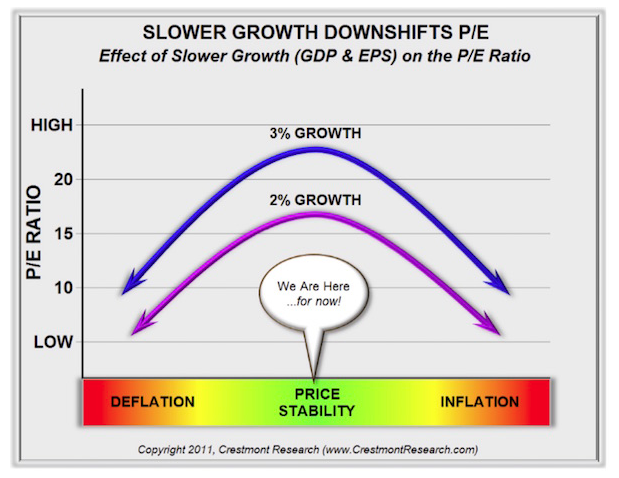

Here is one aspect of the problem: if people perceive that underlying economic growth has dropped to a permanently lower level, they will revise lower the amount they are willing to pay for a share of corporate profits, based on what they perceive as diminished future prospects.

Ed’s research shows that in a world in which 3% GDP growth is the long-term average, P/E ratios will average about 15.5. If expected GDP growth is only 2%, the historical average P/E drops to 11.5. That is a huge difference in long-term gains over a cycle.

Ed explained how he calculates the effect of slow growth on P/E in a 2013 article, “Game Changer: Market Beware Slower Economic Growth.” I suggest you read it. The implications are enormous. The difference between 3% and 2% long-run economic growth is a double whammy for stocks.

Companies will be less profitable if the economy grows more slowly, and P/E multiples will be lower because future profit expectations will not support the kind of valuations we used to think of as normal.

This is not a small problem. According to Ed’s research, if economic growth falls off just 1%, we should expect stock prices on large indexes to fall by 26%. That’s the difference between 15.5x and 11.5x P/E ratios. The reduction in stock prices will vary from cycle to cycle, but that is the average.

From there, the problems radiate outward. Anyone saving for retirement will have to reduce the amount they expect their stock portfolio to contribute. So will institutions and pension funds, which as we saw last week are already severely challenged. Lower profits mean less ability to invest in new capacity and more incentive to replace human workers with machines. Lower profits mean fewer new jobs and lower incomes. Less wealth flowing through the economy will reduce both tax revenue and contributions to charities.

I could go on, but I think you get the point. Economic growth really is the one-stop-shop answer to most of our economic problems. Income inequality? Low growth makes it worse, not better. Bernie Sanders’ many new taxes on top of the existing burden would make income inequality worse, not better. Middle America would soon be in a full-blown depression.

While most people agree the current recovery is too slow, I think many still believe we will eventually bounce back to the halcyon days of 3% and 4% GDP growth. I hope they are right, because we are all in deep trouble otherwise.

Many politicians would like to see the current growth malaise solved by monetary policy. Monetary policy can be useful, but it can’t overcome the enormous economic drag that bad fiscal and regulatory policies create. Without significant changes (and not the kind that “progressive” politicians endorse), the growth that we need will be very elusive. Think Europe.

We are one recession away from a fiscal nightmare. Lacking growth, government debt will explode. Pensions and insurance companies will be deeply underwater. In the wake of the next recession, income and employment will be hit even harder than during this last anemic recovery.

We can avoid that fate by taking the kind of steps John Cochrane outlines in his article. I would go further and say that we need to adopt budget and tax policies in the cooperative spirit of the Clinton/Gingrich era. I urge you again to read Cochrane's ideas and do whatever you can, politically or otherwise, to make some of them happen. As JC Penney once said, “Growth is never by mere chance. It is the result of forces working together.”

Newport Beach, New York, And An SIC Conference Update

I’ll be heading out at the end of month to Rob Arnott’s fabulous advisory council meetings, this time at Pelican Hill in Newport Beach. Those of you who know Rob and Research Affiliates know that his conference is a tad more academic than most, but he combines the intellectual heavy lifting with a fabulous food and party experience. It’s kind of like Adult Nerd Heaven. Then the following week I’ll be in New York, speaking and attending a conference.

For those who want to attend my annual Strategic Investment Conference this May 24–27 in Dallas, I hope you have registered. The conference is sold out, and we are creating a waiting list. We are trying to figure out how to accommodate more people but will not do so if we cannot make sure that the total experience for those already registered will be up to the standards we always strive for.

That said, if you want to attend, I suggest you go to the Strategic Investment Conference website and register to have your name put on the waiting list. I can almost guarantee that if we do find a way to accommodate a few more folks, those seats will almost immediately disappear, too. Those who wanted to wait to the last month to register are going to be disappointed. I won’t even tease you with the fabulous new speakers that we are seemingly adding every week. It just keeps getting better and better. And since I can’t take everybody to Austin for the amazing local music scene, we are working on bringing Austin music to Dallas. It’s going to be fun! Just a little Texas ambience for y’all.

Chicago was a whirlwind of meetings and good food. I was there with my associate Shannon Staton, and it happened to be her birthday. Along with some friends, we went to a restaurant that she wanted to try called The Girl and the Goat. It is quite famous locally and was evidently started by a lady who won a chef competition on TV. I should probably pay more attention, because the food was fabulous. Thanks to Brian Lockhart and Geoff Eliason for being wonderful hosts and introducing us to so many excellent new friends in Chicago.

In less than two weeks we are going to find out if the Republican Party is truly on its way to a brokered convention. I wrote a few weeks ago about what a brokered convention would look like, from the point of view of someone who has managed and been involved in floor fights at political conventions that are much larger than the GOP national convention. The vast majority of people have no idea just how truly wide open such a situation is. If I were responsible for running the upcoming Republican convention, I would be terrified at the prospect. National conventions are supposed to be coronations where everyone comes together, holds hands, and presents the party and the candidate to the nation. Conventions aren’t occasions when you want to air the family laundry on national TV to a world that simply won’t get the dynamics. I guess you could say the upside is that the media will be obsessed with every little twist and turn from individual delegates for three months leading up to the convention and will likely run 24-hour coverage during the convention. Then again, touting that upside might be reaching too hard for the silver lining in what could be a really dark cloud. It will be truly fascinating if the question of a brokered convention comes down to the final state convention in California. Just saying…

Your hoping that somebody will figure out the growth thing analyst,

John Mauldin

Follow John Mauldin as he uncovers the truth behind, and beyond, the financial headlines in his free publication, Thoughts from the Frontline. The publication explores developments overlooked by mainstream news and analyzes challenges and opportunities on the horizon.