Our long-time readers are aware that we analyze the U.S. stock market through the prism of what we call “well-known facts.” A well-known fact is a body of economic information that is pretty much known to all market participants and has been acted on by almost everyone with available capital. Former Intel CEO Andy Grove use to say, “when everyone knows something is so, nobody’s knows nothin’.” Today there are several well-known facts that we believe are leading investors down a destructive path.

Fact No. 1: Data Mining And Artificial Intelligence (A.I.) Will Change The World

Investors have been so jacked up about data mining and A.I. that they have distorted nearly every major U.S. stock market sector. Anybody who can walk while chewing gum knows that data mining and A.I. are in use, and the companies connected to it trade for 100 times profits (if they have any). The S&P 500 Index is loaded with tech stocks that would be at the heart of this phenomena, and Invesco is giving us nightmares with advertisements to invest in the QQQ exchange-traded fund. The QQQ is comprised of the 100 largest NASDAQ companies and gives a little purer heroin to tech-hungry buyers of the well-known fact.

George Gilder, in his book, Life After Google, argues that data mining and A.I. should begin to suffer from diminishing marginal utility going forward. Regardless of whether he is right or not, the price you pay to be on the data mining and A.I. train make five to ten-year investment success unlikely.

Fact No. 2: Home Building Is Driven By Affordability

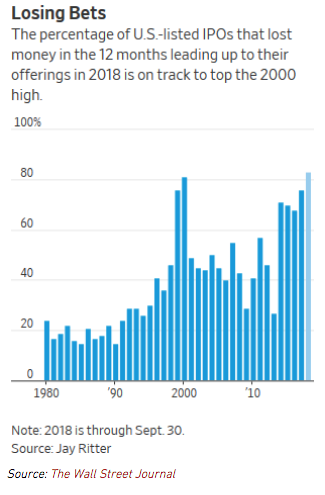

This might be the dumbest well-known fact the markets have ever bought into. Investments do well when purchased at an affordable moment. Stocks were affordable in 2009. Most investors were afraid of them and nobody had an urge to manufacture new ones via initial public offerings (IPOs). In 2018, common stocks as a group are very unaffordable. Despite the lack of affordability, there are the most low-quality IPOs this year as any year in the last twenty (see chart below):

The same is true in houses. Stand-alone residences were the most affordable to buy in 2011 as in any year of my adult life. We built 320,000 in the year 2011. They were the least affordable in the 1970s and 1980s, and we built one million homes many of those years with 65% of the existing population base. There is an inverse correlation between home building and affordability.

Fact No. 3: Big Tech Will Avoid Anti-Trust Scrutiny

There is a well-known fact that goes like this, “Since search, social media and e-commerce delivery are basically free and are benefitting the consumer, the public doesn’t need to be protected from the anti-competitive behavior.” Under this flawed and very selfish logic, controlling 80 percent of the profits in advertising through social media or search is acceptable to the masses. Selling things online and delivering them at a loss to drive traffic to your cloud business seems to be fine with those who aren’t worried about the massive long-term dislocation it could cause in our economy.