We’ve said many times politicians crave the spotlight, but it’s a shame that investors watch the show. History shows quite well that fundamentals, and not politics, ultimately drive the financial markets.

Our November 2014 report, titled “Are you tired of being scared yet?” emphasized that investors were overly concerned about a broad range of issues. We listed nearly 70 risks that at the time led investors to generally conclude that the stock market was an imprudent investment. That was more than two years ago, but such fears have hardly subsided.

An old adage on Wall Street is that one should never take investment advice from Washington, DC. The on-going 9-year (!) bull market proves this seems like sound advice. Investors have been hesitant to invest in this bull market partially because of the warnings of imminent gloom and doom from Washington’s right and left.

Politics vs. Fundamentals

It’s probably fair to say that politics are overwhelming investing fundamentals because it has become difficult to tell the difference between the financial media and traditional news media. Geopolitics, domestic politics, public policy and the like seem to have totally supplanted earnings and sales as investment discussion topics.

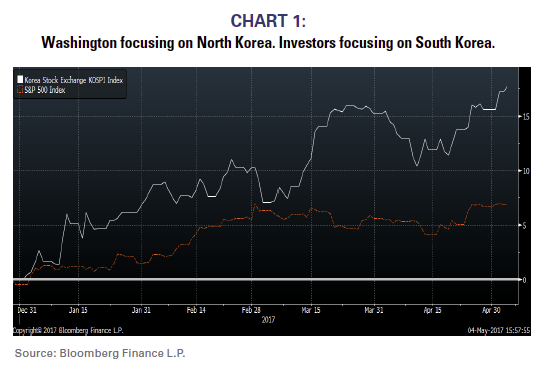

For example, few investors realize that the South Korean stock market is up 18% YTD (through 5/4/17 in USD) because they are so apprehensive about the geopolitical news regarding a potential North Korea nuclear threat. We’ve attempted to capitalize on that misjudgment, and have overweighted Korean stocks in many of our portfolios for months, but the typical investor has probably shunned the region’s stocks.

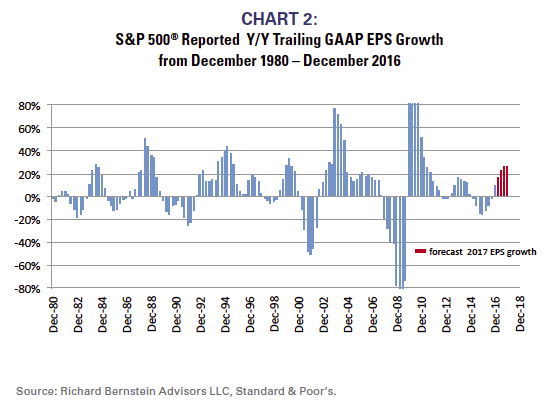

Profits growth looks very healthy with or without tax reform. Investors have somewhat lost touch with overall corporate fundamentals because they are myopically watching politics. RBA’s research has indicated for more than a year that the trough in the US profits cycle was 4Q15, that 2016 was the year of profits recovery, and that 2017 would be the year of the profits expansion. It is likely that S&P 500® reported profits growth will exceed 20% at some point this year. (See Chart 2)

Some investors are incredulous that our optimistic earnings forecasts include no assumptions for corporate tax reform. They cannot believe that profit fundamentals are currently as strong as they are because they’ve been distracted by Washington.

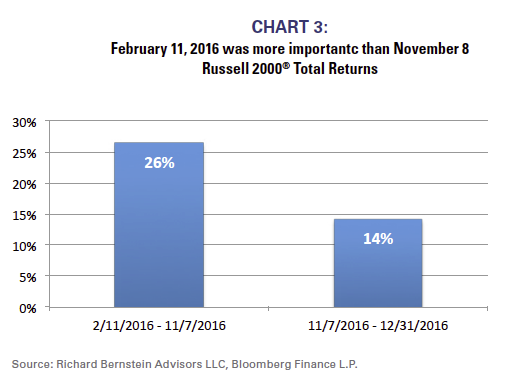

Similarly, many investors have attributed 2016’s stock market performance to the election. However, as Chart 3 shows, nearly 2/3rd of the Russell 2000’s 2016 performance came before Election Day! The Russell 2000 might have appreciated after Election Day because of the election, but 2/3rd of the yearly performance was attributable to improving fundamentals.

Top-Down, but not event-driven

Although RBA is a strictly top-down, macro firm, we are not eventdriven as are most macro investors. We follow a disciplined approach to macro fundamentals. In the past year, this approach has served us well during events like Brexit, the US Presidential election, North Korea, Iran, Syria, the French election, and a litany of other events that in the end have had little effect on the equity bull market. Politicians are always looking for a good photo opportunity like kissing babies. Unfortunately, kissing babies doesn’t typically lead to good portfolio performance. Fundamentally-based disciplined approaches tend to be much more successful.

Richard Bernstein is chief executive and chief investment officer at Richard Bernstein Advisors.