Peak bond-issuance week is in the books, and high-grade corporate bond deals are hanging tough in the face of recession fears and surging risk-free rates, a trend that appears to be extending into the second week of September. It’s a sign that the market remains open for the companies that need it, welcome news for businesses hoping to avoid the risk of a liquidity crunch. If the U.S. is set for a downturn, it won’t be the bond market’s fault.

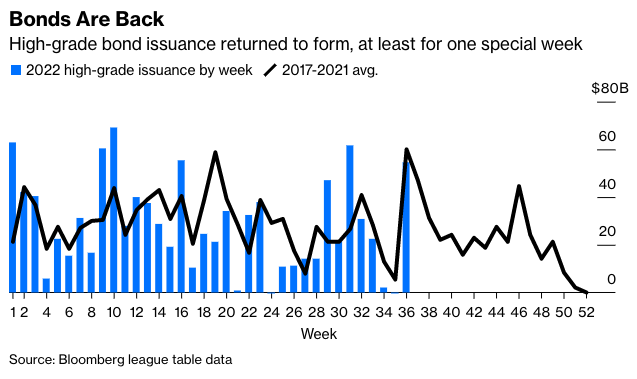

The week after Labor Day—Week 36—is often the busiest time of the year for the purveyors of new corporate bonds, and the past week and change haven’t disappointed. Investment-grade issuers sold more than $54 billion in bonds last week, led by retailers and financial companies. Walmart Inc., Target Corp. and TD-Dominion Bank were among the companies that were active. Although it was just average by Labor Day week standards, the showing will come as a relief in a year that has experienced historic drawdowns in the bond market and spotty business for underwriters. Year-to-date investment-grade issuance in the U.S. is down about 7% compared with the previous five-year average, but this important week ended up matching recent precedent.

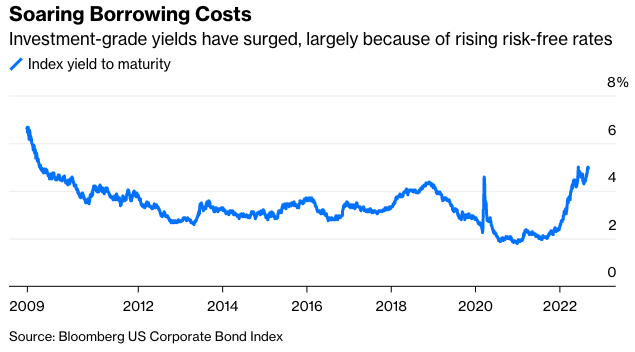

Ultimately, that’s a reminder that investors aren’t necessarily the ones getting cold feet despite interest-rate uncertainty and economists’ growing warnings of a potential recession. Rather, the slump has mostly come down to companies’ reluctance to pay market-rate interest rates. The Bloomberg U.S. Corporate Bond Index of investment-grade securities now has a yield of around 4.95%, close to the highest since 2009. Companies are also paying higher new issue concessions, the extra yield they pay over their existing debt. So far this year, companies have paid 12.7 basis points in such concessions compared with two in 2021, excluding supranational, sovereign and agency debt, according to Bloomberg markets strategist Brian Smith. Last week, the concessions were 13 basis points.

In general, companies that have the flexibility aren’t in any rush to pay these rates. If the Federal Reserve is able to engineer the elusive “soft landing” for the economy—if inflation ebbs without too much pain in the labor market—yields could come down meaningfully. Even if the U.S. dips into a recession, company borrowing costs could conceivably decline amid speculation about Fed rate cuts. Investment-grade credit spreads may simultaneously widen, but perhaps only 75 to 85 basis points at the high end. The situation could even be a net improvement for issuers.

But many blue-chip companies simply have strict financing schedules that they try to keep and don’t bother trying to perfectly time the vagaries of the market. For the less frequent issuers, perhaps the biggest motivator for raising money now is the fear that the future could hold even higher borrowing costs because of sticky high inflation that forces the Fed to get even more aggressive. Under the nightmare stagflationary scenario, risk-free rates would rise while credit spreads widened as well. Fortunately, few economists have that as their base case.

With all those crosscurrents, it’s not likely that the spurt of excitement in the new-issue market will last much longer—not at this pace. Bloomberg Intelligence Chief U.S. Credit Strategist Noel Hebert projected a muted $125 billion to $135 billion in investment-grade bond sales this month, around the weakest September in seven years. The second week after Labor Day tends to be fairly busy, but the momentum fades quickly in the latter part of September. And as Hebert notes, a number of deals were pulled forward into August. The size of the current window of opportunity may depend in part on how markets receive the consumer price index report on Tuesday, which should indicate further moderation in headline inflation but probably won’t be enough to drastically change the Fed’s strategy.

For now, the big takeaway is that the primary bond market remains open for business. Investors are getting a decent carry at these levels, and they will continue to bring their money to the corporate bond market as long as companies are willing to pay the going rates. That should be a bulwark against real deterioration in the corporate outlook. So in that sense, Labor Day week was a welcome victory for the bond market.

Jonathan Levin has worked as a Bloomberg journalist in Latin America and the U.S., covering finance, markets and M&A. Most recently, he has served as the company's Miami bureau chief. He is a CFA charterholder.