Wednesday's Federal Reserve meeting provides the clearest sign yet that the central bank is treating inflation as a national emergency, with markets expecting a 0.75% interest-rate increase. But the Fed's policy actions come at a hefty cost, particularly in the housing market.

With mortgage rates having breached 6%, the housing market is slowing. And while this might be an acceptable short-term price to pay in the fight against inflation, it's going to create future supply-chain problems once inflation is under control and we're ready for activity to pick up again.

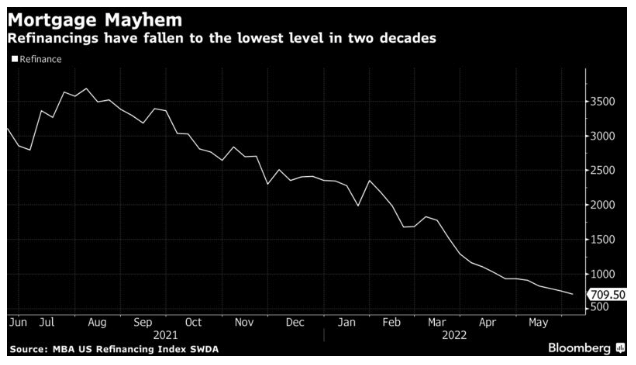

The refinancing market is providing a glimpse of what’s to come. When mortgage rates are low, as they were from 2020 through the beginning of 2022, refinancings surge as homeowners take advantage of lower rates to secure a smaller monthly payment and take cash out of their homes. That process generates economic activity and jobs for people who assist in the transaction—loan officers, appraisers and closing attorneys—even software companies like DocuSign, as anyone who refinanced over the past couple years can attest.

But with mortgage rates north of 6%, refinancings have screeched to a halt, down more than 80% from the pandemic peak and now at their lowest level in over two decades.

This is leading to layoffs at companies operating in the mortgage sector, such as loanDepot, because there is simply not enough work to do.

Unfortunately, layoffs are spreading deeper through the housing industry. Real estate brokerage Compass said on Tuesday it was laying off 10% of its staff, followed by Redfin Corp., another brokerage, announcing job cuts as well.

There are a lot of layers to this new market. Mortgage rates below 3% didn't make sense for the inflation and growth environment that we’ve had over the past year, and it's possible we won't see rates that low again. So to the extent housing and refinancing activity required sub-3% rates to be viable, it's okay that those jobs are disappearing.

Additionally, it's true that inflation is too high and demands a policy response, and the housing market was unsustainably hot, with home prices and mortgage rates combining to create extreme affordability challenges. So it makes sense to raise mortgage rates to help cool off both inflation and the housing market.

The concern comes when we realize there is a wave of tens of millions of millennials who will be looking to buy homes over the next decade. The housing market needs the construction of many more homes to meet that demand. If we’re already constraining economic activity so much that it's leading to job losses, that will make it more difficult to ramp the machine back up after inflation is under control.