Doctors often have both the economic resources and personal and business needs to meaningfully benefit from the help of talented financial advisors. It’s likely that, as many found themselves at the epicenter of the pandemic, these professionals are asking hard questions about their priorities in life. And yet many of them aren’t getting the answers they need.

That’s clear from a survey we recently performed of 198 high-income physicians—all of whom were either specialists or self-employed. They regularly earned between $580,000 and $1.1 million annually, and none of them had seen their incomes drop below $500,000 in the previous three years. Besides their annual earnings, each doctor in the survey had amassed investment portfolios of $1.4 million to $5.1 million (outside their retirement plans).

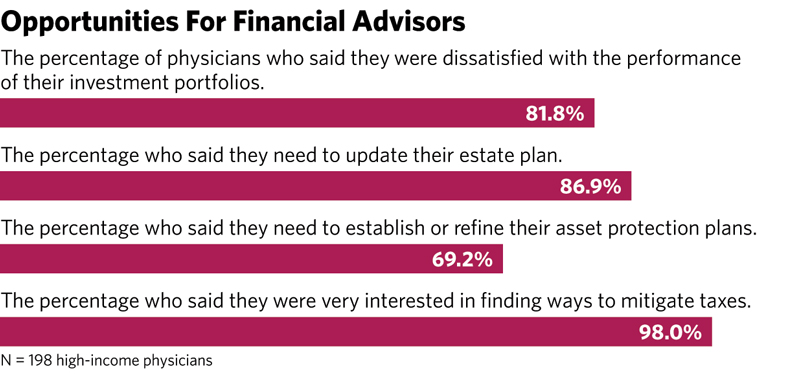

The survey found that physicians are seeking better investment performance and are concerned financial advisors aren’t addressing their needs as well as they could (See chart).

The survey found that physicians are seeking better investment performance and are concerned financial advisors aren’t addressing their needs as well as they could (See chart).

About four out of five of the doctors in our survey said their portfolios were not performing as well as they expected. While their assets might have increased in value over the past five years, it was less growth than they expected.

Another problem is more long term in nature: Even though all the physicians said they had estate plans, only 15% said the plans were current—which means 85% of them aren’t and need updating.

The doctors in the survey also revealed that they needed to refine their asset-protection plans. All of them had malpractice insurance, but they still faced unfounded and frivolous lawsuits—including some that had no direct connection to their practices. About 70% of the physicians in the survey said they were interested in asset-protection planning but had not done anything about it within the last three years.

Meanwhile, physicians, like almost everyone else, prefer to pay as little in taxes as they have to legally, specifically income taxes. There are a number of financial strategies and products that can be used for this purpose, but many doctors are unaware of them.

The Power Of Stress Testing

It’s the job of financial advisors to have a deep knowledge of their clients—to know their hopes and dreams, wishes and concerns. A robust discovery process is the key to developing this understanding.

That requires stress-testing: a process in which advisors find previously overlooked ways to add value and get better results. In this process, advisors evaluate whether there are better financial solutions than the ones the physicians are currently using. There are three steps the advisor needs to take: One is to understand what the doctor’s self-interest is. The next is to evaluate what’s been done already. And the last is to specify a course of action.