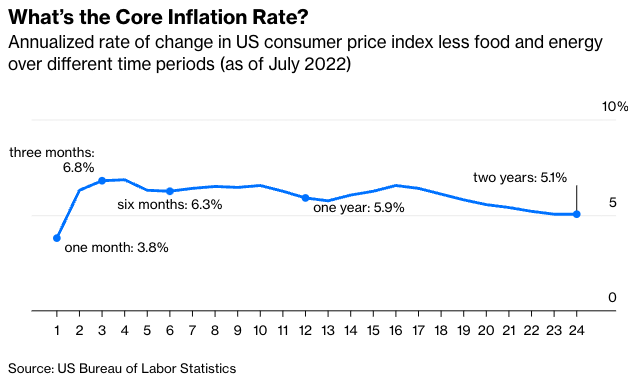

To get around that volatility, monetary policy makers and other inflation observers often look at the price level minus food and energy, aka “core” CPI. Here’s core inflation measured over every period from one to 24 months.

Inflation is markedly lower over one month than over the other periods here, too, which I guess raises the odds that it really is downshifting. Then again, it was still 3.8% in July, and the Federal Reserve Bank of Cleveland’s inflation “nowcast” as of Aug. 15 has it bouncing back to 5.9% annualized in August.

Other ways of getting at the true inflation rate include measures such as the Cleveland Fed’s median and trimmed-mean CPIs, both of which rose in July while the all-items CPI stayed flat, and the personal consumption expenditures price index for July that will be released Aug. 26 by the Bureau of Economic Analysis and usually generates inflation rates a bit lower than the CPI-based ones.

Last week’s Twitter discussions also revealed some interesting personal approaches. “I try to set half my mood based on the current month’s inflation print, a quarter based on the prior month’s, and the remaining quarter based on the previous 10 months,” wrote Marc Goldwein of the Committee for a Responsible Federal Budget. Alan Cole of the Conference Board offered this (tongue-in-cheek, I think) suggestion:

I tried that with monthly CPI data going back to 1913. It came to 6% annualized inflation in July. That’s down from 9% in June (yay!). It’s still a lot more than zero.

Justin Fox is a Bloomberg Opinion columnist covering business. A former editorial director of Harvard Business Review, he has written for Time, Fortune and American Banker. He is author of The Myth of the Rational Market

The ideal is the infinite sum of all monthly inflation measurements, each multiplied by (2/3)^n, where n is the number of months ago. All divided by three, of course, to get a weighted average from the infinite series…