What is ESG investing? There are as many definitions of ESG right now as there are investment vehicles claiming to provide “ESG” exposures. But at its heart, the concept is simple: Environmental, social and governance principles argue for a cleaner environment, a more inclusive society and sounder corporate governance.

These principles are increasingly shaping the business strategies and government policies around the globe, as well as the growing debate about how much “corporate responsibility” corporations should shoulder. The principles are also having a significant impact on investor awareness and consciousness, which in turn spurs a growing need for advisors to be well-versed in the ESG debate and the ways ESG investing can be incorporated into a portfolio.

Principles Pushing Regulatory Changes Globally

Perhaps it’s helpful to look at what people are doing locally. Let’s look at climate change, for example. How are people’s concerns about climate change leading to regulatory changes? And how will that, in turn, affect impact investing in the auto and fossil fuel/commodity industries?

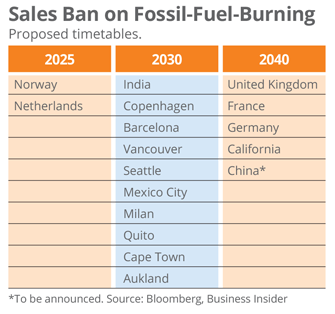

Many national and city governments have begun to propose timetables to ban the sales of fossil-fuel-burning cars in their territories (see the table). Norway and the Netherlands lead the pack, with plans to ban the sale of such cars starting in 2025. China, the top car market for both electric vehicles (EV) and conventional vehicles, is working on its own timetable, but when it completes one, it could be a game changer in the EV industry.

These governments are serious about forcing or motivating manufacturers and consumers to meet these deadlines. China and the U.S. are leading the growth of electric vehicles (see top chart on the right). The production of these will dramatically increase to meet new consumer demand and replace the soon-to-be-obsolete fossil fuel vehicles. Therefore, the challenge to the auto industry is to manage a timely transition to electric vehicles or to face business survival risk.

It is not just auto manufacturers seeing major changes forced upon their business models. The fossil fuel industry is also facing significant upheaval. While we have not reached it yet, a peak in global demand for coal and crude oil is on the horizon. Many of the largest names in fossil fuel extraction and refining have already been diversifying their exposures with efforts in wind, solar, geothermal and other “greener” energy categories. With the technology breakthroughs and regulatory changes, we are seeing the start of a significant, government-backed push away from fossil fuels toward alternative energies, which are viewed as being less damaging for the environment globally.