As an advisor, you deliver the services and solutions that your clients most want and expect from you—and you deliver them well. Right?

Don’t be so sure.

Our research found several major disconnects between what advisors promise their clients—and even believe they deliver—and what those clients actually think they get from their advisors. These gaps greatly undermine trust in advisors, and may present a clear and present danger to your client retention, new client acquisition and ultimately, your bottom line.

But it also spells opportunity for you. If you can truly deliver the services and expertise that clients want—are clamoring for, really—you can differentiate your practice, enhance client retention, garner new business and tap into lucrative growth opportunities.

What The Affluent Want

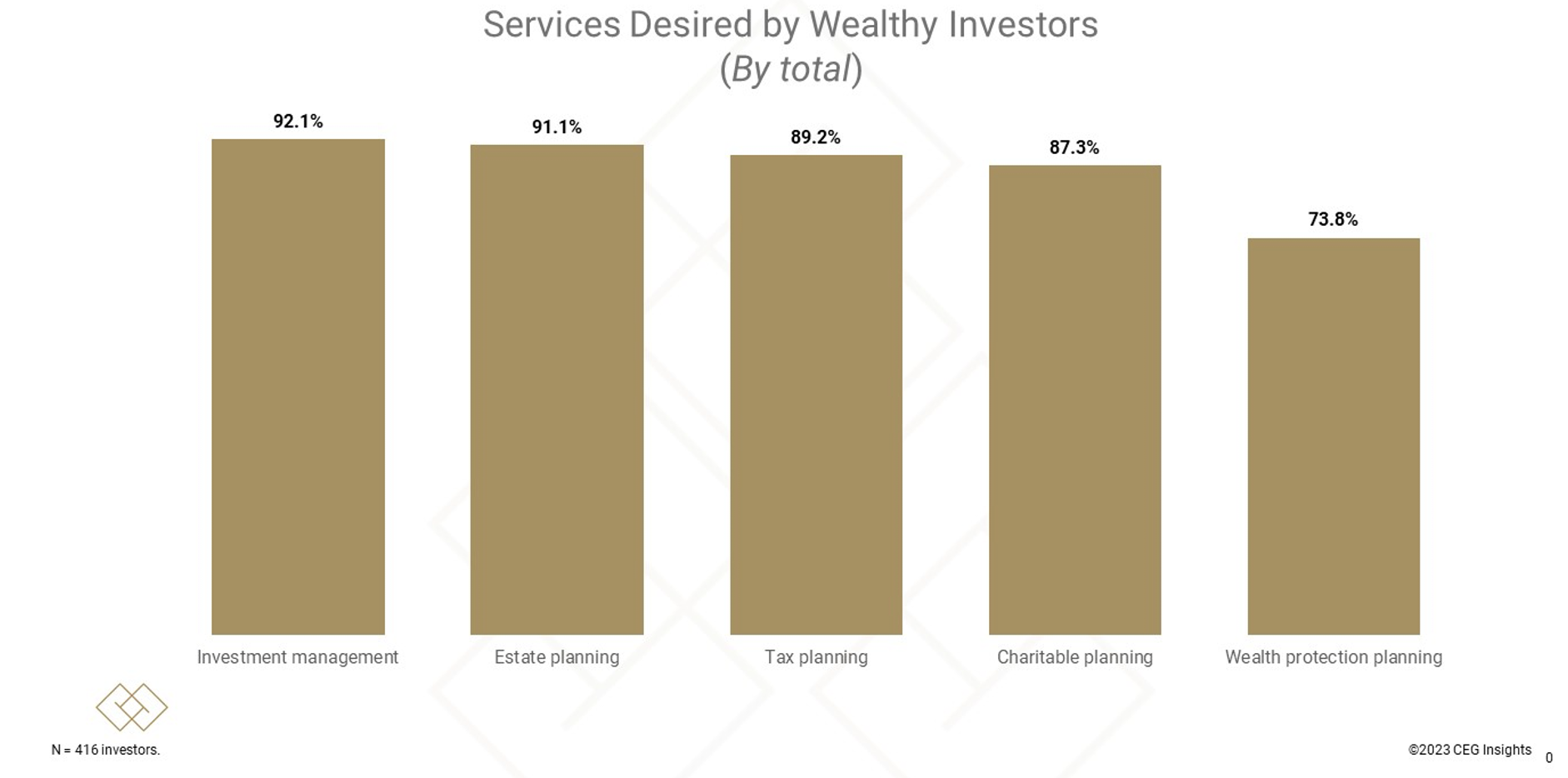

To see the extent of these gaps in service, start by confirming what today’s affluent clients want from you. When CEG Insights surveyed more than 400 wealthy investors, here’s what they told us.

1. Investment management. Not surprisingly, nearly all wealthy clients—92.1%—place a premium on investment management strategies. These clients are in pursuit of advisors capable of crafting portfolios that are aligned with their financial aspirations.

2. Tax planning. At the heart of wealth preservation lies effective tax planning, a service sought after by 89.2% of affluent clientele. They are searching for advisors proficient in navigating the complex tax terrains using an integrated approach that seamlessly marries tax planning with other financial avenues.

