One notable exception is the bear market that accompanied Volcker’s interest rate hikes in the early 1980s. As I have indicated in the past, anyone who expects a similar monetary policy, should not expect gold to perform well. However, we take the Fed at its word that even as inflation and employment moves back to what historically was considered normal, rates may continue to be lower than normal (as the last paragraph of the FOMC statement has stated this since the spring of 2014). To me, that’s a commitment to be ‘behind the curve’, i.e. that rates will be rising slower than inflation. In fact, Fed Vice Chair Stan Fischer in a speech on Monday, February 1, 2016, said that he wouldn’t mind for inflation to temporarily overshoot on the upside. All of this suggests that real interest rates may continue to be low, possibly even negative. While there is no assurance gold will do well in such an environment, to me, it is a key long-term driver for the price of gold.

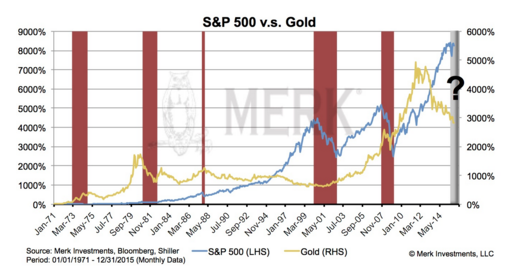

If I look out 10 years and consider the projections of U.S. deficits, I have a hard time seeing how we can afford positive real interest rates. This may bode well for the price of gold. But will gold outperform stocks? I happen to be very negative on stocks in the current environment. Last August, before the sharp selloff in equities, I published a newsletter Coming Out - As a Bear!; the basic premise of the analysis is that the Fed had “compressed risk premia,” i.e. bid up asset prices and taken fear out of the market. For years, investors piled into risky assets, such as equities, not appreciative of their inherent risks. As part of that process, they are likely now over-exposed to equities, having ‘bought the dips’ rather than prudently diversifying. It seems the mentality is gradually shifting towards capital preservation, i.e. ‘selling the rallies,’ but this is a process that, in my assessment, will – at a minimum – take months.

As such, I see the current environment much more like 2000 where investors seemed to be in denial for a long time as equities cascaded lower. This time around, we may have a more aggressive Bank of Japan and European Central Bank; I might change my mind, but so far, I don’t see them being strong enough to stem against the tide. At some point the Fed may join the easing camp once again, but I believe they will be late as they are too focused on the labor market that’s generally considered a lagging indicator. Think of the Fed having removed the lid from a pressure cooker; so even if or when the Fed turns to easing once again, it might have a difficult time preventing this bear market from unfolding. Stay tuned as we update our view.

In the above outlined environment, gold may perform quite well. Can I make a prediction that gold will outperform stocks for 10 or even 20 years? No, because too many things can change. However, I state in the article above that I started shorting equities last August; I increased my short position last December. I also own a substantial position in gold, much higher than the small diversification amount advocated by some.

I’m not suggesting that everyone should go short equities; such a strategy is fraught with many risks. But I believe there may well be times when gold can outperform. My risk tolerance allows me to put my money where my mouth is; any investor, though, should carefully evaluate how much money they allocate to gold, as the price of gold can be rather volatile measured in U.S. dollars. That, by the way, applies to stocks too.

Axel Merk is president and chief investment officer of Merk Investments.

Gold To Beat Stocks?

February 3, 2016

« Previous Article

| Next Article »

Login in order to post a comment