One of the big surprises of 2023 was the resurgence of US growth stocks. The tech-heavy S&P 500 Growth Index outpaced its counterpart Value Index by 7.82 percentage points last year, including dividends, after trailing it badly in 2022. That’s not supposed to happen during a surge in interest rates.

At least not according to a popular theory that rising rates are bad for stocks — and particularly bad for growth stocks. The idea is that stock prices reflect the present value of future earnings, a calculation that relies in part on interest rates to discount future earnings to the present. As the math goes, the higher the interest rate, the lower the present value of future earnings, and vice versa.

If that’s true, then growth stocks have more to lose from higher rates than value ones because more of their earnings are expected in the future. Things played out very differently last year, which raises the question: Was growth’s outperformance in the face of rising rates an exception to an otherwise reliable rule?

It’s a timely question because interest rates are widely expected to decline this year, which in theory points to another winning year for growth relative to value.

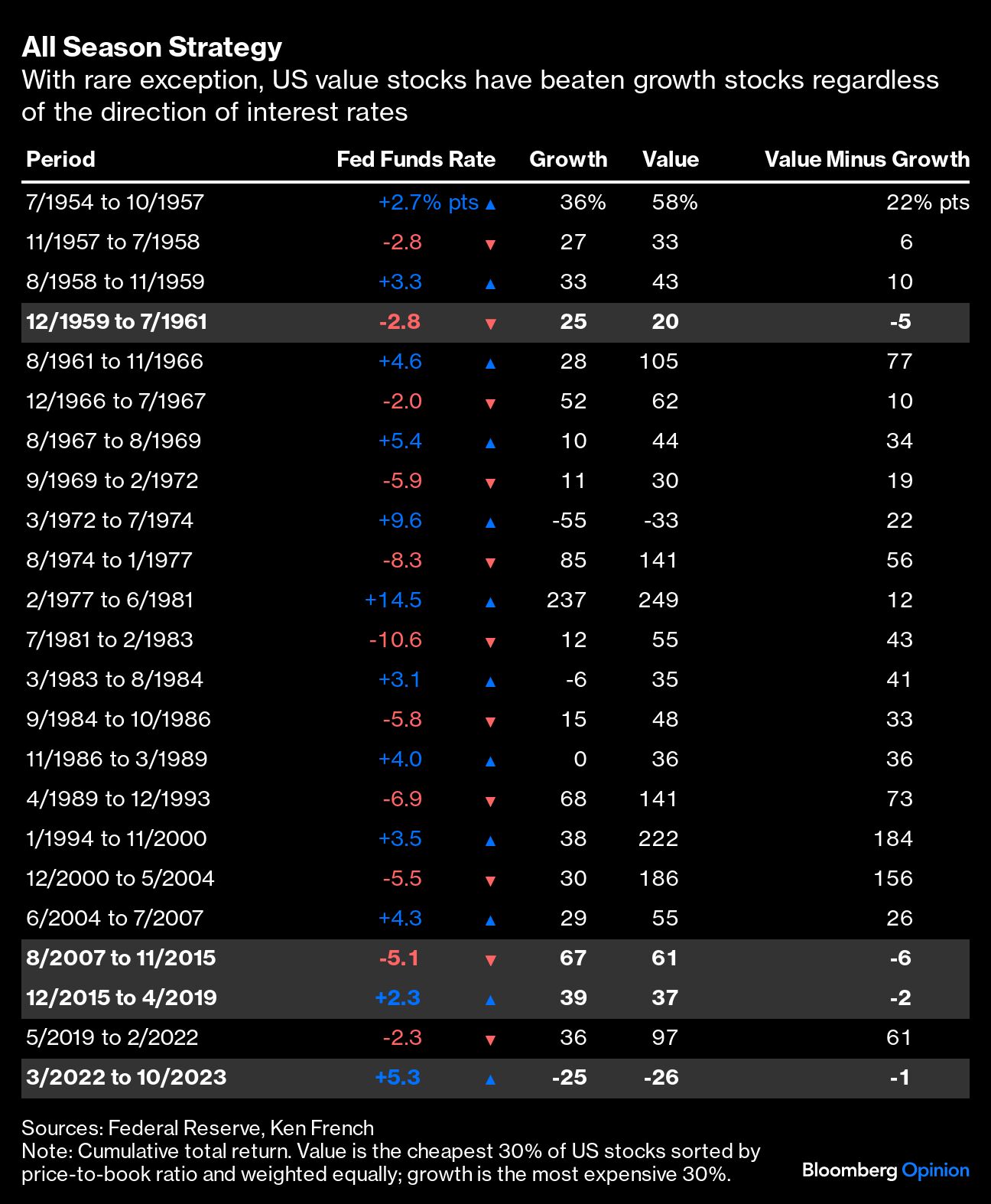

To find out, I looked at how growth and value stocks performed during previous interest rate cycles. Specifically, I looked at alternating peaks and troughs in the federal funds rate back to 1954, the longest record available. I counted 12 periods of rising rates, including the one we just witnessed, and 11 periods of falling rates. While the federal funds rate does not necessarily dictate longer-term rates, which are typically used to discount earnings, they have been highly correlated historically.

The theory seems to bear out during periods of rising rates. I’m comparing the total return of the cheapest 30% of US stocks, sorted by price-to-book ratio and weighted equally, with the most expensive 30%. Value beat growth in 10 of the 12 periods of rising rates. The two exceptions were during the late 2010s, when a bull market in tech stocks lifted growth past value despite rising rates, and again since the Federal Reserve began raising rates in March of 2022.

But if the theory is right, the opposite should also be true — that is, growth should win when rates are falling — and this is where the argument breaks down.

Amazingly, value beat growth in nine of 11 periods of falling rates. The two exceptions were a 20-month stretch that began in late 1959, and a multi-year period of declining and sustained low rates that followed the 2008 financial crisis and coincided with the 2010s rally in tech stocks I mentioned previously.

In other words, changes in interest rates don’t appear to explain growth and value’s relative performance. A better explanation is also a simpler one: Value wins most of the time regardless of the direction of rates. Indeed, value won in 19 of the 23 periods I looked at, or 83% of the time.