The company now has an attractive valuation and, with internal improvements, it should be able to reap additional benefits as consumers increasingly focus on homes. We believe its online marketing efforts will be beneficial and that the bulk of its associated obligations have already been paid.

The Numbers Behind Our Optimism

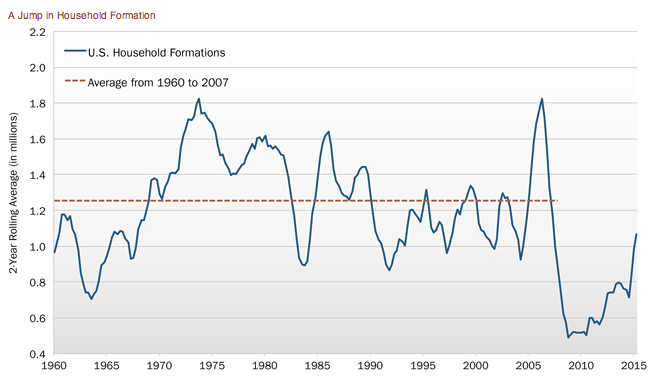

According to recent census data, 30% of the 80 million people in the millennial generation live with their parents. That’s up from 23% for the same age group in 2000. Trends in household formation suggest many of those millennials are starting to venture out of the nest. As the chart illustrates, the number of new households formed rose significantly toward the end of 2014 and has continued to expand. Through the first half of 2015, the number of households has increased by 2.2 million from the same period a year ago. The flood of those millennials moving out on their own should provide a pipeline of home buyers for the next several years.

Source: Cornerstone Macro Economic Research, 3/31/1958 to 6/30/2015

Rolling average computed quarterly, using 8-quarter moving windows.

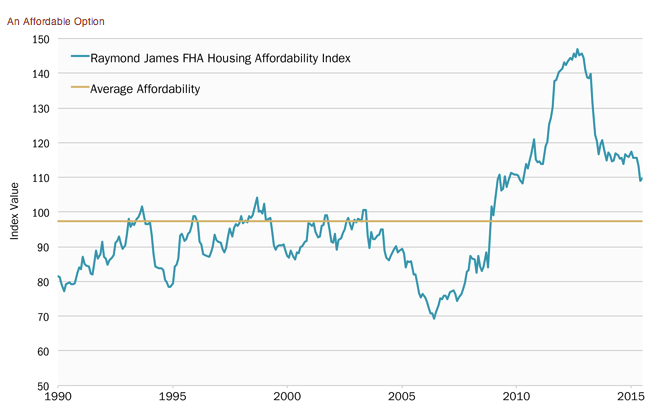

The explosion in household formation has put pressure on the rental market, which, in turn, is making home ownership financially attractive. Vacancy rates for rental properties hit a 10-year low at the end of the second quarter at 6.8%, down from an average of 9.1%. As excess apartment capacity has tightened, rents have edged up to all-time highs in nominal dollars. Meanwhile, housing prices are still more than 20% below their peak from 2006 to 2007.

The housing market is also being affected by interest rates, which are at historic lows and more than 200 basis points lower than they were in late 2006. This offers an additional discount for home buyers. The upshot is that the difference in monthly payments between renting and owning has shrunk, making homeownership more attractive.

Source: Raymond James Research, National Association of Realtors, Federal Housing Finance Agency, and Bloomberg L.P., January 1990 to July 2015

Budding upward pressure on wages should also contribute to the affordability of housing. With unemployment hovering around 5.3%, the Federal Reserve has noted there is evidence that pay is beginning to creep up as some industries compete to fill open positions. We expect that trend to continue.

Summary

While we believe there are several reasons for optimism about housing, recognizing an emerging theme is only the first step in capitalizing on the opportunity. We are convinced that a focus on valuations, management and business strategy is key to identifying companies with the greatest chance for success. Additional analysis is then required to select a group of companies with unique attributes that together provide the greatest opportunity for success regardless of how the broader theme plays out.

(As of June 30, 2015, Heartland Advisors on behalf of its clients held approximately 5.58%, 1.72%, 0.82% and 3.53% of the total shares outstanding of M.D.C. Holdings Inc., WCI Communities Inc., KB Home, and Pier 1 Imports Inc., respectively. Statements regarding these securities are not recommendations to buy or sell. Portfolio holdings are subject to change. Current and future holdings are subject to risk.)