For financial advisors who want to significantly build their practices, there are many ways to pursue new wealthy investor clients. Obtaining referrals from current clients is one approach. Another is to join and be involved in conclaves such as mastermind groups. Still, the most effective approach is creating strategic partnerships with other professionals who have the wealthy investor clientele you are interested in.

These other professionals—commonly known as centers of influence—tend to be accountants and attorneys. The latter are usually trusts and estates lawyers, but while these are excellent potential strategic partners, other types of attorneys, such as divorce lawyers, can also be great referral sources.

In this article, we’ll be looking at lawyers specializing in mergers and acquisitions, especially those working with privately held companies. These are also excellent sources for advisors looking to cultivate wealthy investors.

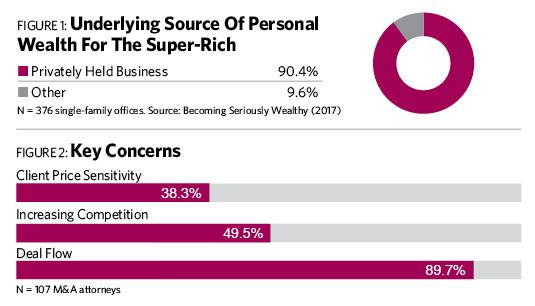

Many potential wealthy clients have built their wealth by building successful companies as entrepreneurs. In a survey of 376 single-family offices, the underlying source of the wealth for nine out of 10 of these super-rich families was a privately held business (Figure 1).

Key Concerns

To enter strategic partnerships with M&A attorneys, it’s necessary for you to understand their professional problems—and one of the big ones is the big competition they face.

In a recent survey we performed of 107 corporate attorneys focused on buying and selling private companies, we found that competition from other lawyers is a source of distress for almost half of them (see Figure 2). Most attorneys say they are living in turbulent times, and this has led some of them to take on more diverse legal work such as corporate sales.

More than 38% of M&A attorneys said that another problem is their clients’ sensitivity to fees, which have been compressed as a result. Lower fees can readily translate into lower profits and lower incomes. Entrepreneur clients may even know the attorney’s hourly rates going in, but they start to feel the pain as the hours get racked up. That means the lawyers must effectively communicate their value early on.

The greatest concern of M&A attorneys is their deal flow. Nine out of 10 of them report that business development is the hardest part of their practice. This is far from surprising. Extensive research with all manner of attorneys (as well as financial advisors, accountants, bankers and consultants), shows that one of their biggest challenges is finding new clients. And no matter how technically adept they are in their fields, if they can’t win clients, their practices suffer.

Getting Referrals From Corporate M&A Attorneys

August 1, 2018

« Previous Article

| Next Article »

Login in order to post a comment