3. Estate planning. A notable 91.1% of wealthy clients prioritize safeguarding their wealth for forthcoming generations, highlighting the prominence of estate planning in their financial narratives. They are drawn towards comprehensive services that ensure the smooth transition and protection of assets while fostering a robust legacy

4. Wealth protection. In a world of uncertainties, a significant 73.8% of wealthy clients are inclined towards advisors capable of devising sturdy wealth protection strategies. They expect these strategies to shield their financial assets from potential risks and unforeseen adversities.

5. Charitable planning. Philanthropic endeavors hold a special place in the hearts of wealthy clients, with 87.3% expressing a desire to make a meaningful impact through charitable activities.

What Advisors Claim To Offer

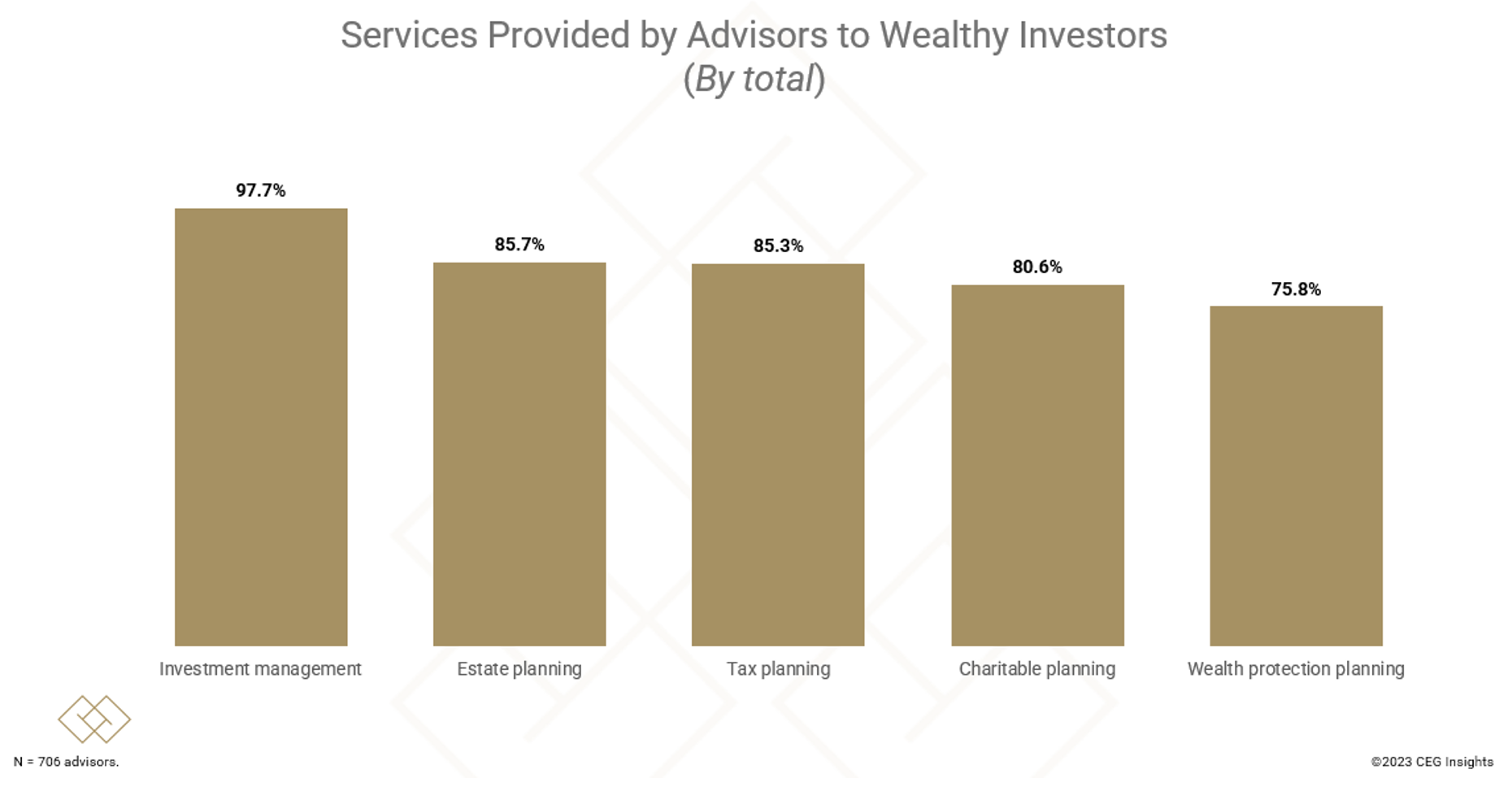

On the surface, it would seem that financial advisors are deeply in sync with their affluent clients’ needs. Consider what they told us when we surveyed 706 financial advisors in the financial industry with a minimum of one year in the industry.

1. An overwhelming majority of advisors—97.7%—note their acumen in investment management. These professionals assert their ability to develop investment strategies that support the financial objectives of wealthy clients.

2. An impressive 85.3% of advisors underscore their proficiency in tax planning, which is rooted deeply in wealth preservation.

3. A significant proportion of advisors, 85.7%, highlight the vital role of estate planning in safeguarding the wealth intended for future generations. These advisors pledge comprehensive services to facilitate smooth asset transitions and foster legacies that withstand the test of time

4. A full 75.8% of advisors report standing ready with robust wealth protection strategies designed to shield clients' financial assets from potential risks and unforeseen adversities.

5. Philanthropy is a focal point in advisors’ offerings, with 80.6% keen on making a significant impact through charitable initiatives.