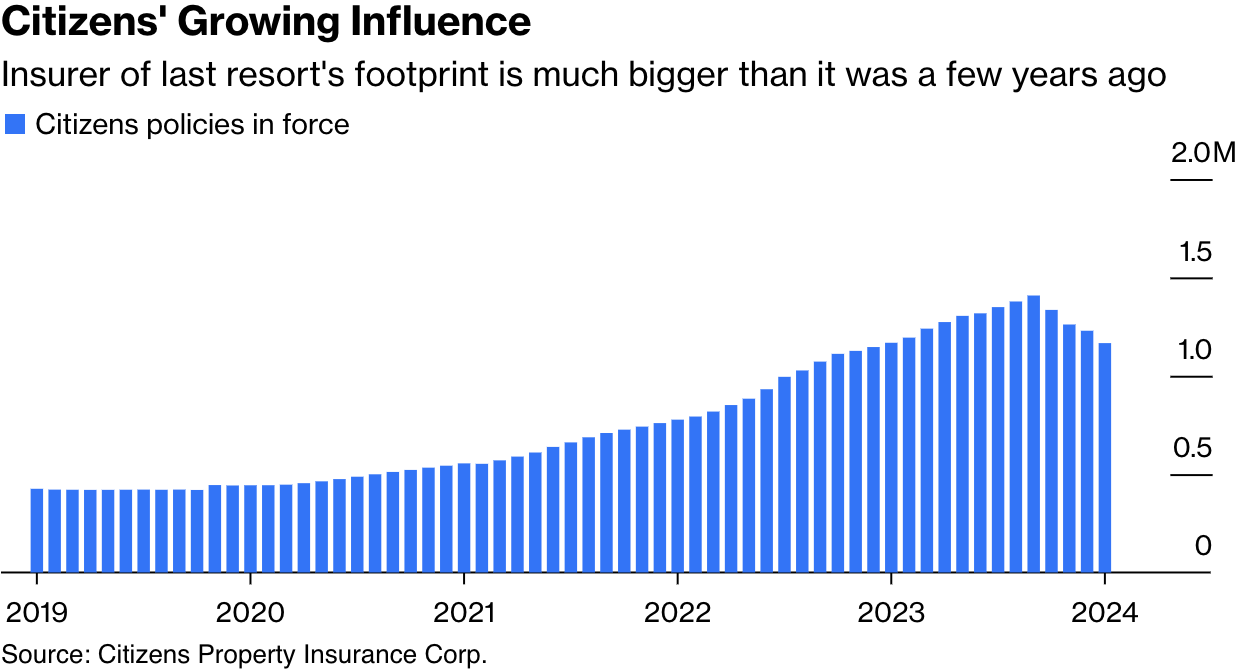

Florida policymakers arrived here after decades of can-kicking. Back in 1992, Hurricane Andrew leveled major swaths of South Florida, bankrupting many insurers and sending others fleeing. In the wake of that historic tragedy, the state felt obligated to take a role in ensuring homeowners could get coverage through what eventually became Citizens, the so-called “insurer of last resort.” During lucky periods with few major hurricane impacts, Citizens policies have tended to migrate back to the private sector. In recent years, the pendulum has swung toward greater state influence. Citizens had 1.17 million policies in force as of January, up from 425,000 five years ago.

Why is private sector insurance so expensive (and, in some cases, unavailable) in Florida?

For one thing, the state has a shockingly high rate of homeowners’ litigation against property insurance companies. Some of them, the argument goes, are based on fake claims drummed up by dishonest contractors who have developed something of a racket with plaintiffs’ attorneys. That, in turn, has created a long tail of litigation costs for insurers after recent storms. The insurance lobby pushed this story hard in 2022, and the legislature made changes to bring down such litigation over time. 1

But lawsuits aren’t the root of the problem. At a time when climate change is making storms more severe and frequent, the amount of residential real estate parked in harm’s way is only increasing. Each time a storm levels part of the state, developers sweep in to redevelop the land into even pricier homes, some of which are protected by Citizens at below-market rates. Lawmakers’ attempt to expand Citizens’ footprint to cover more expensive homes will deepen the moral hazard problem, and the reluctance among private insurers to participate in the market.

In the case of an extreme weather event where claims exceed all of Citizens' reserves and reinsurance coverage, Florida law gives Citizens the power to levy an assessment on all insurance consumers in the state (not just its own policyholders) to cover the shortfall. That would be a bad look, and might ding Florida’s brand. Yet, the risk feels distant enough that the state’s real estate prices have been on a tear since 2020.

Evidently, any concerns about climate risk and insurance costs have been more than offset by the effects of the post-pandemic “work-from-anywhere” revolution and the state’s lifestyle and tax appeal. That’s fine for now, but what of the long run? Ultimately, the state-backed entity can’t be expected to assume an ever-increasing share of Florida’s wind-related property risks at artificially compressed premiums. To keep the state’s real estate-dominant business model viable, policymakers need the private sector.

And to keep private insurers in the state, Florida must guarantee that they can charge the true price of risk, without having Citizens undercut them. Relatedly, policymakers should expand South Florida’s stringent building codes to other parts of the state to limit the human and financial costs of future disasters. For now, property owners may take false comfort in knowing that the state has their back and will provide affordable insurance if they can’t get it elsewhere. But the situation can’t go on like this forever, and Florida’s leaders do homeowners a disservice by letting them believe it can.

Jonathan Levin is a columnist focused on US markets and economics. Previously, he worked as a Bloomberg journalist in the US, Brazil and Mexico. He is a CFA charterholder.