M&A activity among RIAs is intense and looks like it will continue to be strong. Demographics with many advisors getting older, aggregators often supported by private equity money, and a changing competitive landscape are some of the factors continuing to drive the M&A trend.

A central question is what happens after the sale or merger. How satisfied or dissatisfied are the advisors who have sold or merged their firms with the outcomes? To help address this issue, we surveyed 311 advisors who sold or joined their RIA firms within the past 10 years. The sale or merger could have been to another firm, a larger organization such as a bank, or an aggregator.

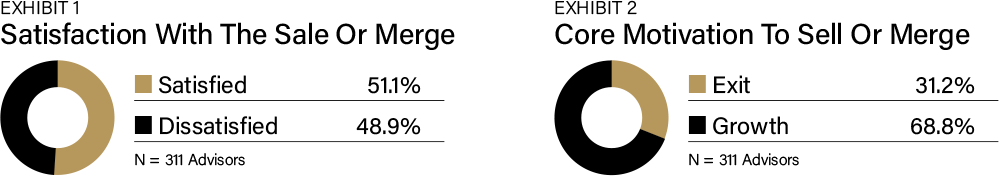

The bottom line is that about half of the advisors were satisfied with how things turned out, meaning that about half were not (Exhibit 1).

The question now becomes what factors contributed to their level of satisfaction. Before going there, we also segmented the advisors based on their core motivation to sell or merge (Exhibit 2). A little more than 30% decided because it provided a way to exit the business profitably. They had no successors for their practice and could not continue working indefinitely or did not want to. Meanwhile, 70% of the advisors were looking for a way to significantly grow their businesses by getting support and access that was otherwise out of reach.

Reasons For Satisfaction And Dissatisfaction

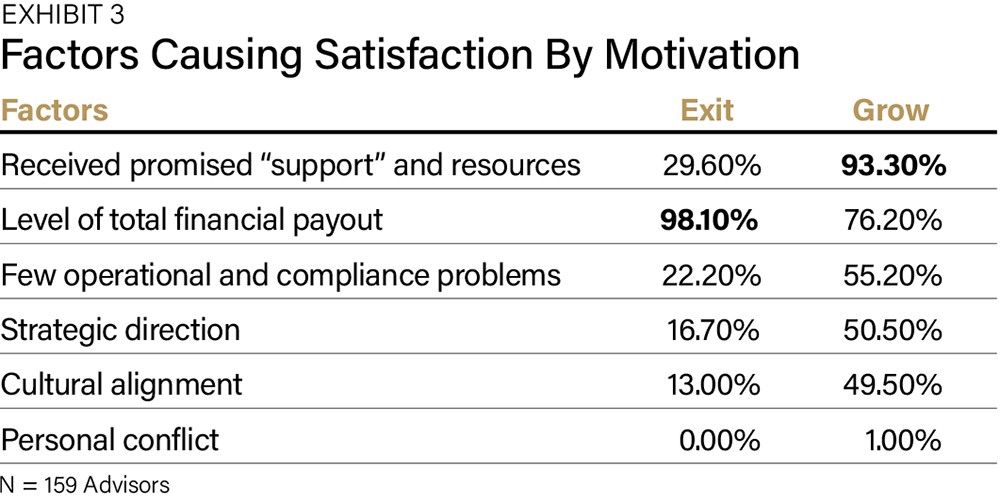

There are particular reasons for advisors to be satisfied with the outcomes of the sale or merger of their practices. It depends on their motivations to sell or merge (Exhibit 3).

For those advisors who transition their firms looking for an exit, the level of total financial payout is the most critical factor determining satisfaction. This includes the upfront monies and any earnout or client retention components of the final payout. Other factors, such as having few operational or compliance problems, the strategic direction of the new firm, and cultural alignment, are not that important. Also, there was no reported conflict with new management or other advisors.

To grow an advisory firm, the acquirer or merger partner must be able to deliver on the promise of support and additional resources. Doing so is the most crucial factor that translates into satisfaction. The other factors were also important for many advisors, but they highly correlated with the ability of the acquirer or merger partners to deliver the expected value.

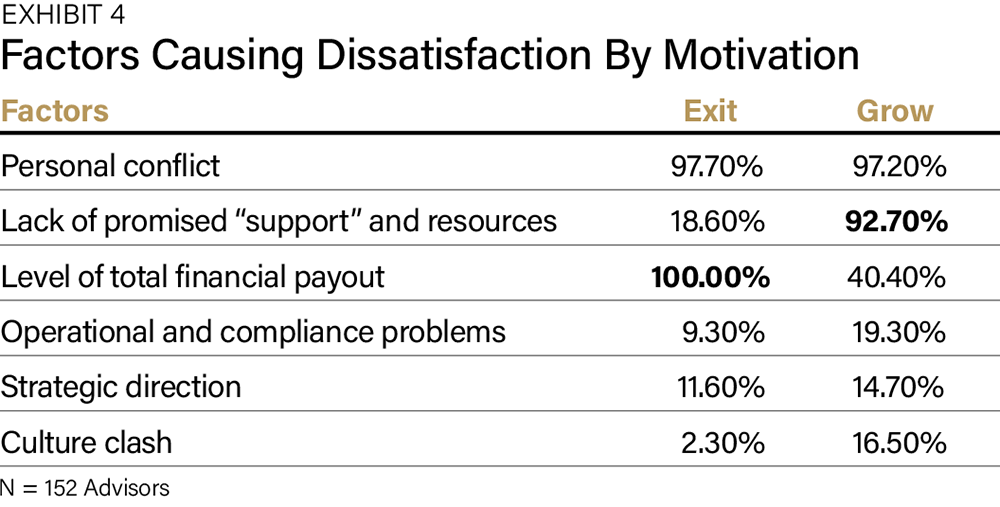

It is a truism that people are unhappy when their firmly held expectations are not fulfilled. And that is just what happened in these situations. The most significant factor for advisors dissatisfied with the sale or merger was personal conflict with new management or other advisors. This is probably a consequence and function of some of the other factors. When expectations—or, in many advisors' minds, “promises”—are not met, they may feel deceived or exploited. This, in turn, often leads to personal conflicts. However, moving beyond personal conflicts, the expectations of the two advisor segments based on their motivations are different (Exhibit 4).

For those advisors looking to exit, dissatisfaction is a function of their final payout. Again, this number includes any earnouts and client retention qualifications. Simply, the advisors believed they deserved a higher final payout than they received.

For these advisors wanting to grow, they see the failure as their new firm being unable to deliver the “support” or resources they said they would. For example, they were told they would be able to connect with centers of influence to get new clients, but this failed to materialize. Or they were told they would have access to exceptional investment products that proved less than stellar. Unable to grow as expected results in a lower financial payout for the firm, which causes further dissatisfaction. Fewer dissatisfied advisors wanting to grow identified operational and compliance problems, the strategic direction of the firm, or the firm’s culture as causes of concern and, thus, dissatisfaction.