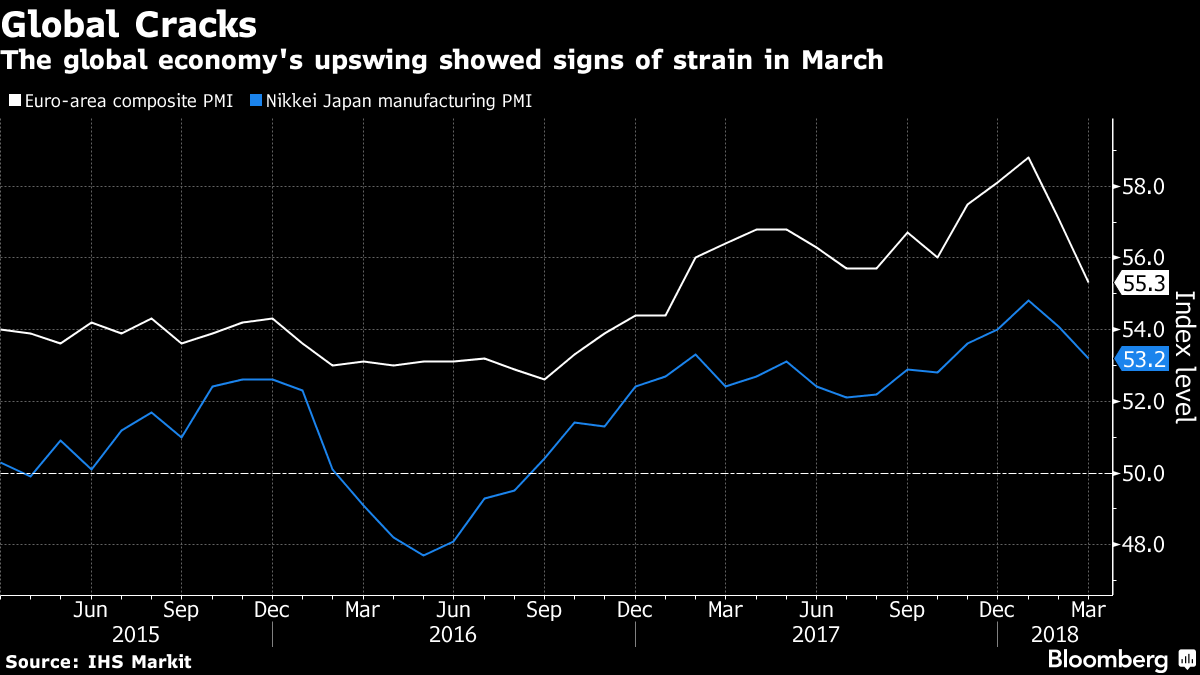

The global economy’s upswing showed signs of strain in March as a drop in momentum at businesses from Japan to the euro region underscored the world’s vulnerability to confidence shocks from a trade war.

Hours after the U.S. Federal Reserve raised interest rates and boosted growth forecasts for this year and next, survey data from elsewhere provided a reminder of how brittle the economic outlook might be. The euro area’s private sector grew at the slowest pace in 14 months, Japanese manufacturing lost steam and German business confidence fell to the weakest level in almost a year, reports on Thursday showed.

That might suggest cracks in a picture of global economic thrust that Group of 20 finance chiefs highlighted as recently as this week. Officials meeting in Buenos Aires also failed to agree on a truce as escalating trade tensions threaten to drag the world into a war of attrition over commerce.

“The kind of growth that we saw at the end of last year was a peak” in the euro area, said Dirk Schumacher, an economist at Natixis in Frankfurt. “The question is what happens now, and how the trade issue evolves is key here. For now, some tightening from the Fed was expected, momentum remains solid and there is no reason why expansion shouldn’t continue, unless things deteriorate politically.”

U.S. President Donald Trump is set to announce about $50 billion of tariffs against China over intellectual-property violations on Thursday, according to a person familiar with the matter. He has blamed the country for the hollowing out of the American manufacturing sector and the loss of U.S. jobs.

Protectionist Threat

Tit-for-tat actions on trade aren’t “going to be any good for the whole economy,” Cofco Corp. President Patrick Yu said in a Bloomberg Television interview at the state-run firm’s headquarters in Beijing. “It just creates a lot of conflicts and misunderstandings.”

While the European Union may be exempted from some tariffs, the threat of protectionism is weighing on sentiment in Germany. The country’s Ifo institute said that business confidence in Europe’s biggest economy continued to drop in March. Its gauge of sentiment fell to 114.7 from 115.4 in February, marking the second month of declines.

In the euro area as a whole, IHS Markit’s composite purchasing managers index slid almost 2 points to 55.3 in March, and well below the median estimate in a Bloomberg survey of economists, which foresaw only a slight decline. Output growth slowed to a seven-month low in France and an eight-month low in Germany.

The region’s expansion “may slow down from its peak,” said Holger Schmieding, chief economist at Berenberg Bank. “But we won’t see it continually weakening from here on out. I see it more as a plateau.”

What Our Economists Say

“The speed of the expansion is decelerating, but only gradually. A slowdown was always to be expected as lingering spare capacity is eliminated. The softer data is likely to be seen as normal at this stage in the economic recovery by the European Central Bank.”-- David Powell and Jamie Murray, Bloomberg EconomicsFor more, read our full reaction

In Japan, the Nikkei Japan Purchasing Managers Index for manufacturers showed a preliminary reading of 53.2 for March, dropping from February’s 54.1. New orders registered the lowest reading since October.