Gulf sovereign wealth funds (SWFs) are ubiquitous players in global markets, and the windfall generated by high oil prices in 2022 translated into increased investment spend.

These funds manage portfolios exceeding USD 4.1 trillion, surpassing the United Kingdom's GDP. Moreover, over one-third of the USD12 trillion held by sovereign funds worldwide originates from the Gulf.

The UAE's Abu Dhabi Investment Authority (ADIA), Abu Dhabi Developmental Holding Company (ADQ) and Mubadala, Saudi Arabia's Public Investment Fund (PIF) and Qatar Investment Authority (QIA) deployed more than USD89 billion in 2022 and USD82.3 billion in 2023.

Most of that capital is spent in Europe and North America. For instance:

• ADIA has a USD2 billion joint venture with real estate private equity firm Rockpoint and a USD2.2 billion investment with the property management company Greystar in the United Kingdom.

• QIA holds a USD2.4 billion stake in Germany's multinational energy company RWE.

• Mubadala committed USD12.7 billion to UK low-carbon infrastructure and technology.

• The PIF's investments include USD5.5 billion in US video game developers such as Activision Blizzard and Electronic Arts. It also acquired UK football club Newcastle United, took the second-largest stake in Aston Martin and injected USD550 million into McLaren Group.

Gulf funds made 26 of the 60 SWF investments in 2022, 17 of which were in Western assets.

This current wave of investments by Gulf SWFs highlights a significant shift towards more aggressive investment strategies and higher-return assets. However, this has now led to greater scrutiny, especially from the United States.

In the case of golf, the proposed PGA Tour, DP World Tour, and LIV Golf merger to create an entity funded solely by Saudi Arabia's PIF was an exceptionally high-profile case that triggered much attention.

As a result, the U.S. Senate Permanent Subcommittee on Investigations is now probing Saudi Arabia's efforts to exert influence in the United States.

The US Committee on Foreign Investment is also examining more than half a dozen acquisitions carried out by Gulf SWFs.

At the same time, the U.K. government blocked an effort by an Abu Dhabi wealth fund to acquire The Telegraph newspaper due to national security concerns.

Opacity and deepening ties with China are at the heart of resistance against Gulf investments.

Transparency questions

The primary factor contributing to pushback is the perceived lack of transparency in the Gulf SWFs' governance structures.

In the case of The Telegraph, U.K. policymakers called on the government to probe the UAE's fund structure and connections with the royal family, raising concerns about foreign autocratic systems restricting editorial freedom in the United Kingdom.

The U.S. Senate is also concerned with PIF transparency, which is not helped by Saudi Arabia pressuring consultancy firms McKinsey and Boston Consulting Group, two PIF partners, to withhold information on the Fund's activities in the United States.

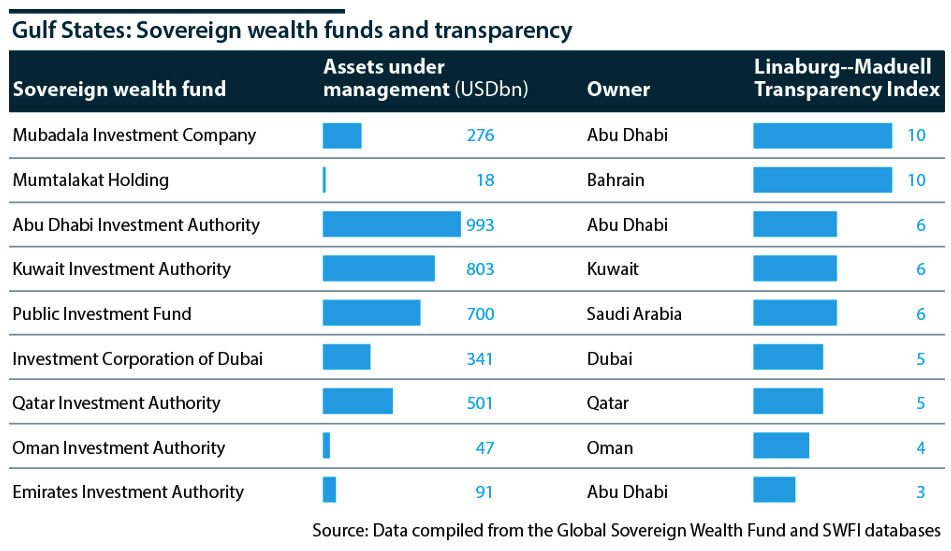

The Linaburg-Maduell Transparency Index measures the transparency of sovereign funds, with a rating of 8 and above considered “adequate transparency.” Most Gulf funds fall below this threshold, likely because of their centralized decision-making by country rulers, thereby fueling concerns about political motives behind state-linked investments.

For instance, two full brothers of the UAE's president, Mohammed bin Zayed Al Nahyan, run three of the world's most prominent SWFs. Mansour bin Zayed Al Nahyan chairs Mubadala, whereas Tahnoon bin Zayed Al Nahyan manages ADIA, ADQ and the Royal Group, a private office for the Al Nahyan family, with assets totaling USD1.6 trillion.

In Saudi Arabia, the PIF is linked to Crown Prince and de facto leader Mohammed bin Salman Al Saud. As prime minister, chairman of the Council for Economic and Development Affairs, and PIF chairman, bin Salman controls decision-making and asset allocation mechanisms.

The PIF's board of directors comprises trusted allies, and its governance framework enables the crown prince to fast-track the evaluation and acquisition processes and bypass established decision-making procedures.

China

Growing Gulf-Chinese ties, at a time when U.S.-Chinese relations simmer, is another crucial element at play.

The U.S. Committee on Foreign Investment spotlights the strong links between Gulf funds and China amid fears that sovereign funds may serve as channels to divert sophisticated technology and data to the Chinese government or firms.

In January, a U.S. congressional committee asked the Commerce Department to assess whether G42 Holding, a Mubadala subsidiary chaired by Tahnoon bin Zayed Al Nahyan that leads the UAE's push into AI, should be subject to trade sanctions because of its relations with China. This month, G42 CEO Peng Xiao said the company had divested from its Chinese investments and is scaling back its presence in China.

However, U.S. national security narratives risk overlooking that GCC wealth funds want to forge a more dynamic presence in Asia.

China is Saudi Arabia's top trading partner, serving as the primary destination for exports and imports. In 2022, China accounted for 16.8% of Saudi exports and 22.1% of imports.

PIF investments in Asia have increased significantly, from eight ventures valued at USD715 million in 2015 to 14 investments worth USD7.3 billion in 2022.

Bottom Line

The United States remains by far the predominant market for Saudi investments—USD36.8 billion across 53 ventures—because of the strength of U.S. financial markets and robust U.S. ecosystems that can support Gulf modernization.

GCC investments are mainly about economic diversification. These funds will act as lead investors and developers of priority sectors. Added to this is intra-regional competition for foreign investment niches, with the UAE and Saudi Arabia vying for top spots.

The funds are also making international investments to position themselves as key players in emerging industries or technologies alongside high-priority sectors such as renewables and infrastructure.